Volume XIII - Cost Accounting

Chapter 04 – Charges and Full Cost Recovery

Questions concerning this policy chapter should be directed to:

0401 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies for the calculation of fees for goods or services provided by VA.

Key points covered in this chapter:

- VA will identify the full cost incurred to provide goods or services and charge those costs to the recipient, except where another pricing method applies;

- VA will use the Managerial Cost Accounting (MCA) system to develop full cost data;

- VA will perform a cost/benefit analysis in response to significant market changes to confirm feasibility of continued production and consider need to revise fees; and

- Legislation allows VA to retain a portion of certain fees (See OMB Circular A-25, section 9b).

0402 Revisions

| Section | Revision | Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Various | Reformatted to new policy format and completed five-year update | OFP (047G) | Reorganized chapter layout | April 2021 |

0403 Definitions

Charges – Fees assigned by the provider (e.g., VA) for the purchase of goods or services.

Costs – Amounts or values expended for goods or services produced or delivered.

Direct Costs – Costs directly attributable to a specific good or service.

Fixed Costs – Costs that do not vary in direct proportion to the volume of activity. The word “fixed” does not mean that the costs do not fluctuate, but rather that they do not fluctuate in direct response to workload changes. Examples include depreciation of equipment and salaries of management positions.

Full Costs – Includes both direct and applicable indirect costs. MCA captures products at the full cost, which is cost recorded at the station, combined with overheads, such as headquarters and the Office of Information and Technology (OI&T).

Goods and Services – Goods are tangible consumable items; services are activities of individuals.

Indirect Costs –Costs that are not directly attributable to a specific product. These costs are allocated through the indirect cost allocation process. Examples include maintenance and overhead costs.

Managerial Cost Accounting (MCA) System – The Decision Support System (DSS) is the Managerial Cost Accounting system for VA. It processes cost and workload data from various agency feeder systems to produce reliable cost per good or service provided.

Overhead – Costs that cannot be directly linked to a particular good or service, or facility, but are incurred during the course of normal operations and are allocated to the facility or administration.

Reasonable Charges – Fees for goods or services sought to be recovered or collected from third party payers as described under 38 U.S.C. § 1729.

Health Care Resources (HCR) Sharing Agreements – Under sharing authority in 38 U.S.C. § 8153, VA may enter into HCR agreements for the utilization of HCR with any health care provider, other entity, or individual.

Stop Codes (also known as VHA Clinic Stops) – Codes used by VHA staff to correctly identify and capture clinical workload prior to its entry into the cost accounting process.

User Fees – A sum of money paid as a necessary condition to gain access to particular goods or services.

0404 Roles and Responsibilities

Administration CFOs and staff CFOs, are responsible for (1) applying approved cost-accounting principles and procedures in determining fees for VA’s goods and services to recipients, and (2) submitting a recommendation to the VA CFO regarding an exception to the imposition of a user charge or to allow VA revenue retention if appropriate (See OMB Circular A-25 sections 6a(4), 6c and 9b).

Managerial Cost Accounting Office (MCAO) a component of the VHA Office of Finance responsible for the operation and maintenance of DSS. MCAO provides training, guidance, and assistance in the processing of cost accounting data and the production of related reports for the Administrations and staff offices. MCAO is responsible for the establishment and oversight of the VHA National Stop Code Council.

0405 Policies

040501 General Policies

- VA will comply with provisions for charges and full cost recovery, as prescribed in

- Office of Management and Budget (OMB) Circular A-25, User Charges;

- Statement of Federal Financial Accounting Standards (SFFAS) No. 4, Managerial Cost Accounting Standards and Concepts; and

- CFO Act of 1990.

- VA will comply with the provisions for medical care charges prescribed in 38 U.S.C. § 1729, and policies for sharing healthcare resources addressed in 38 U.S.C. §§ 8111 and 8153.

040502 Fee Management

- Staff office CFOs and administration CFOs in accordance with OMB circular A-25 will review, approve and impose user fees for VA goods and services.

- VA will comply with OMB Circular A-25 provisions supporting OMB management of the fee-setting process including:

- Providing OMB accessibility to fee determination records;

- Using market pricing where a substantial competitive demand exists for goods or services from different sources;

- Crediting user charge collections to the general fund of the Treasury as miscellaneous receipts, except as authorized differently in statute;

- Discussing significant fee issues in annual financial statements when applicable;

- Requesting OMB approval of prospective legislative proposals permitting retention of fee collections when appropriate (See OMB Circular A-25 section 6c);

- Requesting OMB approval of exceptions to standard fee setting requirement not already addressed in A-25, other OMB circulars or in statute (i.e. market pricing or medical billing reasonable charge application); and

- Resubmitting requests for exceptions granted by OPM at least every four years as need continues (OMB exceptions are effective over no more than 4 years).

- Requests for exceptions to the standard fee requirement and/or the authority to retain fee revenue will flow from the Administration or Staff Office CFO through the VA CFO, to OMB as directed by the OMB examiner responsible for VA budget estimates.

040503 Cost Computation

- In accordance with SFFAS No. 4, the full-cost computation will cover the direct and indirect costs to VA of carrying out an activity. Charges include, but are not limited to, the following:

- Salaries, fringe benefits (i.e., retirement and medical insurance) and travel expense;

- Materials and supplies, rent, cost of fee collection, postage, and maintenance, operation and depreciation of buildings and equipment (unless specifically excluded); and

- A proportionate share of management and supervisory costs.

- To the greatest extent possible, VA will use the Managerial Cost Accounting (MCA) System to provide data to calculate the cost of goods or services. VA will utilize guidelines provided in generally accepted cost accounting principles to calculate the cost in instances where MCA data cannot be used (e.g., pounds of laundry, onsite filming, reasonable charges).

- VA will fully charge or allocate the costs associated with a project start-up regardless of the outcome of the project.

- If a methodology does not exist to establish a fee for new goods or services, one will be developed by the responsible program office (Administration, staff office, etc.). Approvals will include, but not be limited to, the program office CFO and the Administration or staff office CFO.

040504 Field CFO Fee Actions

- VA will, in accordance with the Chief Financial Officer (CFO) Act of 1990 (section 902(8)), on a biennial basis, review fees, royalties, rents and other charges for services and things of value it provides for reasonableness and make recommendations on revising the charges to reflect costs incurred. The biennial review will assure that existing charges are adjusted to reflect unanticipated changes in costs or market values and determine whether other programs should assess fees for goods or services provided.

