Volume XVI - Charge Card Programs

Chapter 02C – Government Travel Card Program Management

Questions concerning this policy chapter should be directed to:

- Veterans Health Administration

- Veterans Benefits Administration

- Home | Salesforce

- For emergency only OPERATIONS.VBACO@va.gov

- National Cemetery Administration

- VACO IT Travel / Travel Card Support

- All Others

0201 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies regarding program management of the Government Travel Card Program individually billed accounts (IBAs) and centrally billed accounts (CBAs).

Key points covered in this chapter:

- VA will adhere to the requirements of:

- 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries); and

- OMB Circular A-123, Appendix B, Revised 2019.

- Agency/Organization Program Coordinators (A/OPCs) must perform monthly program oversight of IBAs and CBAs to identify delinquency, potential fraud, misuse, or abuse;

- Violations of policy must be reported by an A/OPC to their next higher-level A/OPC within five business days after identification or notification;

- Level 4 A/OPCs must initiate Salary Offset procedures for any delinquent IBA account that has a past due balance ≥ 90-days; and

- Level 1 A/OPCs will ensure quarterly rebates from the contracted bank are accurate and properly distributed.

Under 5 U.S.C. § 406 (Inspector General Act of 1978 – PL 95-452, VA Office of Inspector General (VA OIG) employees are required to adhere to travel directives, policies, procedures, and guidance provided by VA OIG.

Union rights and privileges related to travel expenses, as defined in Union agreements, do not supersede the regulations contained in FTR Chapters 300 – 304.

0202 Revisions

| Section | Revision | Requesting Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| All | Rescinded previous Volume XVI, Chapter 2 – Government Travel Charge Card Program, creating three new chapters on IBAs (Ch. 2A), Centrally Billed Accounts (Ch. 2B), and A/OPC program management (Ch. 2C). | Office of Financial Policy | Leadership organizational change | May 2024 |

| Various | Reformatted to new policy format and completed 5-year review. | Office of Financial Policy | Reorganized chapter layout. | May 2024 |

| Various | This is a new policy chapter on A/OPC program responsibilities updated to reflect current charge card management and internal control requirements. | Office of Financial Policy | To align policy with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B, Revised 2019. | May 2024 |

| Various | Added new or changed completion timeframes on internal control requirements. | Office of Financial Policy | To strengthen internal controls. | May 2024 |

| Various | Added policy on administrative actions for IBA cardholders and IBA or CBA A/OPCs on non-compliance of policy. | Office of Financial Policy | To address non-compliance with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B, Revised 2019. | May 2024 |

| Appendices A, B, and C | Added administrative actions for policy violations for IBA cardholders (Appendix A), CBA A/OPCs (Appendix B), and IBA A/OPCs (Appendix C). | Office of Financial Policy | To address non-compliance with, 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B, Revised 2019. | May 2024 |

| Appendix D | Added program oversight guidance on use of contracted bank standard reports for IBA delinquency, potential fraud, and misuse or abuse. | Office of Financial Policy | Procedures for utilizing reports, consistent with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B revised 2019, internal control requirements. | May 2024 |

0203 Definitions

Agency/Organization Program Coordinator (A/OPC) – An appointed employee serving as the point of contact and administrator for an organization’s travel cards. The A/OPC oversees the administration of the Government Travel Card Program in accordance with law, regulation, and policy.

Beneficiary Travel – A categorical term referring to VBA Veteran Readiness and Employment (VR&E) travel of an eligible veteran or another person for vocational rehabilitation or counseling; or VHA Beneficiary travel of an eligible veteran or another person for medical examination, treatment, or care.

Centrally Billed Account (CBA) – A travel card/account established by the contracted bank at the request of the agency/organization. These may be card or cardless accounts.

Charge – A debit value transaction posted to a Government travel card account resulting in an amount due and payable.

Declined Transaction – An action that the contracted bank may take when a Government travel card is used, usually due to insufficient funds, but may result from a condition where the merchant is blocked by VA, the contracted bank has flagged the account for fraud or potential fraud, or the account is closed.

Disposable Pay – The part of pay remaining after the deduction of any amount required by law is withheld. Required deductions do not include discretionary deductions such as health insurance, savings bonds, charitable contributions, etc. Deductions may be made from basic, special, and incentive pay.

Disputed Charge – A charge that the cardholder believes is erroneous that has or will be disputed with the contracted bank.

Electronic Access System (EAS) – The charge card servicing bank’s internet-based system which provides a variety of reports and assists in the effective management of the travel card program.

Federal Travel Regulation (FTR) – The FTR provides travel and relocation regulations for all Title 5 Executive Agency employees.

Hierarchy – A bank term referring to a system of assigning travel cards to A/OPCs at different levels within an organization.

Individually Billed Account (IBA) – A Government contractor-issued travel charge card issued to authorized individuals to pay for official travel and transportation-related expenses for which the contracted bank bills the employee, and for which the individual is fully liable.

Merchant Category Codes (MCCs) – A 4-digit code used to classify a business by the type of goods or services it provides.

Misuse – Use of a Government travel card in an unauthorized, illegal, or adverse manner (e.g., unauthorized cash advances, purchase of unofficial/personal expenses, or use not incident to official travel).

Official Travel – Travel under an official travel authorization (TA) to and from an employee’s official station or other authorized points of departure and a temporary duty location, travel between two temporary duty locations, or relocation at the direction of a Federal agency (FTR § 300-3.1, Official Travel).

Rebates – Monetary incentives offered by Government-wide charge card issuers to encourage the Government to pay charge card invoices early.

Refunds – A return of funds previously disbursed.

Salary Offset – The process of deducting from a VA employee’s disposable pay the maximum allowable amount of the undisputed outstanding balance the employee owes to the contracted bank as a result of delinquency on their IBA.

Split Disbursement – A process in VA’s travel system allowing a travel reimbursement payment to be split between the Traveler and the contracted bank.

Temporary Duty Travel (TDY) – Travel by an employee on official business to a designated location(s) away from their local area, as authorized by an employee’s AO through a TA.

Travel Management Center (TMC) – A common carrier travel firm, under contract with VA’s travel system contractor, providing reservations, tickets, and related travel management services for VA Travelers on authorized official travel.

0204 Roles and Responsibilities

Chief Financial Officers (CFOs) and Local Finance Officials are responsible for ensuring program oversight requirements are completed each month, and appropriate corrective action will be initiated as needed.

Financial Services Center (FSC) is responsible for performing operational, management, and oversight activities for IBA and CBA travel cards. In addition, the Executive Director, FSC, will determine when a violation of regulation or policy warrants referral to VA OIG or Federal prosecutors for criminal investigation.

Level 1 A/OPC (primary and alternates) are responsible for developing and maintaining VA’s Charge Card Management Plan, and overseeing the management, operations, and internal controls of VA’s Government Travel Card IBA and CBA Program, including the referral of suspicious or fraudulent use of a Government travel card to the Executive Director, FSC.

Level 2 A/OPCs are the central point of contact between the Level 1 A/OPCs and the respective Level 3 and/or Level 4 A/OPCs and provide day-to-day support to all A/OPCs under their hierarchy. In the absence of Level 3 and 4 A/OPCs under their hierarchy, the Level 2 A/OPC must perform all Level 3 and 4 A/OPC program oversight responsibilities.

Level 3 A/OPCs have similar responsibilities as the Level 2 A/OPC, with Level 3 being the responsible point of contact between the Level 4 and 2 A/OPCs. In the absence of Level 4 A/OPC’s under their hierarchy, the Level 3 A/OPC must perform all Level 4 A/OPC oversight responsibilities.

Level 4 A/OPCs have the primary responsibility for performing internal control program oversight to identify delinquency, potential fraud, misuse, or abuse. In addition, they provide day-to-day support to all IBA cardholders under their hierarchy and provide guidance and assistance to new IBA applicants.

Office of Human Resources & Administration/Operations Security and Preparedness (HRA/OSP) is responsible for establishing guidelines and procedures for appropriate disciplinary actions to be taken against VA personnel for improper, fraudulent, or abusive use of Government travel cards and assisting supervisors with reporting and imposing appropriate disciplinary actions, when warranted.

