Volume II - Appropriations Funds and Related Information

Chapter 12 – Toxic Exposures Fund

Questions concerning this policy chapter should be directed to:

- Veterans Health Administration

- Veterans Benefits Administration

- National Cemetery Administration

- Debt Management Center

- Financial Services Center

- Construction and Facilities Management

- All others

1201 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies for the use of the Cost of War Toxic Exposures Fund (TEF).

Key points covered in this chapter:

- In the “Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics (PACT) Act of 2022” (PACT Act, PL 117-168), Congress authorized the TEF to fund Veterans’ health care and benefits associated with exposure to environmental hazards such as burn pits or Agent Orange;

- As required by the PACT Act, VA will establish a methodology to estimate the health care expenditures and expenses incident to the delivery of health care and benefits associated with exposure to environmental hazards as well as medical and other research relating to exposure to environmental hazards;

- Cost estimates used for the baseline and associated TEF budget will be documented and updated should the technical and underlying assumptions change;

- to ensure budget estimates are accurate and reliable;

- TEF funds will only be used for expenses associated with exposure to environmental hazards in service; and

- VA will maintain program, operating, and financial data for effective internal TEF management.

1202 Revisions

| Section | Revision | Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Appendix N | Office of Research and Development (ORD) TEF Methodology | OFP | ORD methodology for estimating TEF application | June 2024 |

See Appendix A for a complete listing of policy revisions.

1203 Definitions

Appropriated Entitlements – A form of mandatory spending (also referred to as direct spending). Spending on entitlements not controlled through the annual appropriations process. Instead, entitlement spending is based on the eligibility and benefit criteria established in law, which is under the jurisdiction of the various authorizing committees of the House and Senate. Veterans’ compensation is an example of an appropriated entitlement.

Budget Scorekeeping – The process of developing and recording measures of the budgetary effects of proposed and enacted legislation. These effects consist of changes in Federal spending, revenues, and deficits.

Environmental Health Hazard – As defined by the Centers for Disease Control, a substance that has the ability to cause an adverse health event. This includes physical, chemical, and biological factors that are external to a person. Hazards can be natural or human-made.

Health care associated with exposure to environmental hazards – VA and community provided care with respect to a disability or disease that, in accordance with guidelines issued by the Under Secretary for Health, is found to have resulted from exposure to environmental hazards (38 U.S.C. § 1710(e)(2)).

Incidental costs – Expenses incurred as a result of delivering health care and benefits that are “secondary to” or “occurring in conjunction with” the delivery of toxic exposure-related health care and benefits.

Presumptive List – List of substances, chemical and airborne hazards established and maintained by the Secretary of VA in collaboration with the Secretary of Defense, that presumes specific toxic exposure for any covered veteran.

Priority Group – VA assignment upon Veterans’ enrollment for VA health care in general. Veterans meeting the requirement for more than one priority group will be placed in the highest priority group for which eligible. Veterans placed in priority group 6 are also placed in priority group 7 or priority group 8, as applicable, if the Veteran has previously agreed to pay the applicable copayment for all matters not covered by priority group 6. The enrollment priority group assigned will determine the Veterans’ responsibility for copayments and could determine access to care.

Service Connection – Established when a Veteran’s disability or death was incurred during or aggravated by his or her military service. 38 U.S.C. § 101(16).

Toxic Exposure – Includes the following:

- A toxic exposure risk activity; or

- An exposure to a substance, chemical, or airborne hazard identified in the list under 38 U.S.C. § 1119(b)(2).

Toxic Exposure Risk Activity – Any activity that:

- Requires a corresponding entry in an exposure tracking record system (as defined in 38 U.S.C. § 1119(c)) for the Veteran who carried out the activity; or

- The Secretary of VA determines qualifies when taking into account what is reasonably prudent to protect the health of Veterans (38 U.S.C. § 1710 (e)(4)(C).

Veterans Health Administration (VHA) Priority Group 6 – The Priority Group (at a minimum) in which toxic-exposed Veterans are placed within VHA (38 U.S.C. § 1705(a)(6); 38 U.S.C. § 1710(a)(2)(F); (38 C.F.R. § 17.36). See VA Priority Groups for factors used to assign a Priority Group 6 designation.

1204 Roles and Responsibilities

Secretary of Veterans Affairs (SECVA) is responsible for:

- The content of all budget requests made by VA;

- Establishing, maintaining, and communicating to congress a list of presumptive toxic exposures (substance, chemical, or airborne hazard) as required by 38 U.S.C. § 1119(b)(2) in collaboration with the Secretary of Defense; and

- Determining whether to establish an end date for a covered veteran to qualify for presumptions of exposure.

Administration/Staff Office CFOs, and Fiscal Officers are responsible for compiling annual TEF spend data and for collaborating with the Office of Budget to develop each year’s budget estimate.

Human Resources and Administrations/Operations, Security, and Preparedness (HRA/OSP) areresponsible for tracking positions that are established in support of the PACT Act. HRA/OSP is responsible for ensuring that HRSmart has the correct cost centers and organization structure at the time of hiring. This information may be obtained and verified by the staff office and Office of Budget prior to hiring or transferring Full-time Employee Equivalent (FTEE).

