Volume V - Assets

Chapter 11 – Accounting for Leases

Questions concerning this policy chapter should be directed to:

1101 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies for lease accounting.

Key points covered in this chapter:

- Statement of Federal Financial Accounting Standards (SFFAS) 54: Leases, effective for periods beginning after September 30, 2023, revises financial reporting standards for lease accounting specific to recognizing and disclosing an agency’s lease activities;

- VA will recognize, measure, and disclose short-term leases, intragovernmental leases, and Right-to-Use (RTU) leases in accordance with SFFAS 54;

- All short-term and intragovernmental leases will be expensed; and

- A lease that meets the definition of an RTU lease and meets or exceeds the lease capitalization threshold will be capitalized, recognized with a lease liability and lease asset (when VA is the lessee) or lease receivable and unearned revenue (when VA is the lessor). RTU leases that do not meet the lease capitalization threshold will be expensed.

1102 Revisions

| Section | Revision | Requesting Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| 110505 | Clarify calculations for Right-to-Use lease liability for real estate taxes and insurance costs. | OFP | Clarify lease calculations. | August 2024 |

| Appendix A | Revised for previous policy revisions. Revised remaining appendix lettering based on changes. | OFP | Change in policy formatting. | August 2024 |

| Appendix D | Removed Appendix D for SFFAS 54 changes related to BOC Codes. Revised remaining appendix lettering based on changes. | OFP | BOC Code information already provided for in FSC News Flash. | August 2024 |

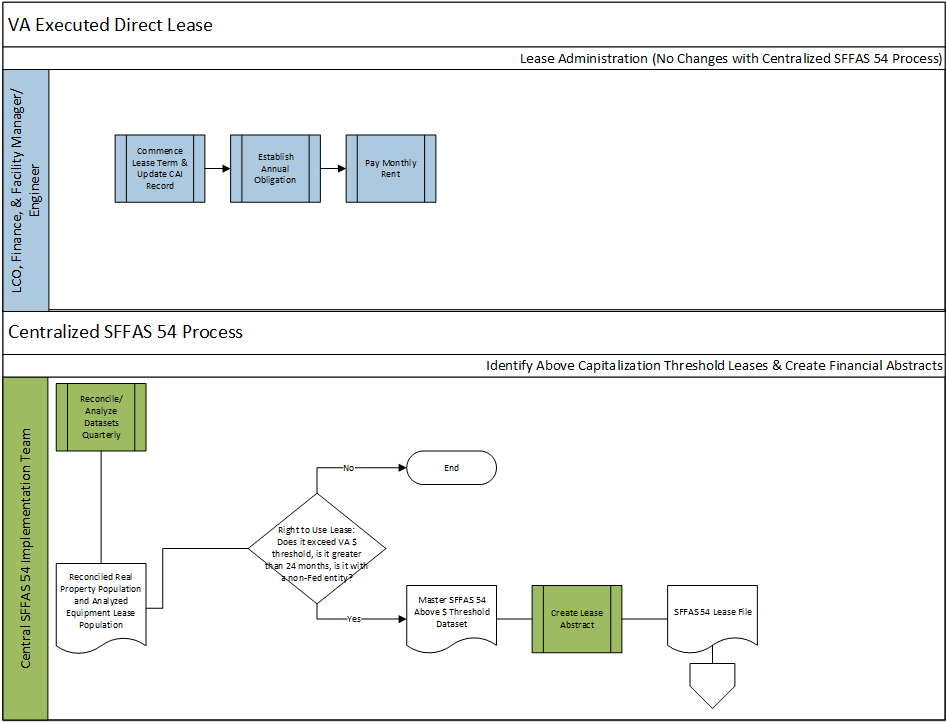

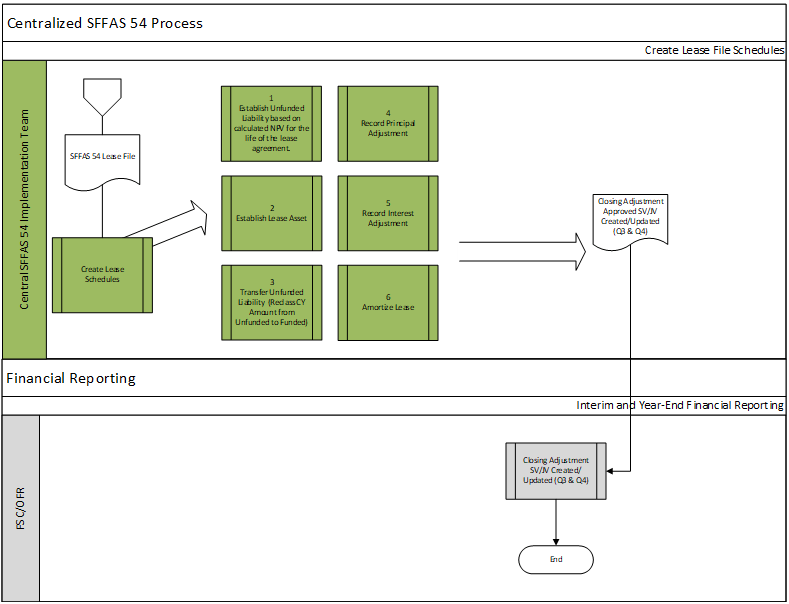

| Appendix E | Updated flowchart for Lessee Obligation, Payment, and Central Processes. | OFP | Clarify processes. | August 2024 |

For a complete list of previous policy revisions, see Appendix A.