Servicing Payroll Offices are responsible for submitting requests, initiated due to travel card debt, for Salary Offset to Defense Finance and Accounting Services.

Supervisors are responsible for:

- Appointing a subordinate employee to perform the duties of an A/OPC;

- Ensuring the appointed employee’s performance standards clearly outline their A/OPC responsibilities in their performance plan;

- Initiating appropriate personnel actions in conjunction with their local HR office for a subordinate IBA cardholder or an IBA or CBA A/OPC who violates policy.

0205 Policies

020501 General Policies

- VA will comply with the requirements of 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries).

- VA will comply with the requirements of OMB Circular A-123, Appendix B, Revised 2019.

- All Government IBA official travel usage and reimbursement, and CBA usage will be consistent with 41 C.F.R., Subtitle F, Federal Travel Regulation System (FTR), and VA Financial Policy.

- In accordance with National Archives and Records Administration (NARA) the responsible Agency/Organization Program Coordinator(A/OPC) must retain travel card documents for a minimum for six years. Items subject to this requirement include but are not limited to:

- Employee and beneficiary travel CBA related documents (e.g., receipts, monthly reconciliations, disputed charges, tracking of unused tickets, etc.);

- Cardholder and A/OPC training certificates (or a Talent Management System (TMS) report in lieu of training certificates) and the respective cardholder and/or A/OPC VA Form 0933s; and

- Documentation of internal control oversight (e.g., data analytics or reports utilized to monitor delinquencies or identify misuse, or fraudulent charges, etc.).

020502 Training

- In accordance with OMB Circular A-123, Appendix B, Revised 2019, all VA program participants must take initial training prior to appointment and refresher training, at a minimum, every 3 years.

- A/OPCs appointed in a hierarchy to perform management and internal control requirements must complete the following training and refresher training timely, providing their training certificates to their next higher-level A/OPC for NARA retention:

- VA 5508, VA Online Travel Card Training, in VA’s TMS; and

- The self-paced GSA SmartPay Travel Training for Program Coordinators TMS course number OFD 3946996.

- A/OPCs can access the contracted bank’s Electronic Access System (EAS) “Training” page for guidance on how to produce reports for performing oversight on their IBA and CBA travel cards.

020503 Program Management

- The primary Level 1 A/OPC Government Charge Card Program Manager at the FSC, will oversee the management, operations, and internal controls of VA’s Government Travel Card IBA and CBA Program, assisted by alternate Level 1 A/OPCs as directed, and lower-level A/OPCs as needed.

- In accordance with OMB Circular A-123, Appendix B, Revised 2019, the Level 1 A/OPC Government Charge Card Program Manager (primary Level 1 A/OPC) will develop and maintain VA’s Charge Card Management Plan.

- Supervisors within each administration and staff office will appoint an employee to perform the duties of a Level 2, 3, or 4 A/OPC (primary and alternate(s)) for CBA and IBA travel card A/OPCs.

- When appointed by a Supervisor as an A/OPC for IBAs, VA Form 0933C, Statement of Understanding for Government Travel Card Individually Billed Account Agency/Organization Program Coordinator must be completed and forwarded to the level 1 A/OPC for approval.

- Once an A/OPC is appointed, their supervisor must ensure the A/OPC performs their duties and that their employees’ performance plan clearly outlines the appointed A/OPC duties and completion timeframes.

- When a Service Line Agreement (SLA) includes a request for the FSC to provide an organization’s A/OPC duties, the FSC will only assign trained employees to provide those services.

- All A/OPCs will ensure:

- Their training requirements, their cardholders, and those of their next lower-level A/OPC under their hierarchy are current;

- Current training certificates will be requested from their cardholders and their applicable next lower-level A/OPCs 15 calendar days in advance of expiration;

- Standard IBA credit limits that were set at $1 due to inactivity are raised to $5,000 when notified by the cardholder they have been approved for travel;

- IBA credit limits are reduced to $1 for any cardholder transferring to another organization within VA and the cardholder is instructed to notify the gaining station to move their IBA under the gaining station’s hierarchy;

- Restricted IBA credit limits do not exceed the needed spending amount per the approved TA(s) for a single, back-to-back, or long-term travel episodes;

- For foreign travel, the estimated conversion rate is factored in when determining the amount of the cash credit limit increase; and

- Communication with lower-level A/OPCs, and cardholders on topics and concerns related to travel cards is timely and complete.

- In addition to the duties performed by all A/OPCs, Level 1 A/OPCs (primary and/or alternates) provide VA-wide management for the travel charge card program by:

- Ensuring contractual arrangements with each travel card issuing contractor contain a requirement that the creditworthiness of an individual be evaluated before the individual will be issued a travel charge card;

- Serving as the Contracting Officer’s Technical Representative (COTR) for the task order between VA and the issuing bank;

- Reporting travel program status to General Services Administration (GSA) and OMB;

- Implementing risk management controls;

- Monitoring travel charge card issues, including pending legislation related to travel;

- Monitoring rebates from the contracted bank for accuracy, ensuring proper distribution, and maximizing refunds while minimizing risk;

- Maintaining and reporting data and performance metrics in accordance with OMB Circular A-123, Appendix B;

- Establishing access for Level 1 and 2 A/OPCs in the contracted bank’s EAS;

- Approving new CBA applications and submitting approved applications and Point of Contact (POC) Maintenance Forms to the contracted bank within five business days;

- Ensuring Continuity of Operations Plan (COOP) standard IBAs retain the contracted bank’s maximum credit limit of $5,000 at all times (i.e., not lowered to $1 when not on travel or due to inactivity); and

- Ensuring COOP restricted IBAs are increased as required for emergency deployments.

- Level 2 A/OPCs are normally appointed at the administration level or staff office level (e.g., VHA, VBA, NCA Office of Management, Office of Information and Technology (OIT), etc.). In addition to the duties performed by all A/OPCs, Level 2 A/OPCs will provide management and oversight of the travel charge card program by:

- Serving as the central point of contact between the Level 1 A/OPC and the respective Level 3 and/or Level 4 A/OPCs and providing support to A/OPCs under their hierarchy;

- Establishing newly appointed Level 3 and 4 A/OPCs under their hierarchy in the contracted bank’s EAS;

- Removing a lower-level A/OPC’s access to the EAS due to failure to meet/maintain training requirements

- Timely notifying the A/OPC and their supervisor of non-compliance issues;

- Reviewing and submitting CBA applications and POC Maintenance Forms within three business day of receipt to the Level 1 A/OPC;

- Providing quality and timely customer service to all A/OPCs and cardholders under their oversight to ensure program success;

- Providing high-level policy and operational guidance to lower-level A/OPCs; and

- Performing the Level 4 A/OPC responsibilities required in this chapter in the absence of a Level 3 and/or 4 A/OPC under their hierarchy.

- In addition to the duties performed by all A/OPCs, Level 3 A/OPCs act as an intermediate level that may be utilized between Level 2 and Level 4 A/OPCs. Level 3 A/OPCs will perform the same roles as those of a Level 2 A/OPC above except for the review and submission of new CBA applications to the Level 1 A/OPC which can only be performed by a Level 2 A/OPC.

- In addition to the duties performed by all A/OPCs, Level 4 A/OPCs assigned at the station, staff office, or organizational level will:

- Assist employees with day-to-day IBA support matters (e.g., credit limit increases, assistance when cards are lost, damaged, or stolen, updating changes to the official billing address in the EAS);

- Ensure IBA applicants are aware of VA policy requirements;

- Submit IBA applications for employees when all requirements have been met; and

- Submit CBA applications to the Level 2 A/OPC for submission to the Level 1 A/OPC for approval and processing with the contracted bank.

- In accordance with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), VA will ensure that the travel charge card of each employee who ceases to be employed by the agency is invalidated immediately upon termination of the employment of the employee. An A/OPC will not authorize the clearance form for a cardholder whose IBA has a balance owed until it is paid-in-full but must close the account. In addition, A/OPCs should confirm there are no pending charges not yet posted. Refer to Volume XII, Chapter 3 – Employee Debt for salary offset guidance on unpaid balances of separated employees.