Office of Management (OM) is responsible for the overall VA spend governance process. OM is responsible for hosting the monthly budget reviews for spend plan oversight and fund execution.

Investment Review Council is responsible for the monthly budget review of the spend plan and fund execution.

Office of Budget (OB) is responsible for:

- Providing guidance and coordinating with the Administrations and Staff Offices on matters relating to the formulation and execution of the Department’s TEF Budget;

- Coordinating and consolidating TEF spend data with the Administrations and Staff Offices; and

- Enforcing VA’s TEF Funds Control policy by confirming the entries made by the FSC align with the ACS and authorizing documents.

Office of General Counsel (OGC) is responsible for providing legal advice and opinions on the PACT Act.

1205 Policies

120501 TEF Establishment

- VA coordinated with the Department of the Treasury and the Office of Management and Budget (OMB) to set up the TEF, which was established by Congress in the PACT Act.

- VA will request funding for the TEF to cover costs associated with providing health care and benefits to Veterans exposed to environmental hazards.

- The PACT Act authorizes funds to be appropriated beginning in fiscal year (FY) 2023, and for each subsequent FY, such sums as are necessary to increase funding over the FY 2021 level for:

- The delivery of Veterans’ health care associated with exposure to environmental hazards in the active military, naval, air, or space service in programs administered by the Under Secretary for Health;

- Any expenses incident to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards in the active military, naval, air, or space service, including administrative expenses, such as information technology and claims processing and appeals, and excluding leases as authorized or approved under section 8104 of title 38;

- Medical and other research relating to exposure to environmental hazards; and

- Modernization, development, and expansion of capabilities and capacity of information technology systems and infrastructure of the Veterans Benefits Administration, including for claims automation, to support expected increased claims processing for newly eligible Veterans pursuant to section 701.

- In accordance with 38 U.S.C. § 1710(e)(2)(B) VA operationalizes health care services for Veterans enrolled in Priority Group 6, the same Priority Group (at a minimum) in which toxic-exposed Veterans are placed. Veterans enrolled in Priority Group 6 may be subject to copayments for care found to not be related to their exposure.

- The use of TEF funds for the delivery of health care and benefits that are not associated with exposure to environmental hazards would be a violation of the Purpose Statute, 31 U.S.C. § 1301(a).

- Not less frequently than once every two years after the enactment of the PACT Act, the Secretary shall submit to the Committee on Veterans’ Affairs of the Senate and the Committee on Veterans’ Affairs of the House of Representatives a report identifying any additions or removals to the presumptive list during the period covered by the report.

120502 Budget Authority

- In accordance with 38 U.S.C. § 324(e), the Secretary will provide detailed estimates of sums required to fund TEF in support of the President’s budget submitted to Congress pursuant to 31 U.S.C. § 1105.

- Immediately upon enactment of the PACT Act, expenses authorized to be appropriated to TEF were estimated for FY2023 and subsequent fiscal years. TEF funds are budget authority that is considered to be direct spending:

- In the baseline for purposes of section 257 of the Balanced Budget and Emergency Deficit Control Act of 1985, (2 U.S.C. § 907);

- By the Chairman of the Committee on the Budget of the Senate and the Chair of the Committee on the Budget of the House of Representatives, as appropriate, for purposes of budget enforcement in the Senate and the House of Representatives;

- Under the Congressional Budget Act of 1974 (2 U.S.C. § 621 et seq.), including in the reports required by section 308(b) of such Act (2 U.S.C. § 639(b)); and

- For purposes of the Statutory Pay-As-You-Go Act of 2010 (2 U.S.C. § 931 et seq.).

- No amount appropriated to the TEF in FY2023 or any subsequent fiscal year pursuant to TEF appropriation shall be counted as discretionary budget authority and outlays or as direct spending for any estimate of an appropriation Act under the Congressional Budget and Impoundment Control Act of 1974 (2 U.S.C. § 621 et seq.) and any other Act.

- Notwithstanding the Budget Scorekeeping Guidelines and the accompanying list of programs and accounts set forth in the Joint Explanatory Statement of the Committee of Conference accompanying Conference Report 105–217, and for purposes of the Balanced Budget and Emergency Deficit Control Act of 1985 (2 U.S.C. § 900 et seq.) and the Congressional Budget Act of 1974 (2 U.S.C. § 621 et seq.), the TEF shall be treated as if it were an account designated as ‘Appropriated Entitlements and Mandatories for Fiscal Year 1997’ in the Joint Explanatory Statement of the Committee of Conference accompanying Conference Report 105–217.