- Each CFO will, for the areas under their authority:

- Ensure the amount of each user fee complies with the applicable statutory authority (e.g., 38 U.S.C. § 1729(c)(2) requires development of reasonable charges for medical care and services in collaboration with the U.S. Comptroller General, and the process for medical fee update and publication is established in 38 C.F.R. § 17.101);

- Review cost/benefit analysis in MCA data in response to a significant change in market costs or conditions;

- Issue implementing procedures and instructions to establish and review fee determinations; and

- Submit discussion of significant fee issues for reporting in VA’s annual financial statements, when applicable.

040505 Veterans Health Administration (VHA) Medical Program Charges

- VHA medical program fees will be updated annually using the methodology prescribed in 38 C.F.R. §§ 17.101 and 17.102. VHA will submit the updated fee schedule for publication in the “Notices” section of the Federal Register and to a VHA Office of Community Care website list of Rates and Charges.

- Per 38 U.S.C. § 1729, third parties liable under a health plan must pay reasonable charges or demonstrate to the satisfaction of the Secretary that the amount paid to VA is what would have been paid to a nongovernment provider in the same geographic area.

- VHA facilities will comply with annual self-certification requirement confirming adherence to fee-setting regulation in accordance with OMB Circular A-25, User Charges, and VHA guidance in VHA Directives 1660.01, Health Care Resources Sharing Authority – Selling, and 1663, and Health Care Resources (HCR) Contracting – Buying. See Appendix A for the certification statement relating to HCR Sharing Agreements, Appendix B for the certification relating to hospital and medical care (charges to third parties) and Appendix C for the certification statement relating to other charges.

0406 Authorities and References

- Chief Financial Officers Act of 1990

- United States Code

- 38 U.S.C. § 309, Chief Financial Officer

- 38 U.S.C. § 1729, Recovery by the United States of the Cost of Certain Care and Services

- 38 U.S.C. § 1729A. Department of Veterans Affairs Medical Care Collections Fund

- 38 U.S.C. § 8111, Sharing of Department of Veterans Affairs and Department of Defense health care resources

- 38 U.S.C. § 8153, Sharing of Health-Care Resources

- 38 C.F.R. § 17.101, Collection or recovery by VA for care or services provided or furnished to a Veteran for a nonservice-connected disability

- 38 C.F.R. § 17.102, Charges for Care or Services

- FASAB SFFAS

- OMB Circulars

- VHA Directive 1660.01 Health Care Resources Sharing Authority – Selling

- VA Directive 1663, Health Care Resources (HCR) Contracting – Buying

- VHA Office of Community Care website list of Payer Rates and Charges

- FAR

- VAAR

0407 Rescissions

Volume XIII Ch 4, Charges and Full Cost Recovery approved September 2, 2010.

0408 Questions

Questions concerning these financial policies should be directed to the following points of contact:

- VHA VHA Financial Policy (Outlook)

- VHA VAFSC Nationwide Accounting (Outlook)

- VBA VAVBAWAS/CO/FINREP (Outlook)

- VBA VAVBAWAS/CO/OPERATIONS (Outlook)

- NCA NCA Financial Policy Group (Outlook)

- NCA NCA Budget Service (Outlook)

- All Others OFP Accounting Policy (Outlook)

Appendix A: Certification of Compliance –HCR Sharing Agreements

CERTIFICATION OF COMPLIANCE WITH FEDERAL AND VA PRICING GUIDELINES FOR VHA

HCR Sharing Agreements

Part I: Certification of Compliance

I, (name and title of the responsible official), certify that the pricing policies for the (name of facility) materially _____comply/_____do not comply with VA Directive 1663, Health Care Resources Contracting – BUYING and OMB Circular A-25, User Charges and the Chief Financial Officers Act of 1990 (P.L. 101-576) (CFO Act). I further certify that I have reviewed and understand how the authorities apply to HCR Sharing Agreements entered into by this facility. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standards No. 4 and No. 7.

_______________________

(Name and Title)

________________________

(Facility)

_________________________

(Date)

__________________________

(Telephone Number)

Appendix B: Certification of Compliance – MCCF

Certification of Hospital and Medical Care – Third Party Charges

(Medical Care Collections Fund)

Part I: Certification of Compliance

I, (name and title of the responsible official), certify that the charge policies for the non-service-connected medical care and services provided to Veterans at (name of facility) materially _____comply/_____do not comply with 38 U.S.C. § 1729(a) and 38 C.F.R. § 17.101. I further certify that I have reviewed and understand how the authorities apply to the hospital and medical care third party charges. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standard No. 7.

_______________________

(Name and Title)

________________________

(Facility)

_________________________

(Date)

Appendix C: Certification of Compliance – Other Charges

Certification of Compliance with Federal and VA Pricing Guidelines*

Other Charges

Part I: Certification of Compliance

I, (name and title of the responsible official), certify that the pricing policies for the (Administration) materially _____comply/_____do not comply with OMB Circular A-25, User Charges and the Chief Financial Officers Act of 1990 (P.L. 101-576) (CFO Act). Instances where this Administration does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standards No. 4 and No. 7.

_______________________

(Name and Title)

_________________________

(Date)

*Note: For hospital and medical care charges to third parties (or MCCF), use Appendix B. Sharing agreements for other than space or HCR are captured under other user charges.

Appendix D: VHA Procedures for Self-Certification Compliance

- General Overview. This appendix provides VHA facilities procedures for reviewing, approving and imposing user charges and full-cost recovery under VHA Medical Center Health Care Resources (HCR) Sharing Agreements and other user fees in compliance with this Chapter.

Self-certification requires an annual review for pricing data no later than 60 days prior to the expiration date of each HCR Sharing Agreement in accordance with VHA Directive 1660.01, Health Care Resources Sharing Authority – Selling. This certification shall be forwarded to the designated Contracting Officer for the official agreement file. Stations are required to conduct biennial reviews of HCR Sharing Agreements to validate that user charges are consistent with the intent of the policy over the life of the agreement (including option years) and provide biennial certification statements.

This appendix includes procedures for:- Preparing Annual Review of HCR Sharing Agreements

- Preparing HCR Sharing Agreements Biennial Certification of Pricing

- Preparing Biennial Certification Statement for Compliance – Medical Care Collection Fund (MCCF)

- Preparing Biennial Certification of Other User Charges

- Preparing End of Year Certification

- Responsibilities.