020504 Program Internal Controls

- In accordance with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), VA will utilize effective systems, techniques, and technologies to prevent or identify improper purchases.

- A/OPCs assigned to a CBA hierarchy will ensure controls identified in Volume XVI, Chapter 2B – Government Travel Card Centrally Billed Accounts are in place and functional.

- The primary Level 1 A/OPC will ensure VA’s Travel Card Program complies with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries) and OMB Circular A-123, Appendix B, Revised 2019, requirements and guidance on management and implementing internal controls.

- Level 1 A/OPCs will perform VA-wide oversight on CBA and IBA travel card usage. The oversight requirements include, but are not limited to:

- Ensuring compliance with FTR, and VA policy, and providing operational training and procedures;

- Ensure all internal control oversight requirements have been completed timely;

- Ensuring all employee and beneficiary travel CBA transactions are reconciled in accordance with Volume XIV, Chapter 2B – Government Travel Card Centrally Billed Accounts;

- Initiating appropriate administrative actions (refer to Appendices A, B, and C);

- Ensuring Level 4 A/OPCs initiate Salary Offset for cardholders who have a ≥ 90-day delinquent outstanding balance;

- Monitoring all VA-initiated Salary Offsets until the debt is paid in full;

- Utilizing Data/analytics for oversight on the usage of all travel cards to identify potential fraud, waste, and abuse;

- Managing Merchant Categories with the contracted bank to limit potential fraud, waste, and abuse of IBAs and CBAs; and

- Monitoring and reducing account delinquencies by working with the contracted bank to provide training to all A/OPCs in the bank’s EAS.

- Level 2, and 3 A/OPC’s as applicable, must:

- Ensure all internal control oversight requirements have been completed timely by their IBA Level 3 and 4 A/OPCs;

- Perform additional internal control program oversight reviews on an as needed basis, utilizing effective systems, techniques, and technologies to prevent or identify improper use or purchases on IBA travel cards under their hierarchy;

- Monitoring the Past Due Report monthly to ensure Level 3 and 4 A/OPCs initiate Salary Offset procedures for cardholders who have a ≥ 90-day delinquent outstanding balance;

- Ensure their station’s, staff office’s, or organization’s CFO or local Finance Official, as applicable, are notified of the following delinquency conditions on any IBA travel card:

- 60-days delinquent and at risk for Salary Offset (initiates at ≥ 90-days);

- Salary Offset has been initiated and the number of days delinquent;

- Pending charge off (180-days delinquent);

- Report CBA and IBA policy violations no later than five business days after identification or notification of a violation to the next higher-level A/OPC;

- Ensure agency policy is being followed and administrative actions are initiated on IBA cardholders and CBA and IBA Level 4 A/OPCs under their hierarchy;

- Assist their respective Level 3 and Level 4 A/OPCs in operational matters, providing guidance on policy violation issues; and

- Assess the need for hierarchy changes that would improve the management and oversight of their administration or organization.

- In the absence of a Level 4 A/OPC, the Level 3 or 2 A/OPC is required to perform the Level 4 A/OPC’s oversight responsibilities.

- All Level 4 A/OPCs will complete IBA travel card internal control program oversight requirements by the 15th of each month following the billing statement date. Level 4 A/OPCs will:

- Utilize the contracted bank’s Past Due Report to identify past due accounts to avoid accounts becoming delinquent;

- Utilize effective systems, techniques, and technologies to prevent or identify improper purchases, to review all account charges under their hierarchy to identify potential fraud, misuse, and abuse;

- Initiate Salary Offset procedures (refer to Appendix E) for accounts ≥ 90-day past due;

- Report policy violations no later than five business days after identification or notification of a violation to the next higher-level A/OPC;

- In accordance with Appendix A, ensure appropriate administrative actions were initiated;

- Maintain a monthly list of all open IBA cardholders under their hierarchy (refer to Appendix D, Account List for guidance) to ensure:

- Accounts not activated within 60-days of receipt are closed (refer to FTR § 301-51.1 and § 301-70-708);

- Cardholder accounts are lowered to $1 due to failure to maintain their current training requirements;

- Restricted IBA credit limits are kept at $1 when not on travel, including those designated as DEMPS and COOP members;

- Credit limits are lowered to $1 for standard IBAs (including DEMPS accounts) with six months of inactivity, except for those designated as COOP members;

- IBAs requiring closure, or requiring credit limits to be reduced to $1, will only occur when:

- The cardholder is not on travel;

- The cardholder does not have an approved TA with a travel start date within five calendar days; and

- The cardholder is notified of this action in advance;

- Accounts contain the cardholder’s valid va.gov email address as required by the contracted bank; and

- Semi-annually (can occur more frequently) an A/OPC obtains a list of all current DEMPS and COOP members to verify all current members have an open IBA and only current members have the required designation (DISASTER/EMERGENCY or COOP, respectively) entered in their IBA’s “Organization Name” field in the EAS.

- Supervisors must ensure the internal control program oversight responsibilities of their Level 4 A/OPCs have been properly performed and completed by the required date.

- When a Level 4 A/OPC establishes a pattern of non-compliance, and the supervisor has not taken corrective action, the Level 1 A/OPC may contact higher-level staff in the supervisor’s chain of command for resolution and/or take administrative action (reference Appendix B and C).

- When performing a monthly review of account charges, the Level 4 A/OPC may request a cardholder provide information related to purchases that appear unusual or inappropriate. The cardholder must respond by the date specified in the request so that the Level 4 A/OPC can determine if a policy violation has or has not occurred.

- Failure of an IBA cardholder to respond timely to requests for information will result in the Level 4 A/OPC reducing the cardholder’s credit limit to $1. This reduction will not occur if the cardholder is actively on travel or pending imminent travel.

- To minimize the potential for delinquency, fraud, misuse, and abuse, FSC will perform periodic audits of IBA and CBA travel cards to ensure compliance with VA policy requirements.

020505 Credit Limit Increases

- When an A/OPC receives a request for a credit limit increase from a standard IBA cardholder, the A/OPC will increase the limit to $5,000, unless a higher amount is requested and justified.

- When an A/OPC receives a request for a credit limit increase from a restricted IBA cardholder, the A/OPC must determine the amount of the credit limit increase. The increase will be based on the TA’s total reimbursable expense amount plus an appropriate buffer for unforeseen authorizable expenses.

- When a cardholder requests a credit limit increase due to extended TDY or back-to-back travel episodes, an A/OPC will:

- Calculate the amount of a potential credit limit increase.

- Assess the travel dates involved and whether the timely submission of a travel claim and payment to the IBA can be accomplished to determine if a higher-than-normal credit limit is warranted.

- For extended TDY, consider requiring the cardholder to file bi-weekly travel claims as opposed to filing a claim every 30 days to avoid the need for a higher-than-normal credit limit.

- For back-to-back travel episodes increase the cardholder’s credit limit as needed for the first travel episode, and once the next travel episode’s TA is approved determine if another increase is necessary.

- When an A/OPC increases a credit limit they must notify the cardholder of the new credit limit, the date the limit was or will be increased, and the date the cardholder’s credit limit will be reduced to $5000 for a standard IBA, or $1 for a restricted IBA.

- When a standard or restricted card credit limit increase is appropriate an A/OPC will increase a restricted IBA cardholder’s credit limit five business days in advance of the travel start date unless notified by the Traveler that authorized charges to the IBA will be incurred at an earlier date.

- A/OPCs will lower restricted IBA credit limits to $1 no later than five business days after the travel end date.

- A/OPCs will only increase cash credit limits from $0 when one of the following conditions exists:

- The cardholder provides an approved TA indicating that:

- Use of an IBA is not practical (e.g., vendor does not accept credit cards) or imposes unreasonable burdens or costs (FTR § 301-51.2);

- The employee is traveling to or in an area where the political, financial, or communication infrastructure does not support the use of the IBA (e.g., certain foreign countries or emergency response areas).