120503 Estimates for Congressional Consideration

- In accordance with 38 U.S.C. § 324(f), VA will establish policies and procedures for developing annual TEF estimates. As each TEF estimate will be unique, Administrations and Staff Offices will create procedures specific to the development of their detailed funding estimates, see:

- Appendix B for VHA’s TEF estimation methodology;

- Appendix D for VBA’s TEF estimation methodology;

- Appendix F for OIT’s TEF estimation methodology;

- Appendix H for OEI’s TEF estimation methodology;

- Appendix J for GenAd’s TEF estimation methodology;

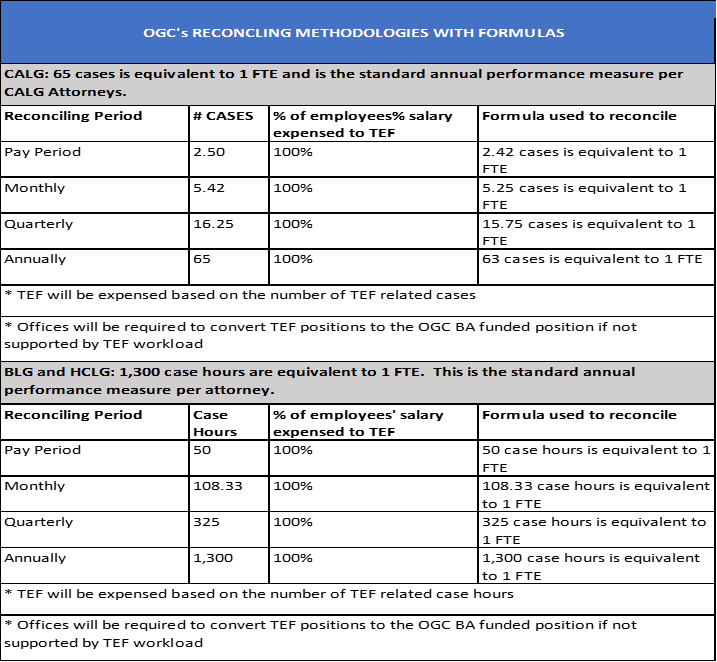

- Appendix L for OGC’s TEF estimation methodology; and

- Appendix N for ORD’s TEF estimation methodology.

- VA may use TEF funds for anticipated expenses if the Administration or Staff Office can demonstrate that an expense is needed to deliver Veterans’ health care and/or benefits associated with exposure to environmental hazards. The TEF is not legally available to fund administrative expenses supporting VA’s delivery of health care and benefits that are not associated with in-service environmental exposure.

- TEF funds may be used to fund a pro rata share of an expense if an Administration or Staff Office is able to:

- Estimate the share that is due to environmental hazards exposure work;

- Track the actual environmental hazards exposure work; and

- Reconcile the estimate with actual workload in order to adjust accounts (e.g., utilizing an “estimate, track and reconcile”) process.

- VA’s OGC has provided guidance that TEF funds may be used for incidental costs that support VA’s delivery of health care and benefits associated with in-service environmental exposures when the costs are demonstrably estimable and reconcilable (e.g., if VBA estimated that it needed X laptops to process new claims based on assumption that, all claims taking the same time to process, 75% of the new claims would be toxic exposure-related, then the TEF could fund 75% of the laptops and the IT Systems account could fund 25% of the laptops; if VBA’s estimate is wrong and only 50% of new claims are toxic exposure-related, then the accounts should be adjusted so that the TEF is charged for 50% and the IT Systems account funds 50%).

- Administrations and Staff Offices receiving TEF resources will develop a long-term staffing plan. This plan will identify anticipated human resource requirements associated with the PACT Act for FYs 2023 through 2025, including planned hiring (permanent, temp/term & contractor) and anticipated attrition based upon workload changes.

- VA Administration and Staff Office CFOs will use Government Accountability Office (GAO) best practices for estimation modeling such that the estimate:

- Can be audited via traceability to source data and model;

- Can be replicated by other estimators via well-defined documentation;

- Identifies and substantiates the costs of resources;

- Discloses any excluded costs along with the rationale;

- Addresses key stakeholder requirements that support decision-making; and

- Is structured to be easily modified to provide answers for unplanned program changes.

120504 Tracking PACT Act Toxic Exposures Fund

- TEF must be utilized only for purposes within the scope of the appropriation, (i.e., expenses attributable to the delivery of health care, benefits, and research due to environmental hazards exposure).

- Use of the TEF for the delivery of health care and benefits that are not associated with exposure to environmental hazards would be a violation of the Purpose Statute, 31 U.S.C. § 1301(a) and could result in Antideficiency Act (ADA) violations, (31 U.S.C. § 1301(a) and (31 U.S.C. § 1341(a), 31 U.S.C. § 1342, or 31 U.S.C. § 1517(a)).

- VA will only use the initial $500 million in FY22 funds made available pursuant to Section 806 of the PACT Act in accordance with the Senate approved spend plan. Detailed information on Senate and House approved uses of initial FY22 TEF funds are contained in Appendix P.

- Prior to recording costs that were not included in the Congressionally approved spend plan, Administration or Staff Office CFOs must submit a request for reprogramming of funds to Office of Budget. OB will determine whether there is a need to provide Congressional notification and/or seek a reapportionment from OMB. If a reapportionment is necessary, obligations may not be incurred that differ from the Congressionally approved spend plan until a new Financial Management Allowance/Transfer of Disbursement Authority (FMA/TDA) is issued.

- VA will not obligate or expend TEF funds in excess of the appropriation or before an appropriation is available (31 U.S.C § 1341).