To carry out responsibilities outlined in this policy, the VA Medical Center (VAMC) Director, Contracting Officials, Contracting Officer’s Representative, Managerial Cost Accounting (MCA) Site Team, Facility Financial Officer, Program Manager, Veterans Integrated Service Network, and the VHA CFO have specific duties and responsibilities as follows. A team approach is recommended for reviewing each sharing agreement, including the Station CFO and staff, the MCA Site Team, Program Managers, the Contracting Officer, Contracting Officer Representatives (CORs), and Contracting Officer Technical Representatives (COTRs):- VA Medical Center Director (Director): The Director is responsible for the overall compliance with policy. Responsibilities involve planning, reviewing, and approving requirement documents for initiating the selling action through the designated contracting office in accordance with VHA Directive 1660.01, Health Care Resources Sharing Authority- Selling. The Director is also responsible for signing each biennial certification review.

- Contracting Officials (CO): The COs are responsible for preparing and executing HCR Sharing Agreements in accordance with applicable VHA policy and regulations governing HCR and sharing space. They are also responsible for serving on the planning team and maintaining documents.

- Contracting Officer’s Representative (COR): The COR is responsible for providing specific data related to the assigned HCR Sharing Agreement. Additionally, the COR is a member of the team that will complete the annual review of the agreement. Usually the COR is the subject matter expert and represents the Contracting Officer on a day to day basis.

- Managerial Cost Accounting (MCA) Site Team: The MCA team maintains cost data used in estimating full cost of a service. The MCA team is responsible for providing cost data for services related to selling agreements in preparation of the initial agreements and data for the annual review of each agreement.

- Facility Chief Financial Officer (CFO): The facility CFOis responsible for submitting completed biennial self-certification to the VHA CFO Office. The facility CFO is responsible for completing the paragraph regarding HCR Sharing Agreements in the Fiscal Year–End Financial Reports and Statement Certification. To this end, staff will be assigned to conduct the annual HCR Sharing Agreements review. A team, which will include the Contracting Officers, CORs, Program Managers and MCA will complete the Agreement worksheets and Summary sheet for the fiscal year.

- Program Manager (PM): The PM accountable for the sharing agreement is responsible for providing information for the annual review.

- Veterans Integrated Service Network (VISN) CFO: VISN CFO is responsible for ensuring that medical centers comply with these procedures and submit appropriate certifications.

- VHA Office of Finance (VHA CFO) is responsible for establishing national policy and procedures for self-certification review process. The VHA CFO is also responsible for responding to policy inquiries and for collecting and reviewing Biennial Certifications and end of year Financial Statements.

- Procedures for Performing Annual Review of HCR Sharing Agreements.

- Identify facility level HCR Sharing Agreements for selling by contacting the assigned Network Contracting Office and medical center key officials. If the station identifies revenue without corresponding agreements determine if there is a need to establish new sharing agreements.

- Contracting Officer, designee or the COR responsible for administering the agreement can provide documentation from the sharing agreement file when requested. (These files are maintained in accordance with VHA Directive 1660.01, Health Care Resources Sharing Authority- Selling. Agreements for “Other User Fees” will also be reviewed. Identify the following:

- Concept proposal (including scope, description, and price methodology)

- Approvals for proposal

- Signed Agreements

- MCA will be used to identify current full costs for each HCR Sharing Agreement where VA is providing service or space.

- MCA Site Teams will assist in identifying comparison cost data. Use the most current MCA data to provide service costs. The MCA data are derived from the National Data Extract (NDE) reports which provide basic financial and unit cost data. Collaborate with the local MCA team for detail of the data and further granularity. Instructions are provided in Appendix E, under Instructions to Obtain MCA Unit Cost Data.

Using MCA data that includes at least 3 months of current fiscal year cost and workload processed, is recommended. Otherwise, use prior fiscal year MCA data for analysis. As with all data, it is suggested that the data be validated by comparing current year MCA data with MCA data for prior fiscal years, and with comparable medical centers within your group or compared with national average data. Care should be exercised when reviewing cost data for unusual workload volumes and/or potential data anomalies. If data between fiscal years has a large variance, the review team may need to consider weighted averages to flush out fluctuations. - Full costs include, but are not limited to:

- Direct costs

- Indirect Costs

- Corporate Overhead

- Depreciation of general property, plant and equipment, if applicable

- Other, e.g.: Laundry, or other areas for which MCA does not have unit cost data

Total Full Costs = Direct + Indirect +Corporate Overhead +Depreciation + Other

- Enhanced Sharing agreements related to using VA controlled space:

- Identify local market rates, and

- Indirect costs related to service. The MCA Site team can provide reports for indirect costs related to services (per square foot, etc.) such as Engineering, EMS, Security, etc., as applicable.

- Enhanced Sharing agreements for Rooftop space (for antennae) or agreements for other unusable square footage; identify rates for non-usable square footage (NUSQ) from MCA or the local market area.

- HCR Sharing Agreements concerning the use of VA Equipment, use MCA data, and interview Biomedical, Logistics, and or service staff to identify supply, utility, maintenance, repair or other relevant costs; include depreciation, indirect, and overhead costs.

- Other sharing agreements, other than health care services or space, will follow the methodology provided in the initial agreement.

- Compare the selling price to current estimated full cost to determine if the selling price is greater than or equal to current full cost (or market price).

- If MCA is used to determine full costs, determine if pricing is in compliance with SSFAS No. 4 and current. The MCA is current when the station is processing costs and workload into MCA according to the National MCA annual processing schedule. If MCA processing is current for the facility, report that the station is compliant with SFFAS No. 4.

- If the selling price is greater than or equal to the full costs for all sharing agreements and MCA is current and being used, check “Yes” on the certification. If full cost is less than the selling price for any agreement, and or MCA is not current or was not used, check “No” on the certification. Maintain documentation or the Summary Spreadsheet described below in paragraph l, with documentation for the Fiscal Year-End Certification Statement.

- This section provides procedures for completing a template which aids in evaluating selling price compared to full costs for each sharing agreement. The Excel workbook should contain a worksheet for each sharing agreement to document annual reviews as well as a Fiscal Year Summary Sheet. The Fiscal Year Summary Sheet and Agreement Worksheets serve as documentation of annual reviews.

- For each sharing agreement, complete a separate spreadsheet labeled Agreement for the annual review analysis no later than the anniversary date of the agreement. The worksheet has a section for entering charges and cost when the sharing agreement covers multiple services. The total line from the section for multiple services will be entered in the space for a sharing single agreement with a single service for the analysis.