- The cardholder will be on extended TDY, and a weekly IBA cash advance has been authorized; or

- A cardholder is performing official travel and has notified the A/OPC, and their supervisor if available, that an unanticipated need for cash arises.

- The cardholder provides an approved TA indicating that:

- A/OPCs will lower the cash credit limit to $0 no later than five business days after the travel end date.

020506 Past Due Accounts

- Level 4 AOPCs will complete a review of their past due report by the 15th of each month following the billing statement date to ensure that accounts are maintained in a current status.

- Level 4 A/OPCs will assess the cause for each past due or delinquent IBA account and contact all cardholders, copying the cardholder’s supervisor, within five business days of obtaining the Past Due Report to prevent further aging consequences (e.g., account suspension, Salary Offset, and the potential for administrative or disciplinary actions).

- Level 4 A/OPCs will provide training and information to cardholders on how to prevent their account from becoming past due or delinquent.

- Level 4 A/OPCs will request the cardholder make payment in full no later than 10 business days from the date contacted and will follow up to ensure the account was paid in full. The Cardholder’s supervisor will also be notified of the past due account. Cardholders currently on travel may be allowed a reasonable number of additional business days to meet the payment requirement after completion of travel but should be advised their past due account will become delinquent 45 days past the billing statement date upon which the unpaid and undisputed charges first appeared.

- Level 4 A/OPCs will document actions taken to address delinquencies on the Past Due Report.

- The Level 4 A/OPC should take the account’s past due or delinquency history information into consideration in determining whether an administrative action discussion with the cardholder’s supervisor is warranted.

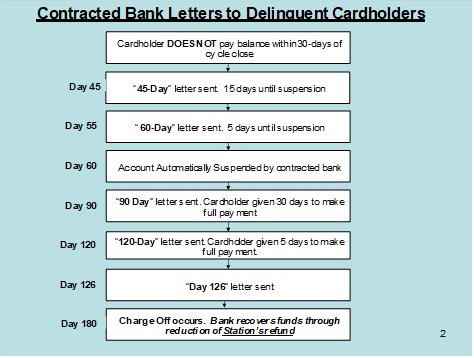

- The table below provides account status and administrative actions that the contracted bank will take and the Level 4 A/OPC or higher-level must take based on the number of days an account remains unpaid/past due:

| Number of Days | Account Status | Contracted Bank/Level 4 A/OPC Actions |

| 30 | Past Due | The monthly statement will indicate the account is past due. Level 4 A/OPC will notify the cardholder and their supervisor the account is past due, requiring payment resolution. |

| 45 | Delinquent | The contracted bank will change the account status to delinquent but will continue to allow charges. The contracted bank will send a pre-suspension letter to the cardholder when 55-days delinquent. |

| 60 | Suspended | The monthly billing statement will include a second notice the account is past due. If the past due amount is paid-in-full between 60 and 90-days, the contracted bank will automatically lift the suspension, re-opening the cardholder’s account. |

| 90 | Suspended | The monthly billing statement will include a third notice the account is past due. The contracted bank will initiate calls regarding the past due balance from their internal collections department. Level 4 A/OPC will serve the cardholder with a Salary Offset Letter indicating intent to collect from disposable pay the unpaid balance owed on the cardholder’s account. If the account is paid-in-full before 120-days delinquent, salary offset will not be initiated and the Level 4 A/OPC can request the contracted bank to re-open the cardholder’s account. |

| 120 | Pre-cancellation | The monthly billing statement will include a fourth notice that the account is past due. The contracted bank will cancel an account with a pre-cancellation status if within 12 months the account has been suspended twice for non-payment of undisputed principal. Level 4 A/OPC initiates salary offset. If the past due amount is paid-in-full between 120 and 126-days, the Level 4 A/OPC can request the contracted bank to re-open the cardholder’s account. |

| 126 | Canceled | The contracted bank sends a letter to the cardholder notifying the account has been canceled. If the past due amount is paid-in-full between 126 and 149-days, the cardholder can request the Level 4 A/OPC seek permission from the Level 1 A/OPC to open a new account on behalf of the cardholder. |

| 150 | Canceled | If the past due amount is paid-in-full between 150 and 179-days, to reinstate the account the cardholder may request reinstatement following Appendix A, Travel Card Reinstatement Procedures. |

| 180 | Charge-off | If salary offset has not been initiated, the contracted bank will report the delinquency to credit bureaus and may refer for collection, based on the amount owed. |

020507 Salary Offset

- 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries) requires:

- Under regulations issued by the Administrator of General Services and upon written request of a Federal contractor, the head of any Federal agency or a disbursing official of the United States may, on behalf of the contractor, collect by deduction from the amount of pay owed to an employee of the agency any amount of funds the employee owes to the contractor as a result of delinquencies not disputed by the employee on a travel charge card issued for payment of expenses incurred in connection with official Government travel. The amount deducted from the pay owed to an employee with respect to a pay period may not exceed 15 percent of the disposable pay of the employee for that pay period, except that a greater percentage may be deducted upon the written consent of the employee.

- Collection under this subsection shall be carried out in accordance with procedures substantially equivalent to the procedures required under 31 U.S.C. § 3716(a).

- In accordance with OMB, Circular A-123, Appendix B, Revised 2019, VA will implement Salary Offset procedures for IBA travel charge card accounts.

- Level 4 A/OPCs, utilizing the contracted bank’s Past Due Report, must identify and initiate salary offset procedures for any cardholder who has an outstanding balance ≥ 90-days.

- VA requires salary offset to be performed in accordance with the procedures in Appendix E.

- Failure to initiate Salary Offset on an account 180 days delinquent will result in the contracted bank charging off the debt. The contracted bank will recover the lost funds through reduction of the station’s rebate, requiring VA to initiate a bill of collection.

- Reference Volume XII, Chapter 3 – Employee Debt for policy on Federal Salary Offset fundamentals.

020508 Violations of Policy

- An A/OPC who intentionally violates policy may be subject to administrative, disciplinary, and when warranted criminal and/or civil actions (refer to18 U.S.C. § 287 and §1001, and 31 U.S.C. § 3729).

- Any A/OPC who is found to have knowingly or negligently violated travel card policy, law, or regulation may be prohibited from serving as a Government Charge Card Program participant.

- In accordance with OMB Circular, A-123, Appendix B, Revised 2019, VA will ensure effective controls are in place to mitigate the risk of internal fraud, misuse and delinquency. Circumstances surrounding each case of card misuse, abuse and/or fraud must be considered when determining the proper type of corrective or disciplinary action, if any, which may be imposed.

- In accordance 5 U.S.C. 5701, (Statutory Notes and Related Subsidiaries), VA “shall establish guidelines and procedures for disciplinary actions to be taken against agency personnel for improper, fraudulent, or abusive use of Government charge cards, which shall include appropriate disciplinary actions for use of charge cards for purposes, and at establishments, that are inconsistent with the official business of the Department or agency or with applicable standards of conduct.”

- Supervisors may initiate disciplinary personnel action(s) when an employee violates policy.

- Supervisors, consulting with their local HR office, will consider a range of appropriate adverse personnel actions, including the removal in appropriate cases, to be imposed on employees who fail to comply with laws, regulations, or VA policy with respect to travel cards. Disciplinary personnel actions, if taken, will be based on the circumstances surrounding each instance and will be designed to ensure that the violations will not be repeated. Refer to VA Handbook 5021, Employee-Management Relations, for policy guidance on disciplinary personnel actions.

- Any VA employees with knowledge or information about actual or possible violations of law concerning the use of a travel card must report the violation (refer to 38 C.F.R., § 1.201). Employees may choose to report a violation to their supervisor, FSC via email to VAFSCChrgCardReview@va.gov, or directly to VA OIG via the “VA OIG Hotline website”.

- Appendix B and C contain a listing of administrative actions a Level 1 A/OPC may take when an employee violates policy.