- VA will accurately track and report the use of TEF funds, associated workload, benefits, and services delivered to Veterans. Each VA organization receiving TEF funds will report on the metrics and workload.

- VA’s administrative control of funds must satisfy the requirements set forth in Volume II, Chapter 3 – VA Fund Control, approved by the Office of Management and Budget (OMB).

- VA will account for expenditures via the use of fund codes for both VA funded TEF costs and reimbursable activities.

- Costs of operations not related to or included in the PACT Act spend plan activities will continue to be recorded using normal funds, accounting classification codes and budget object codes.

- Each Administration or Staff Office receiving TEF funds must coordinate with Human Resources and Administration/Operations, Security, and Preparedness (HRA/OSP) to ensure they are prepared to code and track TEF hires according to their guidance.

- HRA/OSP will track positions that are established in support of the PACT Act by using the Financial Management System fund codes established by the Office of Finance in HRSmart to identify the positions as being funding by TEF appropriations. Temporary positions will have a not to exceed date. They will contact the staff office and Office of Budget prior to hiring or transfer of FTE’s to obtain this information.

- VA will exercise oversight of TEF funding through the VA governance process. Spend plan oversight and fund execution will be routinely reviewed by the Investment Review Council and during monthly budget reviews hosted by OM.

1206 Authorities and References

- Consolidated Appropriations Act of 2023

- Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act of 2022, PL 117-168, PACT Act

- United States Code (U.S.C.)

- Code of Federal Regulations (C.F.R.)

- OMB Circular A-11, Preparation, Submission and Execution of the Budget

- VA Priority Groups

- Volume II, Chapter 3 – VA Funds Control

- Volume II, Chapter 9 – VA Financial Policies and Procedures Expenditure Transfers

1207 Rescissions

Volume II, Chapter 12 – Toxic Exposures Fund May 2024.

Appendix A: Previous Policy Revisions

| Section | Revision | Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Appendix A | Moved all previous revisions to Appendix A | OFP | Standard policy formatting | May 2024 |

| Appendix L | Office of General Counsel (OGC) TEF Methodology | OFP | OGC methodology for estimating TEF application | May 2024 |

| Appendix I | GenAd Funded Staff Offices Methodology for Administrative Costs for Use of the Toxic Exposures Fund | OFP | GenAd methodology for estimating TEF application | April 2024 |

| Appendix G | Office of Enterprise Integration (OEI) TEF Methodology | OFP | OEI methodology for estimating TEF application | March 2024 |

| Appendix E | Office of Information and Technology (OIT) TEF Methodology | OFP | OIT methodology for estimating TEF application | February 2024 |

| 1203 | Updated definitions | OFP | OGC clarification of expenses ‘incidental to’ for allowable use of TEF funds | December 2023 |

| 1205 | Detailed allowable use of TEF funds | OFP | Detailed use of funds for OI&T expenses | December 2023 |

| 1205 | Detailed allowable use of incidental TEF funds | OFP | OGC determination for incidental expenses incurred as part of Toxic Exposure care | December 2023 |

| Appendix C | VBA TEF Methodology | OFP | VBA methodology for estimating TEF application | December 2023 |

| Appendix E | Added Memo for Initial House and Senate Approved TEF Spend Plan | OFP | Leaderships expectations for Estimating, Tracking, and Reconciling TEF funds | December 2023 |

| New Policy | Establish policy for TEF appropriation, estimation procedures, and authorized use of funds | OFP | PACT Act of 2022 | July 2023 |

Appendix B: VHA TEF Estimation Methodology

- VHA will identify the total number of Priority Group (PG) 6 Veterans and the costs associated with their care for the initial TEF estimate each fiscal year. PG 6 will be selected as a proxy because most Veterans in this group are eligible due to environmental exposure-related reasons and because VA could determine what portion of their care was attributable to their exposure based on copayment liability.

- VHA will select a random sample out of PG 6 Veterans receiving care.

- VHA will review data for visits with and without copayment charges.

- VHA will calculate the percentage of Care Without Copayment as the proxy for health care associated with exposure to environmental hazards.

| PG6 Patients | Patient Count | Care that resulted in Copayment | Care without Copayment | FY21 Total Obligations | % of Care Costs without Copayment |

|---|---|---|---|---|---|

| Sample with Billings | 157 | $1,535,701 | $6,728,123 | $8,263,824 | |

| Sample Without Billings | 54 | $0 | $1,330,882 | $1,330,882 | |

| Total | 211 | $1,535,701 | $8,059,005 | $9,594,706 | 84% |

Note: Pharmacy co-payments and pharmaceuticals are excluded from the calculations above.