Link to HCR Worksheet 1

The costs are to be updated annually for the life of the sharing agreement. Data from the individual worksheets will roll into a summary spreadsheet to be used for the year-end and HCR Sharing Agreement biennial certifications.- Enter VISN # (cell B1)

- Enter Station # (cell E1)

The answers for rows 1-13 will be maintained in the agreement file and will be obtained from the Contracting Officer or COR. - Enter Title of Sharing Agreement (cell G1)

- Enter Annual Date – date of the annual review (cell K1)

- Enter Sharing Partner (cell C3)

- Enter COR or COTR/Program Manager (cell J3)

- Enter Sharing Agreement # (cell D5)

- Enter Description of Service (cell J5)

- Enter Locations – (VAMC, CBOC, etc.) (cell C8)

- Sharing Agreement Terms

- Enter Beginning date (cell G8)

- Enter Expiration date (cell K8)

- Enter number of No. of Option Years (cell C10)

- Enter Description of Scope (free text) (cell G10)

- Enter Methodology Used to Arrive at Costs for Services to be Sold according to the Concept Proposal in the file (cell D12).

- Enter Annual Estimated Value in $s for a fiscal year (cell E17)

If there are multiple services in the agreement, begin by entering data in the section of the Agreement worksheet labeled “Multiple SERVICES” starting line 80, cell A81. As shown in the sample.

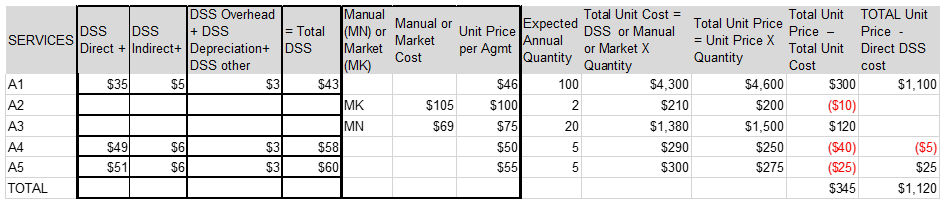

See Figure 4D-1 for Sample Multiple Services. - Enter information for each service on its own line. The grand total for all services for “MULTIPLE SERVICES” will be used for the analysis. Transfer the data from the Total line on the spreadsheet to the cells in the comparison section as outlined below (cell K17). While the agreement may be in compliance if an individual service does not cover the direct costs, the COR will review the charges with the Contracting Officer. It is recognized when dealing with multiple services, some item charges may fall below direct cost or full cost, but overall the agreement for all services will recover full cost.

- Enter Annual Estimated Value in $s for a fiscal year (cell E17)

- Enter Unit Price – i.e., Billing Price Charge in $s

- Enter Unit Price data into cell K17.

- Note: VA is to recover full costs, recommended item charges below direct costs should be eliminated, or charges increased.

- If DSS was used to calculate Full Costs, provide data as described below.

- Enter Current Direct unit costs per DSS in $s (cell E21)

- Enter Current Indirect unit Cost per DSS in $s (cell E23)

- Enter Corporate Overhead unit Cost per DSS in $s (cell E25)

- Enter Depreciation unit Cost per DSS in $s (if applicable) (cell F27)

- Enter Other unit Cost per DSS in $s (cell F29)

- The field for Total Full Cost per unit in $s will automatically calculate (cell K25)

- If DSS data was not available to calculate cost, provide Manual Calculation and, or Market Value.

- Enter Methodology for determining manual calculation by describing specific methods employed, ex. Calculated direct, indirect cost, from private sector data obtained…. (free text) (cell B34)

- Enter Manual Calculation if applicable in $s (cell F41)

- Enter Market Value, if applicable, in $s (cell K41)

- If DSS was used to calculate Full Costs, provide data as described below.

- Based on the entries, the following fields will populate starting with (cell A46)

- Comparison of Unit Price to DSS Full Cost in $s (cell E46)

- Enter Comparison of Unit Price to Manual Calculation, if applicable in $s (cell G48)

- Enter Comparison of Unit Price to Market Value, if applicable in $s (cell E50)

- Analysis of Cost Comparison: Based on the entries, the comparison fields as well as compliance will be denoted based on the following logic.

- YES in Compliance with OMB A-25 signifying for the Sharing Agreement, the medical center is compliant (i.e., unit price/charge is equal to or exceeds Full Costs) if the amount is zero or greater in any the Comparison fields comparing Unit Price to DSS Full Cost or Market Value or Manual Calculation as applicable.

- NO, notin Compliance signifying for the Agreement full costs exceed charge recovery. If the amount is less than zero for the applicable Comparison field comparing Unit Price to DSS Full Cost;

- The amount in Comparison of Unit Price to Market Value; or

- The amount in the Comparison of Unit Price to Manual Calculation.

- If non-compliant, Enter Justification (cell A66) for non-compliance with SFFAS No. 7, stating a reason that full cost is not being charged or recovered by unit price. The Agreement is Non Compliant when the unit price is less than, both Full Cost or Market Price. Per SFFAS No. 7, when non-compliant, i.e. the station’s pricing policy deviates from the general Federal requirement to charge full or market price for goods and services, disclose the circumstance and provide a reason with the certification. (Cell A66 or G66)

- If less than zero, facility should take appropriate action to revise charges to reflect costs incurred (0405I).

- Enter YES in response to, “Was DSS or Managerial Cost Accounting System Used (cell F59) in Compliance w/SSFAS No. 4?”, if DSS was used in determining cost, or is current. DSS is current, when the station is processing cost and workload into DSS according to the DSS annual processing schedule. Check with DSS for processing timeliness. If yes, station is compliant with SFFAS No. 4.

Click on the Summary tab to ensure that it populated from the individual agreement review worksheets. The consolidated Summary Spreadsheet will have the following format for each agreement.- Enter VISN and Station number, cells E1, G1, respectively.

- Check data is populated in the following fields:

- Sharing Agreement Number

- Description of Service

- Methodology Used to Arrive at Costs for Services to be Sold

- Annual Estimated Value

- Current Unit Price (for each service or multiple services under one Sharing Agreement) – Billing price

- Comparison of Charges to Unit Cost – If multiple services, the word “multiple” will appear.

- Compliant with VA Policies, OMB Circular, SFFAS No. 4 and SFFAS No. 7? (Y or N)

- If N, provide disclosure for not meeting SFFAS No7 or justification.

- The individual Agreement review spreadsheet should be kept in the Contracting files. The COR and Contracting Officer team members are responsible for addressing any noncompliance due to pricing reviewing the agreements and deciding if there is an opportunity to change pricing.