1103 Definitions

Agreements that Transfer Ownership – A contract or agreement that transfers ownership of the underlying asset to the lessee by the end of the contract or agreement and does not contain options to terminate but may contain an availability of funds or cancellation clause that are not probable of being exercised. Contracts or agreements that transfer ownership are not treated as leases under SFFAS 54.

Amortization – Expensing the acquisition cost minus the residual value of intangible assets systematically over their estimated useful economic lives to reflect their consumption, expiration, obsolescence, or other decline in value as a result of use or the passage of time.

Capital Asset Inventory (CAI) – VA’s enterprise-wide repository of information on the Department’s real property assets, including leases, EULs, agreements, buildings, facility condition assessment data, and historical asset information. Information in CAI is used by Office of Asset and Enterprise Management (OAEM) and other Staff Offices to record and track real property agreements.

Capitalize – To record an expenditure or contribution which may benefit a future period as an asset rather than to treat the expenditure as an expense of the period in which it occurs.

Discount rate – The interest rate used to calculate the present value of cash flows over a period of years.

Electronic Contract Management System (eCMS) – VA’s enterprise acquisition system. eCMS is the system of record for contract actions, including awards and contract modifications, and assigns the unique contract number.

Embedded Lease – Per SFFAS 54 and 62, is a contract or agreement that contain both lease component(s) and nonlease component(s), such as service components, and serve a primary purpose attributable to the nonlease component(s).

Enhanced Use Lease (EUL) – An agreement to lease VA owned property to an entity to finance, develop, operate, and maintain property for the purpose as provided for in 38 U.S.C. § 8162. This is a negotiated arrangement between the Department and another entity for the use of unused or underutilized VA-owned real property.

Expense – Outflows or use of assets and/or incurrence of liabilities (or a combination of both), for which the benefits do not extend beyond the present accounting period.

Holdover – A tenancy that is created when the tenant continues to occupy the premises beyond the termination date or expiration date of the lease term.

Holdover Period –The period of time after the termination date or expiration date of the lease term where the tenant continues to occupy the leased premises. These holdover periods should be excluded from the lease term for SFFAS 54 calculation purposes.

Intragovernmental (IGT) Lease – Per SFFAS 54, is a lease between Federal entities documented via an interagency agreement. Federal real property terms ‘Permit’ and ‘Occupancy Agreement’ are commonly used to describe interagency or intragovernmental leases.

Lease – Per SFFAS 54, a contract or agreement whereby one entity (lessor) conveys the right to control the use of property, plant, and equipment (PP&E) (the underlying asset) to another entity (lessee) for a period of time as specified in the contract or agreement in exchange for consideration. Leases include contracts or agreements for real property and equipment that meet the definition of a lease and for contracts or agreements that, although not explicitly identified as leases, meet the definition of a lease. A lease excludes contracts or agreements for services, except those contracts or agreements that contain both a lease component and a service component.

Lease Concessions – Per SFFAS 54, are rent discounts made by the lessor to entice the lessee to sign a lease. Lease concessions include rent holidays/free rent periods, or reduced rents.

Lease Extension – An increase of the lease term beyond the initial term to provide for the continued occupancy on a short-term basis. Generally, this period is not to exceed three years from the prior termination date.

Lease Incentives – Per SFFAS 54, are lessor payments made to or on behalf of the lessee to entice the lessee to sign a lease. Lease incentives may include up-front cash payments to the lessee; for example, moving costs, termination fees to the lessee’s prior lessor, or the lessor’s assumption of the lessee’s lease obligation under a different lease with another lessor.

Lease Liability – The lessee’s obligation to make the lease payments arising from a lease measured on a discounted basis.

Lease Option Periods – Per SFFAS 54, are additional lease periods beyond the initial lease term exercisable by the tenant at its option in advance of the expiration of the then current term of the lease. The options may be included in the original lease agreement and are considered evaluated lease renewal options that allow the Government to continue occupancy of leased space for an additional period without conducting a competitive procurement.

Lease Term –The noncancelable period, plus certain periods subject to options to extend or terminate the lease.

Lessee – The entity that enters into a contract to obtain the right to use an underlying asset for a period of time in exchange for consideration. Lessee is also known as the tenant.

Lessor – An entity that enters into a contract to provide the right to use an underlying asset for a period of time in exchange for consideration. Lessor is also known as the landlord.