- VHA will utilize projected health care costs for Veterans who were deployed during the Post 9/11, Gulf War, and Vietnam eras from the most current Enrollee Health Care Projection Model (EHCPM) scenario (scenario BAB1, the current model as of 11/1/22). These eras’ populations constitute an estimate of the maximum number of Veterans who may have faced exposures to environmental hazards as a result of their service.

| ($ millions) | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Post 9/11 | $10,245 | $11,952 | $14,408 | $16,069 | $17,889 |

| Gulf War | $3,345 | $3,568 | $3,989 | $4,149 | $4,303 |

| Vietnam Era – Estimate B | $35,844 | $39,080 | $44,511 | $46,943 | $49,253 |

| Total | $49,434 | $54,600 | $62,908 | $67,160 | $71,445 |

| Estimate B – Based on current enrolleees in FY 2021 aged 69-80 (aged 17-28 in 1969). Note that this is a broad estimate based solely on age during the Vietnam war. | |||||

- VHA will apply the percentage of Care Without Copayment (84%) as the proxy for health care associated with exposure to environmental hazards to the projected health care costs for the identified populations.

| ($ millions) | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Post 9/11 | $8,606 | $10,040 | $12,103 | $13,498 | $15,027 |

| Gulf War | $2,810 | $2,997 | $3,351 | $3,484 | $3,615 |

| Vietnam Era – Estimate B | $30,109 | $32,827 | $37,389 | $39,432 | $41,373 |

| Total | $41,525 | $45,864 | $56,414 | $56,414 | $60,014 |

- VHA will apply a further reduction (1.1%) for lease costs included in the EHCPM-modeled projections that may not be funded by the TEF. This results in the FY 2021 baseline as required by PL 117-168, section 805, and estimated projections for FY 2023, FY 2024, and FY 2025.

| ($ millions) | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Post 9/11 | $8,511 | $9,929 | $11,970 | $13,349 | $14,861 |

| Gulf War | $2,799 | $2,964 | $3,314 | $3,446 | $3,575 |

| Vietnam Era – Estimate B | $29,778 | $32,466 | $36,978 | $38,998 | $40,917 |

| Total | $41,068 | $45,359 | $52,261 | $55,794 | $59,354 |

- VHA will subtract the FY 2021 baseline from the FY 2022 – FY 2025 projections to identify the estimate over the FY 2021 level for health care associated with exposure to environmental hazards or expenses incident to the delivery of health care associated with exposure to environmental hazards that is authorized to be appropriated to the TEF.

| ($ millions) | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Post 9/11 | $0.00 | $1,418 | $3,458 | $4,838 | $6,350 |

| Gulf War | $0.00 | $185 | $185 | $667 | $796 |

| Vietnam Era – Estimate B | $0.00 | $2,688 | $2,688 | $9,221 | $11,140 |

| Total | $0.00 | $4,292 | $11,194 | $14,726 | $18,286 |

Appendix C: VHA Budget Execution

TBD

Appendix D: VBA TEF Estimation Methodology

VBA Toxic Exposures Fund (TEF) Methodology

- Management Direct and Support Staff (e.g., Human Resources, Finance, Office of Field Operations, and PA&I).

- All TEF funded employees are full-time equivalents. There are currently 568 Management Direct and Support Staff (MD&S) Full-Time FTE currently in TEF Cost Centers.

- In order to identify what the TEF will support in this spending category, VBA used the percentage of management direction and support staff compared with direct service staff as a proxy. Over the past 5 years, the average number of Management Direct and Support (MD&S) staff has been 10.7% of the Direct Service staff which represents 23,349 FTE [Disability Compensation, Pension & Fiduciary (P&F), Education, Housing, Veteran Readiness and Employment (VR&E), Insurance, and Outreach, Transition and Economic Development (OTED)].

- VBA will use this as a proxy for normal operations to guide the number of MD&S staff coded to support operations resourced with TEF. In each instance where MD&S staff is allocated because of the requirement to process claims for benefits based on toxic exposure, the requesting office must provide justification to establish the toxic exposure nexus and must recertify the nexus still exists twice per fiscal year – by EOM October and EOM April. Additionally, in instances where staff were hired because of the requirement to process claims for benefits based on toxic exposure are detailed to positions where a nexus does not exist, costs associated with their work will not be allocated to TEF.

- VBA Central Office Direct Staff (Direct: Disability Compensation, VR&E, OTED).

- In order to identify what the TEF supports in this spending category, VBA used the percentage of central office direct staff compared with direct service staff as a proxy. Over the past 5 years, the average number of Direct Service staff at VBA Central Office has been 3.1% of the Direct Service staff in the field [Disability Compensation, Pension & Fiduciary (P&F), Education, Housing, Veteran Readiness and Employment (VR&E), Insurance, and Outreach, Transition and Economic Development (OTED)].

- VBA will use this as a proxy for normal operations to guide the number of Central Office Direct Service staff coded to support operations resourced with TEF. In each instance where Central Office Direct staff is allocated because of the requirement to process claims for benefits based on toxic exposure, the requesting office must provide justification to establish the toxic exposure nexus and must recertify the nexus still exists twice per fiscal year – by EOM October and EOM April. Additionally, in instances where staff hired because of the requirement to process claims for benefits based on toxic exposure are detailed to positions where a nexus does not exist, costs associated with their work will not be allocated to TEF.

- Training Costs for VBA Claims Processors and National Call Center (NCC) Personnel.