- The Level 1 A/OPC will not close or reduce the limit on a CBA due to incomplete performance of a CBA A/OPC’s duties unless the Level 1 first:

- Verifies no pending airfare reservations are awaiting ticketing;

- Verifies no hotel reservations are pending, guaranteed by the CBA; and

- Contacts the CBA organization’s CFO or Chief Fiscal Officer for a resolution to avoid this administrative action.

- Executive Director, FSC, may refer a case to VA OIG, or federal prosecutors for criminal investigation. Any VA employee referred to VA OIG shall be prohibited from being a participant in any Government Charge Card Program pending VA OIG’s opinion and recommendation.

0206 Authorities and References

- United States Code (U.S.C.)

- 5 U.S.C. § 406, Authority of Inspector General (Public Law 95-452)

- 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries)

- 18 U.S.C. § 287, False, fictitious, or fraudulent claims

- 18 U.S.C. § 1001, Statements or entries generally

- 31 U.S.C. § 3729, False Claims

- 31 U.S.C. § 3716(a), Administrative offset

- Code of Federal Regulations (C.F.R.)

- Office of Management and Budget, Circular A-123, Appendix B, Revised 2019

- Department of Defense Form 2481, Request for Recovery of Debt Due the United States by Salary Offset

- Electronic Access System (EAS) website

- National Archives and Records Administration, General Records Schedule 1.1.10

- VA Financial Policy Publications

- VA Handbook 5021, Employee/Management Relations

- VA Form 0933C, Statement of Understanding for Government Travel Card Individually Billed Account Agency/Organization Program Coordinator

- VA OIG Hotline website

- VA Talent Management System (TMS) website

0207 Rescissions

Volume XVI Chapter 2 – Government Travel Charge Card Program, October 2021.

Appendix A: Level 4 A/OPC Administrative Actions for Individually Billed Account Cardholder Policy Violations

- The table below lists administrative actions any Level A/OPC may take for documented IBA policy violations by any IBA cardholder and the Level 1 A/OPC may take to suspend or remove an IBA cardholder as a Government Charge Card Program participant.

| IBA Cardholder | A/OPC Administrative Actions |

|---|---|

| Failure to complete IBA initial training. | 1st offense: The Level 4 A/OPC will advise the cardholder and their supervisor the IBA application will not be initiated until training is completed. |

| Failure to maintain IBA refresher training or to provide a PDF of the current training certificate. | 1st offense: The Level 4 A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1 until refresher training is completed. Failure to complete the training and/or provide a PDF of the current training certificate within 15 days of notification will result in the closure of the IBA. |

| Suspected internal fraudulent use of an IBA. | 1st offense: The A/OPC will notify the cardholder and their supervisor the IBA will be temporarily closed. |

| Failure to pay IBA balance when due, regardless of whether the Traveler has been reimbursed for travel expenses. | 1st offense: The Level 4 A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1, and the cardholder is required to pay the full balance owed within 10 business days (may be allowed more time if on extended TDY) and complete refresher training. Failure to comply, or any repeated pattern of failure to pay the balance owed by the due date, may result in similar actions or, after consulting with the supervisor, permanent closure of their IBA may occur. |

| Misuse of IBA. | 1st offense: The Level 4 A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1 until refresher training is completed, or after consulting with the supervisor, permanent closure of the IBA may occur. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| Cardholder payment returned for non-sufficient funds. | 1st offense: The Level 4 A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1 until refresher training is completed, or after consulting with the supervisor, permanent closure of IBA may occur. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| The cardholder has unpaid charges 45-days past the closing date of the account statement on which the unpaid undisputed charges first appeared. | 1st offense: The Level 4 A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1 until refresher training is completed, and the past due balance is required to be paid-in-full by the date specified. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| The cardholder has unpaid charges 60-days past the closing date of the account statement on which the unpaid undisputed charges first appeared. | 1st offense: The contracted bank will temporarily suspend the account. The Level 4 A/OPC will notify the cardholder and their supervisor, of the cardholder’s requirement to complete refresher training, and the past due balance is required to be paid-in-full by the date specified. The Level 2 A/OPC will notify the CFO or Chief Fiscal Officer of the cardholder’s 60-day delinquency. and that they are at risk for Salary Offset. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| The cardholder has unpaid charges 90-days past the closing date of the account statement on which the charges first appeared. | 1st offense: The Level 4 A/OPC will initiate Salary Offset procedures. The Level 4 A/OPC will notify the cardholder and their supervisor, and the Level 2 A/OPC will notify the CFO or head Fiscal Officer that a Salary Offset has been initiated. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| Failure to respond/comply with either internal or external audit requests by the date specified. | 1st offense: The A/OPC will notify the cardholder and their supervisor that the IBA credit limit will be reduced to $1 until the cardholder responds to the request, or after consulting with the supervisor, permanent closure of the IBA may occur. 2nd offense: After consulting with the supervisor, the A/OPC may permanently close the IBA. |

| Notes: | |

| Depending on the egregiousness of the violation, IBA cardholders must be aware that one violation may be reason enough to be removed from functioning as a Government Charge Card Program participant and that administrative action will be considered by their supervisor. | |

| At the discretion of the Executive Director, FSC, cases may be referred to VA OIG, or federal prosecutors for criminal charges. | |

| Any IBA cardholder referred to VA OIG shall have all charge cards associated with the employee immediately canceled and will be prohibited from serving as a Government Charge Card Program participant, pending VA OIG’s opinion and recommendation. | |

Appendix B: Level 1 Administrative Actions for Centrally Billed Account Program Policy Violations

The table below lists administrative actions that may be taken by the Level 1 A/OPC as a result of CBA policy violations by any employee or beneficiary travel CBA A/OPC, or program participant, including CBA A/OPC failure to perform program management or oversight requirements.

| CBA Cardholder | A/OPC Administrative Actions |

|---|---|

| Purchasing unauthorized items. | 1st offense: A/OPC is required to complete refresher training, issued a bill of collection including debt collection fees, and/or after consulting with the supervisor may be removed as a Government Charge Card Program participant. |

| Failure to secure Government CBA travel charge card account information. | 1st offense: A/OPC or individual is issued a bill of collection, including debt collection fees, and after consulting with the supervisor may be removed as a Government Charge Card Program participant. |

| Using a Government CBA travel charge card without being an authorized cardholder. | 1st offense: The individual is Issued a bill of collection, including debt collection fees, and after consulting with the supervisor may be removed as applicable, as a Government Charge Card Program participant. |

| Failure to maintain A/OPC training requirements or to provide a PDF of the current training certificate(s) to their Level 2 A/OPC. | The A/OPC and their supervisor will be notified of the training requirements, and the current training certificate(s) must be provided within 15 days of notification. Failure to complete this requirement will result in removal as a Government Travel Card Program A/OPC, requiring a new A/OPC to be appointed. |

| A/OPC fails to complete their required program oversight on CBAs by the 15th of each month following the billing statement date. | 1st offense: A/OPC must complete refresher training and the supervisor is notified to resolve the issue. 2nd offense: Complete refresher training and the supervisor must be notified to resolve the issue. If the offense occurs within 3 months of the previous offense, the appropriate levels within the station, staff office, or organizational chain of command may be contacted to resolve the issue. Additional offenses: Subject to removal as an A/OPC and may be removed as a Government Charge Card Program participant, after consulting with the appropriate levels within the station, staff office, or organizational chain of command. |

| Violating VA policy or OMB Circular A-123, Appendix B requirements of the Government Travel Card CBA Program. | 1st offense: A/OPC is required to complete refresher training or, after consulting with the supervisor, may be removed as a Government Charge Card Program participant. |

| Violating ethics standards. | 1st offense: If applicable the A/OPC is issued a bill of collection, including debt collection fees, and after consulting with the supervisor, may be removed as a Government Charge Card Program participant. |

| Notes: | |

| Dependent on the egregiousness of the violation CBA A/OPCs and program participants must be aware that one violation may be reason enough to be removed from functioning as a Government Charge Card Program participant and that administrative action will be considered by their supervisor. The Level 1 A/OPC may contact appropriate levels within the station, staff office, or organizational chain of command for resolution. | |

| At the discretion of the Executive Director, FSC, cases may be referred to VA OIG, or federal prosecutors for criminal charges. | |

| Any CBA A/OPC or program participant referred to VA OIG shall have all charge cards associated with the VA employee immediately canceled and will be prohibited from serving as a purchase card AO, pending VA OIG’s opinion and recommendation. | |