Lessor Improvements – Per SFFAS 54, are additions, alterations, remodeling, renovations, or other changes to a leased property that either extend the useful life of the existing property or enlarge or improve its capacity and are paid for (financed) by the lessor rather than by the lessee. Lessor improvements are considered a lease incentive.

Liability – A probable future outflow or other sacrifice of resources as a result of past transactions or events.

Major Medical Facility Lease –Lease for space for use as a new medical facility approved through the General Services Administration (GSA) under section 3307(a) of title 40 at an average annual unserviced rent equal to or greater than the appropriate dollar threshold described in such section, which shall be subject to annual adjustment in accordance with 3307(h). Does not include a lease for space for use as a shared Federal medical facility for which VA’s estimated share of the lease costs does not exceed the dollar threshold.

Noncancelable period – The term of the lease that cannot be canceled (or terminated) by the lessee or lessor. It is the shorter of 1) the period identified in the lease contract or agreement that precedes any option to extend the lease or, 2) the period identified in the lease contract or agreement that precedes the first option to terminate the lease.

Occupancy Agreement (OA) – A written agreement descriptive of the financial terms and conditions under which GSA assigns, and a customer agency occupies, the GSA-controlled space identified therein.

Permit – A revocable license granted by one Federal agency to another. A permit may be issued to a Federal entity to use VA real property or issued to VA to use another Federal entity’s property. Allows a permit holder to use another federal agency’s space or land.

Present Value – The discounted value of a payment or stream of payments to be made in the future, taking into consideration a specific interest rate.

Probable – That which can reasonably be expected or is believed to be more likely than not on the basis of available evidence or logic.

Purchase Option – A provision allowing the Government to purchase leased property.

Real Property – Land, buildings, facilities, or other structures, firmly attached, including integrated equipment (i.e., items permanently installed or attached that have become a part of the building or structure for the purpose of making the building habitable or usable). Executive Order 13327 defines Federal Real Property as any real property owned, leased, or otherwise managed by the Federal Government, including improvements on Federal lands irrespective of the property’s location.

Recognize – To formally record or incorporate an item into the Agency’s financial statements as an asset, liability, revenue, expense, etc.

Right-To-Use (RTU) Lease – Per SFFAS 54, is a non-intragovernmental lease that exceeds a 24-month term. If the RTU meets or exceeds the lease capitalization threshold, the lease will be capitalized. RTU leases that do not meet the lease capitalization threshold are considered immaterial and will be expensed.

SFFAS 54 Leasehold Improvements – Additions, alterations, remodeling, renovations, or other changes to a leased property that either extend the useful life of the existing property or enlarge or improve its capacity and are paid for (financed) by the lessee. Improvements may also be referred to as build out costs or tenant improvements.

Short-Term Lease – Per SFFAS 54, is a non-intragovernmental lease with a lease term of 24 months or less. If the lease agreement contains an option to renew that can be exercised without additional legislation, it will be presumed for purposes of SFFAS 54 that the option will be exercised, thus included in the consideration of the lease term.

Standstill Agreement – Temporary measure used when the procurement for an expiring lease cannot be completed before the end of its term. The lessor will maintain Government tenancy and VA will continue making rent payments until a new or succeeding lease is executed during the term of the standstill agreement. The standstill agreement does not imply a new lease, extension, or succeeding lease will be offered to the incumbent lessor.

Unserviced Rent – The amortized build-out and shell rent, which includes parking, real estate taxes, insurance, building maintenance and reserves for replacement, lease commission, and management costs, but excludes operating expenses. More commonly used, functional equivalent to “average annual rent” which is the term used in 38 U.S.C § 8104.

1104 Roles and Responsibilities

Secretary of Veterans Affairs is required pursuant to 38 U.S.C. § 8104 to submit to the Committee on Veterans’ Affairs of the Senate and the Committee on Veterans’ Affairs of the House of Representatives (“Committees”) a prospectus for any “new major medical facility lease” exceeding applicable thresholds established in law and to notify the Committees of impending Major Lease awards. The Secretary is also responsible for approval to dispose of EUL assets.

Under Secretaries, Assistant Secretaries, Other Key Officials, and Administration and Staff Office CFOs are responsible for ensuring compliance with the policies and procedures set forth in this chapter.

Assistant Secretary for Management/Chief Financial Officer (ASM/CFO) oversees management of all financial and capital asset activities.

Office of Construction & Facilities Management (CFM) is within the Office of Acquisition, Logistics and Construction. With respect to real property agreements, CFM is delegated authority to manage VA’s real property leasing through 38 USC 312A. CFM is also responsible for management and oversight of VA’s real property programs, including development of policies, providing oversight of real property services, executing non-delegated land management activities, serving as VA’s Leasing Head of Contracting Activities (HCA), and executing Mid-Level and Major Leases as defined by 38 USC 8104.