- VBA proposes that salary, benefits, and non-pay expenses associated with onboarding and training claims processors be directly attributed to TEF. The sole reason for onboarding this cohort of personnel is based on the detailed PACT Act expansion of toxic exposure-related benefits cost estimate developed to identify the manpower necessary to process claims for and address Veteran inquiries associated with benefits based on toxic exposure.

- VBA Claims Processing Staff – Weighted Cost Split based on Production Standards.

- To account for costs associated with claims processing production, VBA proposes that it take the average cost of a claim if only toxic exposure-related conditions were at issue and subtract that from the average cost of a claim with all issues rated, and then divide that by the average cost of a claim with all issues added.

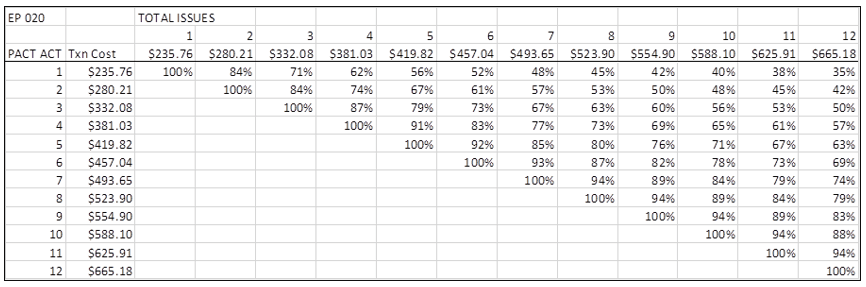

- For example, if we have a claim with two rated issues, and one is a toxic exposure-related condition. If a one issue claim, with a PACT Act expansion of toxic exposure-related benefits contention, costs $235.76, and a two issue claim costs $280.21 on average to process. Based on these cost averages, 84% of the cost of that claim would be attributed to toxic exposure and would be eligible for TEF funding.

- The weighted cost split based on rating claims would also be allocated to the development costs and post-rating costs for consistency.

VBA TEF Methodology Chart

- VBA National Contact Center Staff.

- To account for costs associated with interactions related to toxic exposure benefits handled by the NCC, it is proposed that VBA use the total minutes for all toxic exposure-related logged calls, plus total minutes for AskVA responses for toxic-exposure related inquiries, multiplied by the average cost per minute for personnel costs.

- Non-pay Toxic Exposure-Related Costs.

- All non-pay costs incident to the delivery of Veterans’ benefits associated with exposure to environmental hazards, including administrative expenses, will be allocated to the TEF. This includes contracts, travel, and any other specific costs explicitly attributable to implementing and managing toxic exposure-related efforts.

- Outreach Toxic Exposure-Related Costs.

- All outreach costs incident to the delivery of Veterans’ benefits associated with exposure to environmental hazards, including administrative expenses, will be allocated to the TEF. This includes contracts, travel, and any other specific costs explicitly attributable to implementing and managing toxic exposure-related benefits efforts.

- Scanning Services.

- All scanning costs incident to the delivery of Veterans’ benefits associated with exposure to environmental hazards will be allocated to the TEF. This includes all contract, travel, and any other specific costs explicitly attributable to managing toxic exposure-related benefits efforts.

- These funds will support the file conversion services contract, enable proactive scanning of military personnel files, to include service treatment records, ultimately improving the speed of processing PACT Act expansion of toxic exposure-related benefits claims.

- Automation.

- All automation costs incident to the delivery of Veterans’ benefits associated with exposure to environmental hazards will be allocated to the TEF. This includes all contracts, travel, and any other specific costs explicitly attributable to managing toxic exposure-related efforts.

- These funds will support the additional capacity needed to meet the volume of claims received; allows for increased accuracy and speed of processing claims. Automation efforts will be expanded and updated to support intake of forms, which reside within existing systems of record in VA as well as third-party medical evidence.

- The expansion involves performing claims development, ratings, and award support aimed at easing the workload for VBA claims processors.

Appendix E: VBA Budget Execution

TBD

Appendix F: OIT TEF Estimation Methodology

- OIT TEF Estimation Methodology Framework

OIT developed a methodology to estimate costs that are authorized for TEF purposes as required by P.L. 117-168 and further clarified by OIT-TEF related opinions issued by VA OGC. OIT’s TEF estimation methodology framework focused on non-pay and pay activities that meet TEF authorized purposes and four associated cost types (i.e., fixed, variable, allocable, total).- Non-Pay Activities

- Fixed Costs. Costs that remain constant whatever the quantity of goods or services produced. These costs are associated with benefits IT and systems modernization projects that are listed in the 701b Benefits Modernization Plan submitted to Congress. OIT treats these as “fixed costs” based on the assumption that 100% of the project is in support of the overall modernization of VBA IT systems and does not increase based on the volume of claims processed.

Per OGC, Section 701(a) authorizes the use of TEF funds to continue to modernize systems for the Veterans Benefits Administration and Section 806 appropriation did not limit or exclude the application of section 701(a) to the TEF appropriation. - Variable Costs. Costs that vary with the level of goods or services produced. These costs enable the proportional growth of IT mission support activities (e.g., new user provisioning, enterprise service desk growth, activations) in support of the processing of new toxic exposure presumptive condition disability claims.