Appendix C: Level 1 Administrative Actions for Individually Billed Account Program Policy Violations

The table below lists administrative actions that may be taken by the Level 1 A/OPC as a result of any Level A/OPC’s violation of policy or failure to perform program management or oversight requirements.

| A/OPC | Administrative Actions |

|---|---|

| Purchasing unauthorized items. | 1st offense: A/OPC must complete refresher training, will be issued a bill of collection including debt collection fees, or after consulting with the supervisor may be removed as a Government Charge Card Program participant. |

| Failing to secure Government IBA information. | 1st offense: As applicable, A/OPC or another individual will be issued a bill of collection including debt collection fees. After consulting with the supervisor, the A/OPC may be removed as a Government Charge Card Program participant. |

| Using a Government IBA without being an authorized cardholder. | 1st offense: A/OPC will be Issued a bill of collection, including debt collection fees as applicable, and after consulting with the supervisor may be removed as a Government Charge Card Program participant. |

| Failure to maintain A/OPC training requirements or to provide a PDF of the current training certificates to their next higher-level A/OPC. | 1st offense: The A/OPC and their supervisor will be notified of the training requirements, and current training certificate(s) must be provided within 15 days of notification. Failure to complete this requirement will result in removal as a Government Travel Card Program A/OPC, requiring a new A/OPC to be appointed. |

| A/OPC fails to complete their required program oversight on IBAs or CBAs by the 15th of each month following the billing statement date. | 1st offense: A/OPC must complete refresher training and the supervisor is notified to resolve the issue. 2nd offense: Complete refresher training and the supervisor must be notified to resolve the issue. If the offense occurs within 3 months of the previous offense the appropriate levels within the station, staff office, or organizational chain of command may be contacted to resolve the issue. Additional offenses: Subject to removal as an A/OPC and may be removed as a Government Charge Card Program participant, after consulting with the appropriate levels within the station, staff office, or organizational chain of command may be contacted to resolve the issue. |

| Violating VA policy or OMB Circular A-123, Appendix B, Revised 2019 requirements for the Government Travel Card Program. | 1st offense: Complete refresher training and supervisor must be notified. After consulting with the supervisor, may be removed as a Government Charge Card Program participant. |

| Violating ethics standards. | 1st offense: If applicable, the A/OPC will be issued a bill of collection, including debt collection fees. After consulting with the supervisor, may be removed as a Government Charge Card Program participant. |

| Notes: | |

| Depending on the egregiousness of the violation, A/OPCs must be aware that one violation may be reason enough to be removed from functioning as a Government Charge Card Program participant and that administrative action will be considered by their supervisor. The Level 1 A/OPC may contact appropriate levels within the station, staff office, or organizational chain of command for resolution. | |

| At the discretion of the Executive Director, FSC, cases may be referred to VA OIG, or federal prosecutors for criminal charges. | |

| Any A/OPC referred to VA OIG shall have all charge cards associated with the A/OPC immediately canceled and will be prohibited from serving as a Government Charge Card Program participant, pending VA OIG’s opinion and recommendation. | |

Appendix D: Program Oversight – Contracted Bank Reports

A. The contracted bank’s EAS has various reports available to produce (standard) or to create (design) for use by an A/OPC to perform program oversight. Except for the contracted bank’s standard Past Due Report, an A/OPC may choose to use the reporting flexibilities available in the EAS, other than the standard reports available, but the internal control review elements specified in 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), and/or OMB Circular A-123, Appendix B, Revised 2019, must be performed.

B. To ensure consistency in covering all usage timeframes, reports utilized to perform the oversight must be created for the same period each month to account for all calendar day usage. The bank’s monthly billing cycle (typically on the 23rd of each month) begins the day after the previous month’s billing cycle date. Reports may be created for the first calendar day of the bank’s billing cycle through the last day of the bank’s billing cycle or may be created based on a calendar month, as long as the preferred report period will be used consistently each month in creating the reports.

C. The contracted bank reports identified below are the standard reports that Level 4 A/OPCs may select to perform the specific oversight requirements in this chapter. When obtained from the contracted bank’s EAS, the reports are recommended to be saved as a clean “Master”, and copies made for use in performing and documenting the required program oversight reviews have been completed.

1. The “Past Due Report” (standard report) will be created each month on the first business day after the contracted bank’s billing cycle date and reviewed within five business days. It shall be scheduled to be produced monthly in EAS with additional recipients. It will be used to identify when an IBA has a past due or delinquent balance and provides the current amount past due plus an aging history in 30-day increments ending with 181+ days on the cardholder’s delinquency. Level 4 A/OPCs must be diligent in taking appropriate action to eliminate the potential for a cardholder to become delinquent and move into the 60-day (contracted bank suspension of IBA) or greater delinquent aging categories.

- Insert a “Comments” column in the Past Due Report (as the second column after the name in the report) and save the report. After assessing the cause for each cardholder’s past due or delinquent amount the Level 4 A/OPC will follow the policy in this chapter regarding documentation and correspondence on the delinquency.

- Level 4 A/OPCs will first determine the cause of each cardholder’s delinquency. Travel claim was not submitted or approved timely is one possible reason, but the most common reason is a cardholder’s lack of knowledge or understanding of how to properly use the split disbursement feature to pay all charges owed on their account. Level 4 A/OPCs will offer training or support to cardholders assisting them in learning how to confirm their travel claim payment to the bank posted and cleared the balance due (e.g., open all bank statements received or use EAS) or how to avoid insufficient split disbursements in future travel claims (reference Volume XVI, Chapter 2A – Government Travel Card Individually Billed Accounts for procedures on split disbursement).

- Level 4 A/OPCs will communicate the delinquency and requirement to pay the outstanding balance to the cardholder and the cardholder’s supervisor following the policy and the applicable timeframes in this chapter. The Level 4 A/OPC will offer to provide guidance or training to the cardholder, and the cardholder’s AO as applicable, to assist in the prevention of future delinquencies.

2. The “Transaction Detail Report” will be used to comply with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), first to validate that the employee’s charges were associated with authorized official travel, and second to validate businesses used for charges were appropriate for official travel purposes. The following steps guide a Level 4 A/OPC in preparing the standard contracted bank Transaction Detail Report for review, and how to perform the oversight for the elements required:

Step 1: Make a copy of the Master Transaction Detail Report obtained from the EAS and prepare the report hiding columns not needed so the column headings read from left to right: Name, insert a “Comment” column, Transaction Date, Transaction Amount, Merchant Category Code Group, Merchant Category Code Description, Merchant Name. The report should be sorted from A to Z on the “Name” column. It is recommended under View, to freeze the top row. Save this version of the report as “Transaction Detail – Authorized Travel”, Then save a second copy as “Transaction Detail – Merchant Category” (utilized in Step 6 below).

Step 2: Obtain from VA’s travel system a “Travel Documents Not Complete Report” and a “Completed Expense Voucher Report” for the corresponding date range of the Transaction Detail Report for your organization. Adjust the columns for both reports to read from left to right: Employee, Doc Name, TA Number, Current Status, Trip Departure Date, and Trip Return Date. Sort the report A to Z by the “Employee” column. For cross-funded travel, the A/OPC must look up the TA in VA’s travel system to obtain the travel date range, as these two reports for your organization will not list cross-funded travelers.

Step 3: For each cardholder on the Transaction Detail – Authorized Travel report, use VA travel system reports to identify the Departure Date and Trip Return Date, posting the travel episode date range in the Transaction Detail – Authorized Travel “Comment” section.