Office of Asset and Enterprise Management (OAEM) is the CAI system owner tracking all existing real property agreements. OAEM is responsible for assigning a unique FMS Accounting Classification Code (ACC) to every lease using FMS.

Office of Finance (OF) performs centralized accounting and reporting activities and ensures proper consolidation of data to include the measurement and disclosure of leases in accordance with provisions of SFFAS 54.

Lease Contracting Officers (LCOs) are responsible for entering, amending, administering, and/or terminating a lease within their warrant authority. LCOs will seek GSA delegation or confirmation from OAEM that use of the categorical delegation is appropriate and score leases as a lease-purchase, capital lease, or operating lease (per OMB Circular A-11, Appendix B). LCOs will work with Local Finance Offices to ensure the appropriate budget object class code is used to classify real property leases and any associated leasehold improvements.

Local Finance Offices are responsible for recording lease obligations, including obtaining appropriate documentation, to support the obligation and lease payments. Local Finance Offices are responsible for ensuring the accuracy of the budget object class code and, for FMS transactions, the unique lease specific ACC.

1105 Policies

110501 General Policies

- VA may enter into a lease agreement to acquire real or personal property as an alternative to outright purchase upon GSA delegation.

- There are three types of leases:

- Short-term;

- Intragovernmental (IGT); and

- RTU.

- For periods beginning after September 30, 2023, SFFAS 54 is the authoritative financial reporting standard for federal lease accounting. The standard revised the definition of a lease, the accounting for a lease, lease terms, and financial disclosure requirements.

- VA may lease real property and equipment from Federal agencies and non-Federal entities. VA would be the lessee in these types of leases.

- VA would be considered the lessor should it lease real property to Federal or non-Federal entities under EULs, outleases, historic outleases, or permit agreements.

- In accordance with 40 U.S.C. § 3307 and 38 U.S.C. § 8104, no funds may be appropriated for any fiscal year (FY), and the Secretary may not obligate or expend funds (other than for advance planning and design), for any major medical facility lease unless the Committee on Environment and Public Works of the Senate,the Committee on Transportation and Infrastructure of the House of Representatives, and the Committees on Veterans’ Affairs of the Senate and the House of Representatives each adopt a resolution approving the lease.

- Contracts or agreements that transfer ownership are not accounted for as leases. If the underlying asset meets or exceeds VA’s PP&E capitalization criteria when ownership transfers to VA, VA will treat these as a long-term funded liability and as an asset under PP&E.

- In accordance with Treasury’s United States Standard General Ledger (USSGL) Changes Related to Implementation of FASAB Standards, budgetary accounting requirements remain unchanged by SFFAS 54 and continue to be guided by the lease scorekeeping rule developed by Office of Management and Budget (OMB), Congressional Budget Office (CBO), and the House and Senate Budget Committees originally in connection with the Budget Enforcement Act of 1990, and guidance regarding this rule provided in OMB Circular No. A-11, Appendix B, Budgetary Treatment Of Lease-Purchases and Leases of Capital Assets.

110502 Capitalization Threshold

- VA will capitalize RTU leases with unserviced annual rent that meets or exceeds the major medical facility lease threshold as defined in Honoring our PACT Act of 2022, H.R. 3967, 117th Cong. (2022) and established by 40 U.S.C. § 3307 (a). The major medical facility lease threshold, described in 40 U.S.C. § 3307 (a), is subject to adjustment in accordance with § 3307 (h).

- The lease capitalization threshold will be in effect when SFFAS 54 is effective or the year the lease becomes operational, whichever is later. For FY24, the capitalized lease threshold is $3.613 million unserviced rent, the 2024 prospectus threshold for Construction – Alteration and Lease Projects.

- The lease capitalization threshold will be applied to relevant lease activity, unless deemed clearly inconsequential, and RTU leases that meet or exceed the lease capitalization threshold will be capitalized and accounted for in accordance with the provisions of SFFAS 54.

- Leases below the capitalized lease threshold are considered to be immaterial and will not be subject to the provisions of SFFAS 54.

110503 Accounting for and Reporting of Leases

- VA will adhere to the guidance mandated for lease funding under OMB Circular A-11, Preparation, Submission and Execution of the Budget. See Volume V, Chapter 11A – Real Property Leases, for information on the criteria for lease scoring.

- VA will record lease transactions using the appropriate Treasury Financial Manual (TFM) United States Standard General Ledger (USSGL) Transaction Codes (TC) and USSGL accounts.

- VA will report material leases in accordance with OMB Circular A-136, SFFAS 54 and related publications, SFFAS 62 and Fiscal Service TFM Crosswalks to Standard External Reports.

- In accordance with SFFAS 54, when determining the lease term, VA evaluates a lease’s noncancelable period and, as applicable, option period(s) and extension period(s). VA does not include a lease in holdover or standstill status, as these are short-term, typically monthly, arrangements.