Variable costs are only for IT resources, endpoint equipment, and software licenses that directly tie to staff funded entirely with TEF dollars. Specifically, OIT uses TEF funding to pay for the PC, laptop, cell phone, scanner, printer, and other end user devices assigned directly to 100% TEF-funded staff. OIT will not attempt to derive allocable costs for anything that serves as common infrastructure, such as circuit cost or network switches, that can be assigned to both TEF and base appropriations (i.e., multiple funding streams).

Example: VA allotted $9 million in TEF funding to “New User Provisioning and Enterprise Service Desk Growth” for new devices for employees hired to support PACT Act activities. These IT costs included laptops, docking stations, 2 monitors, keyboards, mice, and software and management tools required to be on VA’s network. VA estimated “New User Provisioning and Enterprise Service Desk Growth” funding based a projected hiring of 2,350 FTE and IT cost of $3,823 per FTE. - Allocable Costs. Costs for goods or services involved are chargeable or assignable in accordance with the relative benefits received by the project. These costs are associated with IT systems, programs, projects, and activities that support claims processing of the 23 presumptive conditions in the PACT Act. These IT costs are calculated by only allocating the percentage (%) of cost associated the claims workload attributable to PACT Act’s new and expanded presumptive conditions.

Example: If PACT Act contracting actions paid with TEF funding only account for 20% of all acquisition costs, then OIT will only pay 20% of the annual Technology Acquisition Center (TAC) acquisition fees with TEF funding.

- Fixed Costs. Costs that remain constant whatever the quantity of goods or services produced. These costs are associated with benefits IT and systems modernization projects that are listed in the 701b Benefits Modernization Plan submitted to Congress. OIT treats these as “fixed costs” based on the assumption that 100% of the project is in support of the overall modernization of VBA IT systems and does not increase based on the volume of claims processed.

- Pay Activities

- Total Cost. Sum cost incurred to produce a certain quantity of output. This is the composition of total IT costs associated with IT staffing as it relates to staff who work 100% of their time on TEF-fund projects and activities.

TEF funding can be used to pay for new or existing staff whose work is completely dedicated to toxic exposure efforts. OIT will identify both existing and new staff for whom 100% of their time is spent in support of those fixed cost activities defined in Appendix E, Section A.1.a and may pay for these positions with TEF dollars (up to the TEF pay and administration account budget ceiling). This includes any project managers, engineers, or cybersecurity staff that are assigned 100% to support said product. This guidance applies to both permanent and term positions.

OIT uses the guiding principle of 100% of OIT staff time is used in support of 100% TEF workload for permissible TEF staffing expenses. OIT prohibits fractional time in using TEF dollars.

- Total Cost. Sum cost incurred to produce a certain quantity of output. This is the composition of total IT costs associated with IT staffing as it relates to staff who work 100% of their time on TEF-fund projects and activities.

- Non-Pay Activities

- Tracking TEF Obligations and Expenditures – Non-Pay and Pay Activities

- Non-Pay Activities. TEF is tracked in a OIT PACT Act Dashboardthat pulls data from the OIT Budget Tracking Tool (BTT). This dashboard provides real-time TEF data by Treasury Appropriation Fund Symbol (TAFS) and subaccount (i.e., Development, Sustainment, Pay).

To meet the enhanced reporting requirements guidance shared with Congress and OMB, OIT established TEF transactional codes in financial applications and financial systems of record. For example:- BTT,Spend Plan Module: “PA”

- Integrated Financial and Acquisition Management System (iFAMS): “1126MDMB PACT Act”

OIT uses these transaction codes in tracking TEF funding through a program, project, and activity (PPA) taxonomy allowing OIT to capture wholistic PACT Act Planning Categories (e.g., Effective Claims Processing and Tracking) as well as more detailed and nested project-level (e.g., Individual Longitudinal Exposure Record (ILER)) costs and outcomes. These codes are further used in tracking hiring plans, acquisition packages, and contracts.

- Pay Activities. TEF-funded employees are assigned to a unique TEF Code in OIT’s Payroll Management Database (PMD), an OIT Office of People Science (OPS) database that tracks personnel count and respective cost centers established in the Human Resource and Payroll Application Services (HRPAS) system.

- Non-Pay Activities. TEF is tracked in a OIT PACT Act Dashboardthat pulls data from the OIT Budget Tracking Tool (BTT). This dashboard provides real-time TEF data by Treasury Appropriation Fund Symbol (TAFS) and subaccount (i.e., Development, Sustainment, Pay).

- Reconciliation of TEF Financial and Performance Metrics – Non-Pay and Pay Activities

- Non-Pay Activities. Based on the tracking and enhanced reporting capabilities described in Appendix E, Section B in support of PACT Act, OIT will reconcile estimates with actual expenses, work outputs, and performance outcomes. Such financial reconciliations will occur for each TAFS, subaccount, and project in the TEF taxonomy and align with performance outcomes as defined in the 701b Modernization Plan. This will ensure OIT maintains necessary adjustments to its accounting records. OIT will conduct periodic governance and internal control reviews to ensure the enforcement of the reconciliation process.