Step 4: Compare the cardholder’s travel dates to the cardholder’s transaction dates to determine if any transaction charges were incurred outside of the authorized official travel dates, requiring assessment. The cardholder may have had more than one travel episode during the reporting period. Certain transactions may be incident to an official travel episode and the date of the transaction may occur before or after the travel episode dates (e.g., authorized Automated Teller Machine (ATM) cash withdrawals shall be allowed up to five calendar days in advance of the travel start date, advance payment of ground transportation shuttle, advance hotel deposit was required, etc.).

Step 5: The Level 4 A/OPC should document and date in the report under the Comments column the review determination on each invalid or questionable transaction identified and any action taken, or communication sent or received. Upon completion of the Transaction Detail – Authorized Travel report review, save the report.

Step 6: Use the “Transaction Detail – Merchant Category” report (refer to Step 1 above) to review business use (merchant used) on transactions. The column headings were previously prepared, but you will sort this report from A to Z on the Merchant Category Code Group column.

Step 7: For each MCC Group (e.g., Airlines, Limousine, Other, Other Travel), scroll through each group looking at the transaction amounts to find anomalies that may indicate potential inappropriate use for official travel or use inconsistent with FTR or VA policy, for example:

- “Airline” MCC Group amounts are indicative of an airline’s normal baggage fee, internet fees charged will be claimed in the travel claim for official business, airfares must not be charged as policy mandates the CBA must be used, and early boarding fees must not be charged since it is a personal preference, not a reimbursable travel expense);

- “Rental Car” MCC Group transactions were authorized and justified in the TA or the travel claim;

- The additional MCC Description and Name column information can provide further guidance in assessing if a charge is appropriate or will need further information:

- The “Eating and Drinking” MCC Group transactions have amounts appropriate for a single meal purchase and type of meal, not attributable to the purchase of meals for more than 1 person (e.g., a single meal above $100 or $50 spent at a McDonalds; the Merchant Name indicates a bar and the amount spent is excessive for the purchase of a meal);

- “Other Travel” MCC Group does not indicate Limousine in the Merchant Name, or expenses for a Taxi or Uber are higher than normal (e.g., greater than $75), or merchant information indicates unofficial expenses were purchased; and

- Wholesale Purchases MCC Group Description transaction amounts at grocery stores are reasonable and incurred at the TDY location, and for the duration of the travel, grocery purchases make sense when compared to the frequency of charges made at “Eating and Drinking” MCC group establishments.

Step 8: In general Level 4 A/OPCs should be looking for charges which may be personal in nature or inappropriate, in particular during holiday periods, and other times when the Level 1 A/OPC advises additional caution or awareness will be required.

Step 9: The Level 4 A/OPC should document and date under Comments in the report their determination on any questionable transaction, including any action taken, and communication sent or received. Upon completion of the Transaction Detail – Merchant Category report review, save the report.

3. The Declined Transaction Report will be reviewed for potential misuse or fraud. The IBA cardholder must notify their Level 4 A/OPC whenever they incur a declined transaction, (refer to Volume XVI, Chapter 2A – Government Travel Card Individually Billed Accounts).

Step 1: Prepare the report hiding columns not needed so the column headings read from left to right: Account Name, insert a “Comment” column, Decline Date, Decline Time, Decline Reason, Requested Amount, Request Type. The report should be sorted from A to Z on the “Account Name” column. It is recommended under View, to freeze the top row.

Step 2: The Level 4 A/OPC will assess each declined transaction based on any cardholder required prior communication received regarding the declined transaction incident. If the cardholder has not communicated they incurred a declined transaction as required, the Level 4 A/OPC should contact the cardholder, copy the cardholder’s supervisor, and request information regarding the declined transaction, providing the amount of the charge, date, time, and the merchant’s name associated to the declined transaction. The information provided by the cardholder should be assessed by the Level 4 A/OPC to decide if their use was appropriate or inappropriate. Examples of declined transactions:

- Hotel MCC Group transaction reason declined “Pick-up 1 – Fraud-F1”, can occur if an IBA, reported as lost or stolen, is attempted to be used;

- Bank cash advance declined due to “Not Enough Available Money” (e.g., could be fraud, misuse, or abuse but when associated with an authorized travel episode will often be due to a credit limit having been previously lowered to $1 and not requested to be raised by the cardholder as required for upcoming travel); or

- Wholesale Trade MCC Group transaction was blocked for MCC Description of Department Store, with a Merchant Name of “Macy’s”.

Step 3: Document and date in the report under the Comments column the review determination and any action taken, or communication sent or received. Upon completion of the Declined Transaction Report review, save the report.

4. The Cash Advance Report will be reviewed for potential fraud, waste, or abuse to ensure ATM withdrawal(s) were appropriate, and IBAs were not used for the same expenses for which an ATM was authorized and withdrawn (refer to Volume XVI, Chapter 2A – Government Travel Card Individually Billed Accounts).

Step 1: Prepare the report hiding columns not needed so the column headings read from left to right: Account Name, insert a “Comment” column, Optional 2, Transaction Date, Description, Amount, Posting Date. The report should be sorted from A to Z on the “Account Name” column. It is recommended under View, to freeze the top row.

Step 2: Review each cardholder to determine the ATM or bank cash advance listed were:

- Authorized in advance on the cardholder’s TA as an FTR or VA policy exception to the mandatory use of the IBA;

- Authorized withdrawals occurred only within five calendar days before a travel start date or during a travel episode, but not after the travel return date, and typically not on the return day of travel unless the authorized ATM was for a specific expense not incurred until the return travel date;

- Taken for official travel purposes, with post-approval for the withdrawal attached in the travel claim;

- Only one withdrawal (ATM or bank cash advance) was taken per week and did not exceed the authorized amount unless specifically authorized in the TA for additional withdrawals (refer to Volume XVI, Chapter 2A – Government Travel Card Individually Billed Accounts for policy on ATM frequency); and

- Authorized expenses taken through an ATM withdrawal, were not then paid using the IBA (requires referring to the TA ATM authorization and reviewing the Transaction Detail Report to confirm).

Step 3: Document and date in the report under the Comments column the review determination and any action taken, or communication sent or received. Upon completion of the Cash Advance Report review, save the report.

5. The Account List will be used to review IBA oversight requirements on card activation, restricted IBA credit limits, credit limits must be lowered on inactive accounts, ensuring email addresses are current for all open accounts, and to manage current DEMPS and COOP members have an IBA and must be designated accordingly.

Step 1: Save an unaltered master copy of the Account List as created by the contracted bank and then save a copy of the report. Using the copy sort the report A to Z on the “Account Status Description” column. Remove any account row that does not reflect “Open” and save.

Step 2: Prepare the report hiding columns not needed so the column headings read from left to right: Account Name, insert a “Comment” column, Optional 2, Email Address, Open Date, Organization Name, Needs Activation, Last Transaction Date, and Account Credit Limit. It is recommended under View, to freeze the top row. At this point, you can perform the following steps using the one report or make a copy of this prepared report for each review action, as preferred.

Step 3: Sort the report A to Z on the “Needs Activation” column to review all open accounts for “Card needs to be activated”. Following policy, any account not activated (“Card needs to be activated”) requires notification to the cardholder via email, copying the cardholder’s supervisor, to activate the issued card within 10 business days and to reply when it has been activated. The Level 4 A/OPC must follow up to ensure activation has been completed. Any account not activated within 60-days of issuance (FTR § 301-51.1 and § 301-70-708) must be closed. Should the cardholder respond they have not received the travel card, the Level 4 A/OPC must assist the cardholder in resolving the matter. The Level 4 should document and date in the report under the Comments column their review determination (e.g., the cardholder did not notify their Level 4 A/OPC to update their official billing address as required so the travel card was returned to the contracted bank as undeliverable or was delivered and thrown out as junk mail without opening, etc.) and any action taken, and communication sent or received.

Step 4: Sort the report A to Z on the “Optional 2” column. Review the Account List to ensure restricted IBA credit limits are kept at $1 when cardholders are not on travel. Following policy, if the review identifies a restricted account is not at $1, the Level 4 A/OPC must verify the cardholder is either on authorized travel or not on authorized travel or imminently pending authorized travel before lowering the limit and notifying the cardholder by email their credit limit has been lowered to $1. For each cardholder listed on the report with a credit limit, not at $1, document and date in the report under the Comment column the review determination, any action taken, or communication sent or received.