- For each sharing agreement, complete a separate spreadsheet labeled Agreement for the annual review analysis no later than the anniversary date of the agreement. The worksheet has a section for entering charges and cost when the sharing agreement covers multiple services. The total line from the section for multiple services will be entered in the space for a sharing single agreement with a single service for the analysis.

- Contracting Officer, designee or the COR responsible for administering the agreement can provide documentation from the sharing agreement file when requested. (These files are maintained in accordance with VHA Directive 1660.01, Health Care Resources Sharing Authority- Selling. Agreements for “Other User Fees” will also be reviewed. Identify the following:

- Identify facility level HCR Sharing Agreements for selling by contacting the assigned Network Contracting Office and medical center key officials. If the station identifies revenue without corresponding agreements determine if there is a need to establish new sharing agreements.

- Procedures for Preparing HCR Sharing Agreements Biennial Certification

- See Figure 4D-2 for a schedule by VISN, month and year due.

- The HCR Sharing Agreements Biennial Certification Statement certifies that VA Medical Center complies with VHA Directive 1660.01, Health Care Resources Sharing Authority – Selling and OMB Circular A-25, User Charges and the Chief Financial Officers Act of 1990 (CFO Act) and disclosed any noncompliance with Federal and VA pricing policies under the Statement of Federal Financial Accounting Standards No. 4 and No. 7. Refer to Appendix A, Certification of Compliance – HCR Sharing Agreements, for template and samples.

- The Biennial Certification Statement requires a review to determine compliance with pricing and full cost policies and disclosure, if necessary, (per CFO Act and SFFAS No. 7) and to determine compliance with use of managerial accounting (per SFFAS No. 4) as described in this chapter. Biennial Certification requires the same annual review for each sharing agreement of selling price to current full cost as described above, including the use of the DSS for determining full costs and validating whether DSS is current. VHA uses Figure 1, 2, or 3 to Appendix E as appropriate (see below) for the certification.

- According to the schedule above, complete the certification including signatures and submit it to the VHA CFO Financial Analyses Shared Mailbox (10A3A) in the appropriate month and year.

- If all HCR Sharing Agreements are compliant and DSS is current and being used, complete the template in Appendix A, Certification of Compliance – HCR Sharing Agreements. See Figure 4E-1 for a sample of the completed form.

- If any of the HCR Sharing Agreements are non-compliant concerning pricing and DSS is current and being used (even if the final costs charged were not the DSS costs), complete Appendix A and complete the section for Disclosure. Under the Disclosure heading, list the Agreement number for each non-compliant agreement and provide a justification. For example: 1) Charging Market Price which is less than Full Costs; 2) Pricing set by law (and provide the legislative citation); or 3) Service for another Federal Agency, or other pertinent reason. Complete the template in Appendix A, Certification of Compliance – HCR Sharing Agreements. See Figure 4E-2.

- If DSS was not used for calculating pricing and is not current, then add to the Disclosure section the following statement: This station is not in compliance with the requirement for having a managerial cost accounting system per SFFAS No 4, “Managerial Cost Accounting Concepts and Standards for the Federal Government.” Complete the template in Appendix A, Certification of Compliance – HCR Sharing Agreements. See Figure 4E-3.

- Retain documentation of extracts, comparison worksheets, analyses and Appendices for 6 years and three months (for availability upon auditor request).

- Questions regarding these procedures should be submitted to VHA CFO Financial Analyses Shared Mailbox (10A3A).

Figure 4D-1 Sample Multiple Services

Figure 4D-2 Schedule by VISN, month and year due

| VISN | MONTH | YEAR |

|---|---|---|

| 1 | FEBRUARY | ODD |

| 2 | FEBRUARY | EVEN |

| 4 | FEBRUARY | EVEN |

| 5 | MARCH | ODD |

| 6 | MARCH | EVEN |

| 7 | MARCH | ODD |

| 8 | MARCH | EVEN |

| 9 | APRIL | ODD |

| 10 | APRIL | EVEN |

| 12 | APRIL | EVEN |

| 15 | MAY | ODD |

| 16 | MAY | EVEN |

| 17 | MAY | ODD |

| 19 | JUNE | ODD |

| 20 | JUNE | EVEN |

| 21 | JUNE | ODD |

| 22 | JUNE | EVEN |

| 23 | JUNE | ODD |

- Procedures for Reasonable Charges Biennial Certification Statement for Compliance – Medical Care Collection Fund (MCCF)

The Reasonable Charges – Medical Care Collection Fund (MCCF) Biennial Certification Statement certifies that policies relating to reasonable charges for the nonservice-connected medical care and services comply with 38 U.S.C. § 1729(a) and 38 C.F.R. § 17.101, and discloses any noncompliance with Federal and VA pricing policies under the Statement of Federal Financial Accounting Standards No. 7. Refer to Appendix B, Certification of Compliance – MCCF, for template and sample.

This section provides step-by-step procedures for VHA facilities to certify compliance with the requirements of the CFO Act and OMB Circular A-25 as they pertain to Reasonable Charges. The most current available DSS Costs will be used for Reasonable Charges certification. It is recommended the review be done in January, using the most recent full-year DSS data for comparison. Appendix B is the certification form to use. Submission will be according to chart provided in section D, Procedures for Preparing Sharing Agreements Biennial Certification.

Only Diagnostic Related Group (DRG) costs and charges will be reviewed.- Facility DRG costs: These costs come from the DSS NDE reports (or you may work with the MCA Site team). Produce a DSS report listing all DRGs performed by your facilities in the year for the DSS data.

- Facility DRG costs: These costs come from the DSS NDE reports (or you may work with the MCA Site team). Produce a DSS report listing all DRGs performed by your facilities in the year for the DSS data.

Access to these reports requires completion of a VA Form 9957 approval process as noted below. MCA staff should already have access and be able to assist you. The Customer User Provisioning System Points of Contact (CUPS POC) at each station manages access to select levels of data within VA Support Service Center (VSSC) and Managerial Cost Accounting (MCA) Web Reports. The Local CUPS POC Request Process is used to request permission to access these data.

To access FPD, including provider-specific information, the

FPD – 110AL99 task code

must be requested on the VA Form 9957 to allow a user to see any DSS Web report.

The required VA Form 9957, “ACCESS FORM” is available at

https://vaww.va.gov/vaforms/va/pdf/va9957.pdf

The Local Customer User Provisioning System Point of Contact (CUPS POC),

in most cases your Information Security Officer (ISO),

should be able to process your request and forward the signed form to Austin.