- In accordance with SFFAS 54, VA will not record short-term leases and intragovernmental leases as assets or liabilities on the balance sheet.

- Short-term leases:

- When VA is the lessee, VA will recognize short-term lease payments, incentives and concessions as an expense based on the payment provisions of the lease. VA will recognize short-term lease payments in the general ledger as expenses.

- When VA is the lessor, VA will recognize short-term lease payments, incentives and concessions as revenue based on the payment provisions of the lease. VA will recognize short-term lease payments in the general ledger as revenue.

- VA will not recognize a lease liability or lease asset for short-term leases.

- At the time of implementation of SFFAS 54, any VA lease that has fewer than 24 months remaining will be considered a short-term lease and will not be subject to capitalization and will be treated like a short-term lease, recognizing the payments as operating expenses of the periods in which they are paid.

- IGT leases:

- When VA is the lessee, VA will recognize IGT lease payments and lease-related operating costs (maintenance, utilities, taxes, etc.) paid to the lessor as expenses based on the provisions of the IGT lease. VA will recognize IGT lease payments and operating expenses in the general ledger as expenses.

- When VA is the lessor, VA will recognize IGT lease payments, incentives and concessions as revenue based on the payment provisions of the lease. VA will recognize IGT lease payments in the general ledger as revenue.

- VA will not recognize a lease liability or lease asset for IGT leases.

- RTU leases that meet or exceed VA’s lease capitalization threshold:

- When VA is the lessee, VA will recognize a lease liability and a lease asset at the commencement of the lease term or the effective date of SFFAS 54, whichever is later. VA will value the lease liability at the present value of the future payments expected to be made during the lease term, discounted by the applicable discount rate (as stated in the contract or the applicable Treasury rate). The lease will be amortized over the course of the lease term. When VA pays in arrears (at the beginning of the following month), VA will record an accounts payable entry at the end of a month for the accrued rent payable.

- VA will evaluate lessor agreements against VA’s lease capitalization threshold, recognizing a lease receivable and unearned revenue at the commencement of the lease term or the effective date of SFFAS 54, whichever is later. The lease receivable will be valued at the present value of the future payments expected to be made during the lease term.

- If any subset of lease activity is deemed clearly inconsequential, VA may choose to evaluate the subset at an aggregate level rather than assessing each lease against the lease capitalization threshold.

110504 Accommodation for Implementing SFFAS 54

- SFFAS 62: Transitional Amendment to SFFAS 54 provides transitional accommodations to implementing SFFAS 54 in the area of contracts or agreements that contain both lease component(s) and nonlease component(s), such as service components, and serve a primary purpose attributable to the nonlease component(s), known as “embedded leases.”

- The transitional accommodation applies only to contracts and agreements that meet both of the following criteria:

- The contract or agreement contains lease and nonlease component(s); and

- The purpose of the contract or agreement is primarily attributable to the nonlease component(s), such as a service component.

- During the transitional accommodation period, VA elects not to assess whether contracts or agreements meeting the eligibility criteria contain lease components as of October 1, 2023. The election applies to contracts and agreements existing as of October 1, 2023, and/or those subsequently entered into or modified on or prior to September 30, 2026 (end of the accommodation period).

- Contracts or agreements meeting the criteria will be accounted for as nonlease contracts or agreements for their remaining term, unless they are subsequently modified after September 30, 2026, the end of the accommodation period.

- For lease component modifications effective after the accommodation period that relate to contracts or agreements that the accommodation previously applied:

- The lease terms for such leases would assume that the lease term began as of the effective date of the modification for the purposes of initial recognition and measurement.

- The lease liability and lease asset (for lessees) or lease receivable and unearned revenue (for lessors) will be measured based on the remaining lease term and associated lease payments.

110505 Calculation of RTU Leases

- When VA is the lessee:

- Measurement of the lease liability will include the following:

- Fixed payments;

- Variable payments that depend on an index or a rate (such as the Consumer Price Index or a market interest rate), initially measured using the index or rate as of the effective date of SFFAS 54 or the commencement of the lease term;

- Variable payments that are fixed in-substance;

- Amounts that are probable of being required to be paid by the lessee under residual value guarantees;

- The exercise price of a purchase option if it is probable that the lessee will exercise that option;

- Payments for penalties for terminating the lease, if the lease term reflects the lessee exercising (1) an option to terminate the lease or (2) an availability of funds or cancellation clause;

- Less any lease incentives receivable from the lessor; and

- Any other payments to the lessor that are probable of being required based on an assessment of all relevant factors.

- When VA considers the exercise of the option(s) probable, VA will include payments during the option period(s). Since, real property leases that exceed VA’s lease capitalization threshold are predominantly leases for mission critical medical facilities, it is probable that any available option periods will be exercised.

- Future lease payments are discounted using the interest rate stated in the lease contract. If no interest rate is stated in the lease contract, VA will use the Department of Treasury’s borrowing rate for securities of similar maturity to the term of the lease, which includes option period(s) probable of being exercised.