Step 5: Sort the report A to Z on the “Last Transaction Date” column. Review the Account List to identify IBAs with no activity in the last six months. These accounts must have their credit limit lowered to $1, except for standard IBAs with COOP annotated in the “Organization Name” field on the account, which will not be lowered. Level 4 A/OPCs must verify the cardholder is not on authorized travel or imminently pending authorized travel and is not a COOP standard IBA cardholder before lowering the credit limit and must notify the cardholder via email of the credit limit action taken and the reason. The Level 4 A/OPC should document and date in the report under the Comments column the review determination, any action taken, and communication sent or received.

Step 6: Sort the report A to Z on the “Email Address” column. The contracted bank requires a valid email address on each IBA account. Review the “Email Address” column to locate any new accounts with misspelled email addresses or accounts with either no email address entered or an invalid email format. Contact the cardholder to obtain a valid email to enter in the EAS. The Level 4 A/OPC should document and date in the report under the Comments column the corrective action taken, and communication sent or received. Additional reasons an email address may be invalid (e.g., spelling error, improper email format, the cardholder’s name and email address changed since the card was issued, and a new email address was not provided to the Level 4 A/OPC to update in the EAS. The only practical way an A/OPC can ensure all accounts have a valid email would be to make corrections when communicating by email new information pertinent to all of their cardholders, as invalid emails will be identified by email to the Level 4 A/OPC as undeliverable and the Level 4 A/OPC should address the correction of the invalid email in the EAS at that time.

Step 7: Sort the report A to Z on the “Organization Name” column. At least semi-annually (can occur more frequently) Level 4 A/OPCs will obtain a copy of their organization’s DEMPS and COOP members (as applicable) to ensure the Account List identifies all current members have open IBA accounts and only current members have the required respective designation DISASTER/EMERGENCY for DEMPS or COOP for COOP in the respective account’s “Organization Name” field. Any IBA cardholder identified on the Account List as a DEMPS or COOP member who is no longer a current member should have their respective designation removed from their account. The Level 4 A/OPC should document and date in the report under the Comments column any corrective action taken, or communication sent or received.

Step 8: Upon completing the Account List review following the steps above, save the report or each “Step” (review criteria) report as preferred.

D. To certify the completion of each program oversight report used, the A/OPC will enter their name and date in the report.

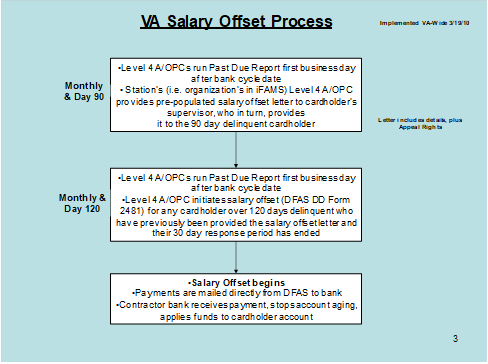

Appendix E: Salary Offset Procedures

- All VA employees or retired employees who are delinquent in payment ≥ 90-days on their IBA travel charge card accounts will be subject to Salary Offset procedures. The following procedures will result in automatic payment(s) to U.S. Bank deducted from the employee’s disposable pay each pay period or disposable retirement annuity respectively, unless or until, the delinquent balance is paid in full. The Salary Offset Flowchart in Figure 1 below, visually describes the payment process.

- The Level 4 A/OPC will customize each Salary Offset Letter (Figure 3), with the current date, cardholder’s name, contracted bank’s name (entered twice in the letter), and amount owed. The Salary Offset Letter must contain the Due Process Notice and Grounds for Appeal (Figure 4) as an enclosure, which serves as VA’s notification. No other letters will be provided to the cardholder since the bank has already sent the cardholder letters to obtain the balance owed.

- The Level 4 A/OPC will prepare and provide the Salary Offset Letter (refer to Figure 3) to the cardholder’s supervisor who, in turn, provides it to the cardholder.

- The Level 4 A/OPC must then wait 30 calendar days from the date the Salary Offset Letter was received by the cardholder before initiating the actual Salary Offset, allowing the cardholders one additional opportunity to pay their balances in full. Cardholders with a balance of 120-days or greater (who have previously been provided the Salary Offset Letter and whose response period has ended) must have Salary Offset implemented immediately.

- To initiate Salary Offset on a cardholder, A/OPCs will follow the DD Form 2481 Instructions (Figure 4) to complete the form. This form must be initiated by the Level 4 A/OPC and provided to their servicing payroll office for completion of Item 5 and submission to DFAS through Remedy. Salary Offsets will begin on the next available payroll date.

- IMPORTANT: A/OPCs and servicing payroll offices must ensure that all Salary Offset payments go directly from DFAS to the bank. Stations and staff offices must not request that monies be sent from DFAS directly back to VA.

- Every two weeks, a Level 1 A/OPC will compare the report to the US Bank system to validate that offset collections are being applied to the corresponding account(s) and then we will reach out to the bank if there are any collections that are missing or applied to the wrong account.

Figure 1 – Salary Offset Flowchart

Figure 2 – Salary Offset Letter

Figure 3 – Salary Offset Letter

Department of Veterans Affairs

Washington, DC 20420

Date:

[Name]

Subject: Delinquent (enter contracted bank name) Charge Card Account Balance – Salary Offset

Dear Sir/Madam:

This is to advise you that (enter contracted bank name), hereby known as the bank, has requested the Department of Veterans Affairs to offset your pay for a delinquent Government travel charge card balance in the amount of $___________. The delinquent balance excludes any disputed transactions that are still pending.

5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries) and OMB Circular A-123, Appendix B, Revised 2019, VA is authorized to offset up to 15 percent of your disposable pay at the request of the contracted bank to collect delinquent balances. Therefore, payroll deductions will begin the first pay period ending 30 calendar days after the date of this letter unless you resolve the matter before such date or submit an appeal as described below. The deduction will continue until the total amount is paid in full or we are notified by the bank to stop collection action.

The amount deducted in any single pay period, including the administrative fee, will be limited to 15 percent of your disposable pay. Disposable pay, for this purpose, is defined as your biweekly gross pay less deductions required by law, i.e., retirement; Thrift Savings Plan; Federal, State, local taxes; Medicare; Old-Age, Survivors, and Disability Insurance; regular life insurance and health benefit premiums, and any debt owed to the United States Government.

The deductions for the offset will show on your Leave and Earnings Statement as “Debt, Gov Vol”.

If you wish to authorize a larger offset to accelerate the payment of this debt, please submit a written request to (insert local Finance Official contact information) Your request must specify a percentage of disposable pay or a specific dollar amount.

If you believe that your account is delinquent because you have not been reimbursed for a related travel claim, please contact your travel office to determine the status of the travel claim. You must inform your organization’s local Finance Official in writing of the name and phone number of the approving official of your travel claim(s) to verify a travel reimbursement delay.

You have the right to inspect and copy records related to the delinquency, to request the bank review its decision to pursue collection of the debt from your Federal salary and to make a written repayment agreement with the bank. If you wish to exercise any of these rights, please contact a representative of the bank directly at (888) 994-6722. You must also contact the bank if you have questions about the requested offset or wish to dispute the offset as erroneous. We suggest that you keep copies of any correspondence and/or evidence of payment to the bank. The bank must report to us any charges or amount adjustments regarding the delinquent charge card balance offset.

If you feel you have received this notice in error, please refer to the enclosed information on appeal rights.

VA’s Employee Assistance Program (EAP) is available to employees who wish to voluntarily and confidentially seek counseling due to stress caused by personal financial problems. For further information on the program, please contact your local facility’s Office of Human Resources and Administration/Operations Security Preparedness, EAP coordinator.

If you have questions regarding our process in this matter, please contact your local A/OPC.

Enclosure

Grounds for Appeal

Figure 4 – Grounds for Appeal Enclosure

GROUNDS FOR APPEAL