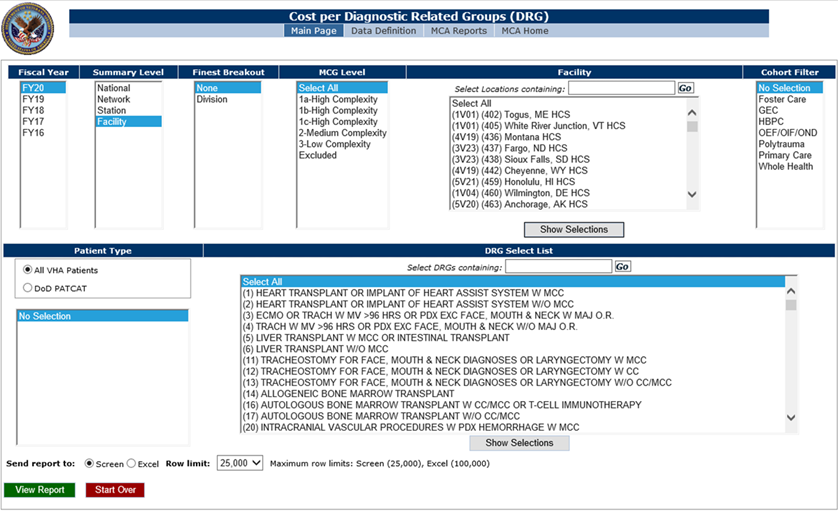

- Download the DRG data from DSS as follows: See screen shots below.

- Open the “MCA (Managerial Cost Accounting) Web Reports” site.

https://mcareports.va.gov/ - Hover over “VHA Reports Home”, then click on Reports from Financial User Support, and NDE Cost Reports.

- Select “Cost per Diagnostic Related Group (DRG)”

- Select FY, Summary Level = Station, Finest Breakout = None, MCG Level = N/A, select specific facility, Cohort Filter = No Selection, Patient Type = All VHA Patients, DRG Selection List = Select All.

- Download as a spreadsheet and save. (Disregard any file format message that may appear.)

The report should contain:- DRG number

- DRG description

- Actual Total Cost by DRG

- Patient days by DRG (total Length of Stay (LOS) by DRG)

- Number of Discharges by DRG (use as needed)

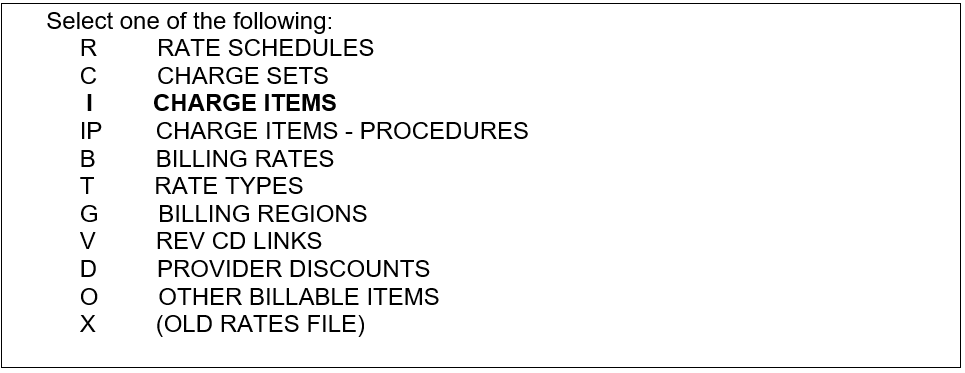

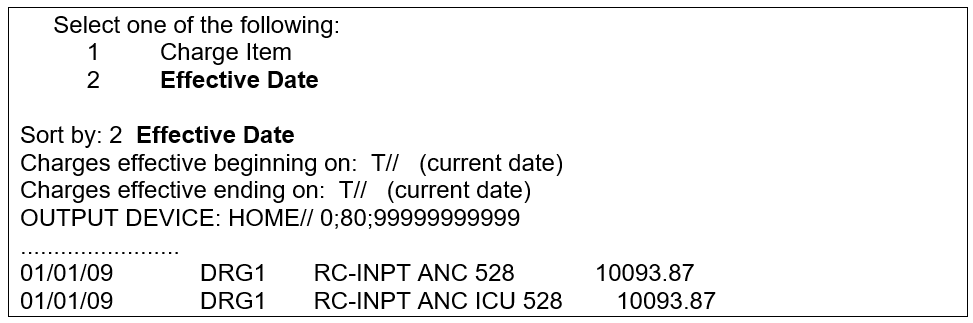

To obtain Facility Reasonable Charges costs, in VISTA, Select Charge Master Menu Option: Print Charge Master. (May need to coordinate with Information Technology or Medical Care Cost Recovery staff)

Charge Master Reports

- Select Report: i CHARGE ITEMS

Caution: This report may be extremely long for some Charge Sets.

Some Charge Sets, such as CMAC or AWP, may have many thousands of Charge Items.

****** Charge Item Report *****

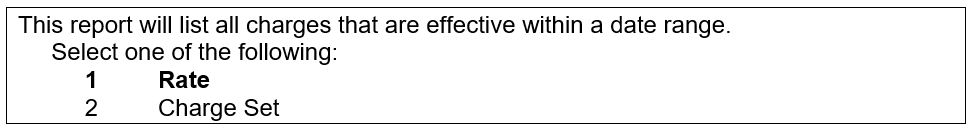

First sort by: 1 Rate

- Select BILLING RATE NAME: RC INPATIENT FACILITY

- Select a single item to display or press return for all items.

- Select DRG:

- Build an Excel spreadsheet which compares DSS daily cost (Per Diem) to Reasonable Charge rate (Ancillary Costs + Room & Board =Total Costs) by DRG. Determine Daily Per Diem by Dividing Total Actual Cost by LOS.

| Total Actual Costs / | LOS = | Daily Per Diem | Per Diem @ 80% | ||

|---|---|---|---|---|---|

| 1 | Craniotomy | $511,108 | 145 | $3,528 | $2,822 |

| 480 | Liver Transp | $2,305,423 | 194 | $11,884 | $9,507 |

| Ancillary Costs + | Room & Board = | TOTAL Costs | ||

|---|---|---|---|---|

| 1 | Craniotomy | $4,037 | $1,454 | $5,491 |

| 480 | Liver Transp | $7,616 | $961 | $8,577 |

| TOTAL Costs – | Per Diem @ 80% = | Difference | ||

|---|---|---|---|---|

| 1 | Craniotomy | $5,491 | $2,822 | $2,669 |

| 480 | Liver Transp | $8,577 | $9,507 | ($930) |

Notes: VA daily Per Diem Costs (DSS) contain professional services fees which are not included in the Reasonable Charge Rates. Therefore, we compare only 80% of DSS costs to Reasonable Charges and note any significant variances.