- VA will recognize an RTU lease liability in the general ledger as a lessee lease liability and unfunded lessee lease liability.

- VA will calculate amortization of the discount on the lease liability and recognize that amount as interest expense in the general ledger as other interest expenses for the period. Payments are allocated first to the interest liability and then to the lease liability.

- Measurement of the RTU lease liability excludes lease-related operating costs such as system maintenance and repair, janitorial services, utilities, etc. paid to the lessor. VA will recognize an expense for all RTU lease-related operating costs in the general ledger as operating expenses/program costs.

- Measurement of the RTU lease liability includes established base amounts for real estate taxes and insurance costs, which are part of the shell rent for real estate leases, because these costs have a high probability of being required. Annually, VA reimburses the lessor or receives a rent credit for differences between the actual real estate tax and insurance amounts and the established base amounts. These annual differences in real estate taxes and insurance amounts are variable expenses not dependent upon a rate and therefore expensed in the year incurred. They are also excluded in the measurement of the lease liability.

- Measurement of the RTU lease liability excludes leasehold (tenant) improvements. VA will recognize an asset for RTU leasehold improvements in the general ledger as leasehold improvements in accordance with Volume V, Chapter 9 – General Property, Plant, and Equipment.

- Measurement of the lease liability will include the following:

- When VA is the lessor:

- Based on the terms of the lease, measurement of the lease receivable will include the following:

- Fixed payments;

- Variable payments that depend on an index or a rate (such as the Consumer Price Index or a market interest rate), initially measured using the index or rate as of the commencement of the lease term;

- Variable payments that are fixed in-substance;

- Residual value guarantees that are fixed payments in substance; and

- Less, any lease incentives payable to the lessee.

- When VA considers the exercise of the option(s) probable, VA will include payments during the option period(s) in the lease receivable calculation.

- The future lease payments to be received are discounted using the interest rate stated in the lease contract. If no interest rate is stated in the lease contract, VA uses the Department of Treasury’s borrowing rate for securities of similar maturity to the term of the lease.

- VA will recognize a lease receivable and unearned revenue.

- VA will calculate the amortization of the discount on the lease receivable and recognize that amount as interest revenue for the period.

- Lease payments received are allocated first to the accrued interest receivable and then to the lease receivable.

- The RTU lease receivable amount will not include variable payments based on future performance.

- Based on the terms of the lease, measurement of the lease receivable will include the following:

110506 Amortization of RTU Leases That Meet or Exceed VA’s Lease Capitalization Threshold

- When VA is the lessee:

- VA will recognize an unearned revenue liability equivalent to the value of the lease receivable.

- VA will amortize the lease asset as follows:

- Using straight line amortization, over the shorter of the lease term or the useful life of the underlying asset;

- If a lease contains a purchase option that VA determines is probable of exercising, VA will amortize the lease asset over the useful life of the underlying asset;

- If the underlying asset is non-depreciable, such as land, VA will not amortize the lease asset; and

- VA will recognize amortization of the lease asset as lessee lease amortization and accumulated amortization of lessee lease assets.

- When VA is the lessor:

- VA will value unearned revenue equivalent to the lease receivable and amortize the deferred revenue.

- Deferred revenue will be valued equivalent to the initial measurement of the lease receivable.

- VA will recognize an unearned revenue liability.

- VA will amortize the unearned revenue using straight line amortization over the lease term.

- VA will continue recognizing depreciation on the underlying asset unless the lease contract requires the lessee to return the leased property to its original or enhanced condition. In this circumstance, the value of the underlying asset would not be decreasing, and VA will not record depreciation on the underlying lease asset.

110507 Annual Review of RTU Leases

- VA will review all RTU lease contracts and agreements for changes on an annual basis to determine if a remeasurement is required.

- VA will remeasure the RTU lease liability or lease receivable if one or more of the following changes have occurred and if the changes individually or in the aggregate, are expected to affect the amount of the lease liability or lease receivable since the previous measurement by an amount equal or greater than the lease capitalization threshold:

- There is a change in the lease term (Lessee or Lessor);

- An assessment of all relevant factors indicates that the likelihood of a residual value guarantee being required to be paid has changed from probable to not probable or vice versa (Lessee);

- An assessment of all relevant factors indicates that the likelihood of a purchase option being exercised has changed from probable to not probable, or vice versa (Lessee);There is a change in the estimated amounts for payments already included in the liability (Lessee);

- There is a change in the interest rate the lessor charges the lessee if there is a rate stated in the lease agreement that is used as the initial discount rate. (Lessee or Lessor); or

- A contingency, upon which some or all the variable payments that will be made over the remainder of the lease term are based, is resolved such that those payments now meet the criteria for measuring the lease liability. For example, an event occurs that causes variable payments that were contingent on the performance or use of the underlying asset to become fixed payments for the remainder of the lease term. (Lessee or Lessor).

- If remeasurement is required:

- VA will evaluate any change in index rate used to determine variable payments and update the discount rate.

- If the discount rate is required to be updated, the discount rate will be updated using the interest rate stated in the lease contract.

- If no interest rate is stated in the lease contract, VA will use the Department of Treasury’s borrowing rate for securities of similar maturity to the remaining term of the lease.

- When remeasurement of a lease liability is required, VA will adjust the lease asset by the same amount as the lease liability with any difference recognized in the current period as a gain or loss.

110508 Disclosure Requirements for Leases

- In accordance with SFFAS 54, VA will not prepare disclosures for short-term lease expenses or revenues in the Agency Financial Report (AFR).

- VA will disclose a general description of significant IGT leasing arrangements, lease terms, and the annual lease expense in total by major underlying asset category in the AFR.

- VA will apply the RTU lease disclosure provisions of SFFAS 54 below to all RTU leases that meet or exceed VA’s lease capitalization threshold.

- Where VA is the lessee, VA will disclose:

- A general description of its leasing arrangements, including the basis, terms, and conditions on which variable lease payments not included in the lease liability are determined and the existence, terms and conditions of residual value guarantees, if any, provided by VA.

- The total amount of lease assets and the related accumulated amortization, to be disclosed separately from other PP&E assets.

- The amount of lease expense recognized for the reporting period for variable lease payments not previously included in the lease liability.

- Principal and interest requirements to the end of the lease term, presented separately, for the lease liability for each of the five subsequent years and in five-year increments thereafter.

- The amount of the annual lease interest and amortization expense and the discount rates used to calculate the lease liability.

- Where VA is the lessor, VA will disclose:

- A general description of its leasing arrangements, including the basis, terms and conditions on which any variable lease payments not included in the lease receivable are determined.

- The carrying amount of assets on lease by major classes of assets and the amount of related accumulated depreciation.

- The total amount of revenue (such as, lease revenue, interest revenue, and any other lease-related revenue) recognized in the reporting period from leases.

- The amount of revenue recognized in the reporting period for variable lease payments and other payments not previously included in the lease receivable, including revenue related to residual value guarantees and termination penalties.

- Where VA is the lessee, VA will disclose:

- In accordance with SFFAS 62, VA will disclose the election of transitional accommodations for implementing SFFAS 54 during the reporting period(s) covered by the accommodation period and the reporting period immediately following the accommodation period. The disclosure will not be repeated during subsequent reporting periods.

1106 Authorities and References

- Public Law 117-168, Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics (PACT) Act of 2022

- United States Code (U.S.C.)

- Executive Order 13327 Federal Real Property Asset Management

- Department of Treasury

- General Services Administration (GSA)

- Office of Management and Budget (OMB)

- OMB Circular A-11, Preparation, Submission and Execution of the Budget

- OMB Circular A-136, Financial Reporting Requirements

- Federal Accounting Standards Advisory Board (FASAB) Handbook by Chapter

- SFFAS 6, Accounting for Property, Plant, and Equipment

- SFFAS 54, Leases

- SFFAS 58, Deferral of the Effective Date of SFFAS 54, Leases

- SFFAS 60, Omnibus Amendments 2021: Leases-Related Topics

- SFFAS 61, Omnibus Amendments 2023: Leases-Related Topics II

- SFFAS 62, Transitional Amendment to SFFAS 54

- Federal Financial Accounting Technical Release (Technical Release) 20, Implementation Guidance for Leases

- Technical Release 21, Omnibus Technical Release Amendments 2022: Conforming Amendments

- Technical Release 22, Leases Implementation Guidance Updates

- Technical Bulletin 2023-1, Intragovernmental Lease Reimbursable Work Agreements

- VA Financial Policy Publications

- Volume V, Chapter 9 – General Property, Plant, and Equipment

- Volume V, Chapter 11A – Real Property Leases

- Volume V, Chapter 13 – Accounting for Internal Use Software

- Volume XIII, Chapter 02 – Budget Object Class Codes

- FSC NewsFlash FY24 Issue 19 – SFFAS 54 BOC and GL Changes

1107 Rescissions

Volume V, Chapter 11 – Accounting for Leases, March 2024.

Appendix A: Previous Policy Revisions

| Section | Revision | Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Various | New policy chapter | OFP | SFFAS 54 implementation | March 2024 |

Appendix B: Lessee Lease Recognition and Measurement

VA’s significant leasing activity occurs when VA is in the lessee position. VA will apply the following recognition and measurement procedures to its three lease subset populations:

| Lease Subset Populations | Recognition and Measurement |

|---|---|

| Short-term Leases Immaterial Leases: RTU Leases < Lease Capitalization Threshold | Continue to recognize an expense based on the payment provisions of the lease contract. No Change. |

| Intragovernmental Leases | Recognize lease payments, including lease-related operating costs paid to the lessor, as expenses based on the payment provisions of the contract or agreement. Intragovernmental lease payments will be recognized in the Treasury established USSGL account number for intragovernmental lease activity. |

| RTU Leases ≥ Lease Capitalization Threshold | At the commencement of the lease term or the effective date of SFFAS 54, recognize a lease liability and a right-to-use lease asset based on the measurement of the present value of payments expected during the lease term. |

Due to the immateriality of VA’s lessor lease population, VA will continue to recognize revenue as earned from short-term, Intragovernmental, and RTU leases.