When comparing cost it is important to note that in many instances the DSS DRGs will not match VACO DRGs. This is due in part to:

a. The facility DSS DRGs are based on actual patient visits and may not match VACO.

b. VACO DRGs may be specialized or new.

c. DRG 888 is for observation and does not include any medical treatment (only room and board).

Review comparisons to identify if DSS costs exceed Reasonable Charges.

Analysis of individual charges not meeting the requirement will provide facilities with a chance to improve performance, but they do not preclude them from being compliant with the established criteria. In the example for DRG 480 listed above, the potential loss is $180,420 (194 LOS x $930 difference).

It is important for stations to review how their costs relate to the amounts being charged. If DSS costs exceed charges, identify the factors causing this. Stations can also take additional steps and describe how costs relate to the actual collection of funds for these procedures. Stations should report discrepancies between costs and charges if the total charges are less than the total costs.

d. Submit Attachment 2 (provided in this guide) for Medical Center Director signature with the comparison report attached.

e. Once signed, submit both the Comparison Worksheet and Completed Appendix B certification to VHA CFO Financial Analyses Shared Mailbox (10A3A) mailbox via Outlook during the month designated for your VISN to report Biennial Certification. Refer to Appendix B, Certification of Compliance – MCCF, for template and sample. See Figure 4E-4.

f. Retain documentation of extract, comparison worksheets, analyses and attachments for 6 years and three months (for availability upon auditor request).

g. Send questions regarding these procedures should be submitted to VHA CFO Financial Analyses Shared Mailbox (10A3A).

- Procedures for Preparing Biennial Certification of Other User Charges

The Other User Charges – Sharing agreements for other than space or HCR are captured under other user charges. Refer to Appendix C, Certification of Compliance – Other Charges, for template.- Send questions regarding these procedures VHA CFO Financial Analyses Shared Mailbox (10A3A).

- Procedures for Preparing End of Year Certification. The Fiscal Year–End Financial Reports and Statement Certification will include the following:

The station has accurate and timely information on the cost and revenue for sharing agreements, e.g., HCR Sharing Agreement is in compliance with SFFAS Number 4, Managerial Cost Accounting Concepts and Standards for the Federal Government. Cost information is / is not accurate and available for FY 20XX.

Stations will respond based on the annual certification of HCR Sharing Agreements. Include a copy of the Worksheet with End of Year Certification supporting documentation. The Fiscal Year Summary Sheet and Agreement Worksheets serve as documentation of annual reviews.

- Send questions regarding these procedures or the accompanying spreadsheet to VHA CFO Financial Analyses Shared Mailbox (10A3A).

- Send questions regarding these procedures or the accompanying spreadsheet to VHA CFO Financial Analyses Shared Mailbox (10A3A).

MCA Reports Access/Additional Charge Certification Samples

Instructions to Obtain MCA Unit Cost Data

- Prior to obtaining MCA data, new users may need to request access to VA Financial Management System and/or additional task codes to process reports.

- Request task codes (consulting the MCA Site Team as needed) using VA Form 9957 and obtain the necessary approvals from your facility. VA Form 9957 is available at https://vaww.va.gov/vaforms/va/pdf/VA9957.pdf.

- MCA Web Reports are requested using the Local Customer User Provisioning System Point of Contact (CUPS POC) or the NDS Healthcare Operations Request Process. For MCA Web Reports access contact your Identity and Access Management (IAM) POC or OIT ITOPS IO Mainframe Access Management Office (Outlook).

- The MCA Reports Portal is on the VSSC web site and can be accessed by this link: https://mcareports.va.gov/.

- For inpatient DRG costs, refer to instructions and screenshots provided in section E, Procedures for Reasonable Charges Biennial Certification Statement for Compliance – Medical Care Collection Fund (MCCF), of this document.

- There are many reports for outpatient care by clinic stop or department; long term care, overhead, depreciation. Just click on desired values on the screen and hit submit. Download as a spreadsheet and save.

Remember the MCA Site Team is available to assist.

Appendix E: Additional Charge Certification Samples

Refer to Appendix D, VHA Procedures for Self-Certification Compliance, for detailed process information.

Figure 4E-1: Sample HCR Certification when in Compliance

CERTIFICATION OF COMPLIANCE WITH FEDERAL AND VA PRICING GUIDELINES FOR VHA

Health Care Resources (HCR) Sharing Agreements

I, John P. Director, Director, certify that the pricing policies for the VA Medical Center, USA materially JPD _comply /_____do not comply with VHA Directive 1660.01, Health Care Resources Sharing Authority – Selling or OMB Circular A-25, User Charges, and the Chief Financial Officers Act of 1990 (P.L. 101-576) (CFO Act). I further certify that I have reviewed and understand how the authorities apply to HCR Sharing Agreements entered into by this facility. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standards No. 4 and No. 7.

John P. Director

John P. Director, Director

VA Medical Center, USA

March, 20XX_

Disclosure of Non Compliance in accordance with SFFAS No. 4

Disclosure of Non Compliance in accordance with SFFAS No. 7

Figure 4E-2: Sample HCR Certification when not Compliant

CERTIFICATION OF COMPLIANCE WITH FEDERAL AND VA PRICING GUIDELINES FOR VHA

Health Care Resources (HCR) Sharing Agreements

I, John P. Director, Director, certify that the pricing policies for the VA Medical Center, USA materially _____comply /_ JPD ____do not comply with VHA Directive 1660.01, Health Care Resources Sharing Authority – Selling or OMB Circular A-25, User Charges, and the Chief Financial Officers Act of 1990 (P.L. 101-576) (CFO Act). I further certify that I have reviewed and understand how the authorities apply to HCR Sharing Agreements entered into by this facility. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standards No. 4 and No. 7.

John P. Director

John P. Director, Director

VA Medical Center, USA

March, 20XX_

Disclosure of Non Compliance in accordance with SFFAS No. 4

Disclosure of Non Compliance in accordance with SFFAS No. 7

- Agreement with ABC Medical School – Charging Market Price which is less than full cost per DSS.