Appendix C: Lease Data Reconciliation Process

- To ensure completeness of VA’s real property lease population that meets the lease capitalization criteria, VA reconciles data from the CAI system against the financial systems of record.

- SFFAS 54 is effective for periods beginning after September 30, 2023. In accordance with the Standard, VA does not apply the provisions of SFFAS 54 to immaterial leases.

- The systems VA uses throughout the lease process are:

- Financial Management System (FMS): VA’s legacy core accounting system. FMS records obligations, accruals, payments, and journal vouchers related to VA’s leasing activity. OAEM assigns a unique FMS Accounting Classification Code (ACC) to every lease where the obligations and payments are made in FMS.

- Integrated Financial and Acquisition Management System (iFAMS): The system replacing VA’s legacy accounting and acquisition system. As of SFFAS 54’s effective date, iFAMS is deployed at National Cemetery Administration, VBA’s General Operating Fund, CFM (Major Construction), Office of Management, and Office of the Inspector General (OIG) and is used to record obligations, accruals, payments, and journal vouchers related to VA’s leasing activity.

- Capital Asset Inventory (CAI): VA’s enterprise-wide repository of information on the Department’s real property assets, including real estate leases, agreements, buildings, facility condition assessments data and historical asset information for the portfolio. OAEM is the system owner. This system does not interface with FMS or iFAMS. VA station Field Managers/Engineers, or designees, are responsible for manually entering and maintaining real property agreement data in CAI.

- Electronic Contract Management System (eCMS): VA’s enterprise acquisition system. The procurement system records the contract actions, including awards, contract modifications, obligations of awards, and assigns the unique contract number. However, the obligation number comes from FMS or iFAMS, and is manually entered into eCMS. eCMS is used to research contract information such as contract number, ACC Code, modifications, and completion date when investigating differences between CAI and FMS or iFAMS.

- Pulling Data from the following systems: FMS, iFAMS, and CAI.

- FMS

- The ACC is the FMS data attribute that serves as the unique identifier for all real property leases in FMS. OAEM assigns a unique ACC that begins with “LG” for every real property lease where VA is the lessee.

- On a quarterly basis, VA pulls an F850 Undelivered Orders Report from FMS to identify all obligations (USSGL 480000 series) made in the current fiscal year coded BOCs that include rent or lease of real property in the definition and ACC Codes beginning with “LG.” See Volume XIII, Chapter 02 – Budget Object Class Codes for the definitions.

- VA analyzes the datasets – categorizing leases into two categories – intragovernmental and non-IGT.

- VA applies the lease capitalization threshold to the RTU real estate obligation lease dataset. VA tags any lease with an obligation that exceeds the lease capitalization threshold for a detailed review.

- iFAMS:

- On a quarterly basis, VA pulls an F850 Undelivered Orders Report from iFAMS. VA uses an iFAMS dataset, to identify all obligations (USSGL 480000 series) coded to BOCs that include rent or lease of real property in the definition. See Volume XIII, Chapter 02 – Budget Object Class Codes for the definitions.

- VA analyzes the datasets – categorizing leases into two categories – intragovernmental and non-IGT.

- VA applies the lease capitalization threshold to the RTU real estate obligation lease dataset. VA tags any lease with an obligation that exceeds the lease capitalization threshold for a detailed review.

- CAI:

- On a quarterly basis, VA pulls an extract from the CAI database of all active real estate leases and filters for operational non-IGT RTU leases.

- The CAI dataset is reconciled to the general ledger data to verify that there are no non-IGT real estate agreements active in CAI that have been excluded from the FMS and iFAMS datasets discussed in 1. and 2. above. If an additional record is identified during the reconciliation, it is added to the FMS or iFAMS dataset and reviewed against the capitalization threshold to ensure all obligations over the lease capitalization threshold are flagged for detailed review.

- FMS

- For information on the active lease BOCs and GL updates, see the related FSC News Flash.

Appendix D: Lessee Obligation, Payment, and Central Processes

Appendix E: SFFAS 54 Local Field Office Quick Reference Guide

Purpose: Statement of Federal Financial Accounting Standards 54: Leases (SFFAS 54) went into effect beginning FY24. This document provides a high-level overview and background information on VA’s implementation of SFFAS 54 and quick tips to prepare Stations for SFFAS 54 related questions that may arise during FY24 Financial Statement Audit site visits.