Figure 4E-3: Sample HCR Certification when DSS not Compliant and Agreements Not Compliant

CERTIFICATION OF COMPLIANCE WITH FEDERAL AND VA PRICING GUIDELINES FOR VHA

Health Care Resources (HCR) Sharing Agreements

I, John P. Director, Director, certify that the pricing policies for the VA Medical Center, USA materially _____comply /_ JPD ____do not comply with VHA Directive 1660.01, Health Care Resources Sharing Authority – Selling or OMB Circular A-25, User Charges, and the Chief Financial Officers Act of 1990 (P.L. 101-576) (CFO Act). I further certify that I have reviewed and understand how the authorities apply to HCR Sharing Agreements entered into by this facility. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standards No. 4 and No. 7.

John P. Director

John P. Director, Director

VA Medical Center, USA

March, 20XX

Disclosure of Non Compliance in accordance with SFFAS No. 4

- This station is not compliant with SFFAS No. 4, concerning having a managerial cost accounting system.

Disclosure of Non Compliance in accordance with SFFAS No. 7

- Agreement with ABC Medical School – Charging Market Price which is less than full cost per DSS.

REASONABLE CHARGES BIENNIAL CERTIFICATION HOSPITAL AND MEDICAL CARE – THIRD PARTY CHARGES

Refer to Appendix D, VHA Procedures for Self-Certification Compliance for detailed certification information.

Figure 4E-4: Sample of Certification for Compliance with Reasonable Charges- MCCF

Medical Care Collections Fund

I, John P. Director, Director, certify that the charge policies for the non-service connected medical care and services provided to Veterans at VA Medical Center, USA materially JPD _____comply/_____do not comply with 38 U.S.C. § 1729(a) and 38 C.F.R. § 17.101. I further certify that I have reviewed and understand how the authorities apply to the hospital and medical care third party charges. Instances where this facility does not comply with Federal and VA pricing policies are disclosed under the certification for compliance with the Statement of Federal Financial Accounting Standard No. 7.

John P. Director

John P. Director, Director

VA Medical Center, USA

March, 20XX

Appendix F: Cost-Benefit Analysis

A cost-benefit analysis (CBA) for a proposed computer matching process will aid VA in determining if the benefits received from performing the match exceed the costs associated with producing that benefit. The Office of Management and Budget (OMB) and Government Accountability Office (GAO) have provided agencies with guidance on assessing CBAs for computer matching processes. The guidance requires agencies to identify in their CBAs:

- All potential costs that will be incurred by implementing a computer matching must be identified. Key cost elements include:

- Personnel costs (i.e. salaries, benefits, time dedicated to performing the match) for staff involved in the matching process.

- Computer costs (i.e. maintenance and use of computers at facilities, generating the data file) related to processing the matching file.

- All anticipated benefits associated with the computer matching must be identified. Key benefit elements include:

- Avoidance of future improper payments: prevention by identifying and correcting errors.

- Recovery of detected improper payments through matching process.

If the results of a CBA suggest that the overall benefits associated with a proposed match outweigh the incurred costs, then the Data Integrity Board (DIB) should approve the match.

General Description of CBA

Each step and activity of the matching process should be evaluated for feasibility and provide the qualitative and quantitative information needed to complete the analysis. There are eight sections to the CBA which are described below:

- Objective: This section will provide information about the purpose of conducting the computer matching process being analyzed.

- Program Level Matching: In this section, the systems to be matched, details about the data files to be generated, similarities or dissimilarities intended to identify, and information about the Requesting Agency and the Providing Agency will be provided. If a similar computer matching program is already in existence, information about the matching should be provided and differences of this new program should be listed.

- Percentage and Number of Potential Hits: In this section, the program manager will: project the intended number of positive matches expected, how the results will be screened, what problems (i.e. data entry error, non-compliance, ineligibility) are to be verified, how hits will be adjudicated, and what actions will be taken to resolve the data or program problems. If the projected results are based upon the results of another program, this information should be provided in this section. It is important to use only roughly comparable programs to ensure credible comparisons are made for decision making purposes.

- Dollar Value of Potential Loss Avoidance: The program manager should identify all future improper payments and debts expected to be avoided in the future by performing the computer matching process.

- Description of Any “Non-Dollar” Factors Regarding the Match: In this section, all qualitative factors should be listed, to include any statutory requirements to perform the match regardless of the outcome. For example, the Improper Payment Elimination and Recovery Improvement Act of 2012 (IPERIA) provides agencies a waiver to listing specific estimates of associated benefits and costs, although a justification for the program and the anticipated results are still required.

- Costs for Conducting the Computer Matching Activity: Dollar values of all key elements of potential costs should be assessed. VA will comply with the Statement of Federal Financial Accounting Standards (SFFAS) No. 4, Managerial Cost Accounting Concepts and Standards for the Federal Government and recognize the full cost of conducting the computer matching process. See VA Financial Policy, Volume XIII – Cost Accounting for more information on full cost.

- Total Cash Collected as a Result of the Computer Matching Activity: The recovery and collection of improper payments and debts should be provided in this section. In addition, as required by OMB Circular A-25, VA may charge user fees to recover the full cost for providing the computer matching file.

- Conclusion: This section should summarize the outcome of the CBA and provide the recommendation of the Program Manager on whether to conduct the computer matching or not.

Prior to forwarding for DIB review, the CBA must be approved by the Administration’s Chief Financial Officer (CFO) or the Program’s CFO as applicable for the VA Staff Offices. A sample CBA template is included in Appendix G, below.

CBA APPENDIX ADDED AUTHORITIES AND REFERENCES

- VA Handbook 6300.7, Procedures for Computer Matching Programs

- Office of Management and Budget (OMB) Circular A-130, Management of Federal Information Resources

- Government Accountability Office (GAO), Computer Matching: Assessing Its Costs and Benefits, GAO/PEMD-87-2 (Washington, D.C.: November 10, 1986)

Appendix G: CBA Template and Sample CBA

[Insert Date]

Cost-Benefit Analysis

[Insert Matching Program Name]

For

[Insert Receiving Agency Name]

From

[Insert Providing Agency Name]

- Objective

- Program Level Matching

- Percentage and Number of Potential Hits

- Dollar Value of Potential Loss Avoidance

- Description of Any “Non-Dollar” Factors Regarding the Match

- Costs For Conducting This Computer Matching Activity

- Total Cash Collected as a Result of the Computer Matching Activity

- Conclusion

Signatory Authority Approve/Disapprove

———————— ——————————–

Program Manager Administration or Program

Chief Financial Officer (CFO)