- Pay Activities. Based on the tracking and enhanced reporting capabilities described in Appendix E, Section B in support of the PACT Act, OIT developed a TEF Payroll Tracker that captures all TEF payroll related costs. This tracker will reconcile estimates to the individual position identifying specific duties and total time dedicated to said duties. Per current guidance, only those permanent and term positions working 100% TEF related duties in support of 100% TEF 701b Modernization Plan (i.e., VBA IT Systems Modernization) project will be authorized to be paid with TEF pay funding. All other OIT staff are to be paid through the base appropriation.

Appendix G: OIT Budget Execution

TBD

Appendix H: OEI TEF Estimation Methodology

VA Office of Enterprise Integration / Enterprise Program Management Office Methodology to Determine When to Use Toxic Exposure Fund (TEF)

- Public Law 117-168 or the “Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act of 2022” (commonly known as the “PACT Act”) is a comprehensive law, which, among other things, authorized the expansion of healthcare and benefits access for Veterans exposed to toxic substances during military service. The Office of Enterprise Integration (OEI) drives unity of effort across the Department of Veterans Affairs (VA) by using evidence, policy, and governance to create an integrated VA where strategy and resources are aligned to improve outcomes for Veterans.

- In regards to the PACT Act expansion of toxic exposure-related health care and benefits, OEI primarily performs work through two teams. The first team is the VA’s Enterprise Program Management Office (EPMO), which has both Federal employees and contractors. The EPMO is a temporary team focused on ensuring integration of Departmentwide efforts related to P.L. 117-168 while ensuring that legislative requirements and deadlines are met. OEI provides administrative services to support the EPMO, however it does not provide direction, which is provided by the VA’s Office of the Secretary.

- The second team is OEI’s Data Governance and Analytics (DGA) office, which is a permanent team that employs Federal employees and contractors to perform a variety of data gathering, analysis, and presentation work for the Department. OEI has also overseen PACT Act expansion of toxic exposure-related health care and benefits-related work in other OEI offices and may continue to do so in the future. In support of the PACT Act’s expansion of toxic exposure-related health care and benefits, DGA performs data integration and analytics to allow for informed and evidence-based decision making and to properly implement the various reporting requirements of the law. This includes work under Sections 103, 104, 111, and 501, which require the Secretary of Veterans Affairs to gather and analyze data to assist in determining the efficacy of the Department’s efforts to expand the delivery of health care and benefits associated with exposure to environmental hazards. DGA also manages the agency’s data governance bodies to ensure consistency and alignment on matters related to data collection, management, and analysis activities.

- As OEI embarks on the process of utilizing the Cost of War Toxic Exposures Fund (TEF) provided by Congress to perform some of these functions, it is crucial to establish a clear methodology to ensure compliance with the language outlined in 38 U.S.C. § 324. This methodology seeks to answer two questions: 1) What expenditures will OEI consider allowable under 38 U.S.C. § 324, and 2) What methodology will be used to estimate, track, and reconcile these expenditures. Accordingly, this methodology is divided into two parts: Allowable Expenditures and Methodology.

Section 1: Allowable Expenditures

- Sec. 805 of the law created a “Cost of War Toxic Exposures Fund” (TEF) account by establishing 38 U.S.C. § 324, which allows funds to be used for only certain limited purposes. To ensure TEF funds are used only for those limited allowable purposes, OEI is committing to restrict its use of TEF funds to fund only the following activities, which are all administrative expenses directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards, per 38 U.S.C. § 324:

- Activities authorized under P.L. 117-168, Title I, Subtitle A, Sec. 103 (“Expansion of Health Care for Specific Categories of Toxic-Exposed Veterans and Veterans Supporting Certain Overseas Contingency Operations”), implementation of which requires gathering, visualizing, and analyzing data and dashboard support to assist in the identification of eligible Veterans, outreach activities designed to support enrollment of eligible Veterans, and tracking efficacy of VA’s outreach campaign. These activities are considered authorized administrative expenses allowable under 38 U.S.C. § 324(c)(2) because they allow the VA to identify and communicate eligibility to Veterans who meet the requirements of the legislation in order for VA to deliver health care and benefits associated with exposure to environmental hazards.

- Activities authorized under P.L. 117-168, Title I, Subtitle A, Sec. 104 (“Assessment of Implementation and Operation”), which mandates the gathering and analyzing of data to assist in producing the required reports, dashboards, and visualizations that represent the PACT Act expansion of toxic exposure-related health care and benefits eligible population and to summarize the effect of activities authorized under Sec 103 (“Expansion of Health Care for Specific Categories of Toxic-exposed Veterans And Veterans Supporting Certain Overseas Contingency Operations”) and their cost. This section requires data and data analytics support for the assessment of resources necessary for PACT Act expansion of toxic exposure-related health care and benefits implementation and the production of mandated reports. Additionally, the implementation of this Section may require development of recommendations for data schemas and data structures supporting the configuration of information technology systems that support PACT Act expansion of toxic exposure-related health care and benefits implementation. These activities are considered authorized administrative expenses allowable under 38 U.S.C. § 324 (c)(2) because they allow the VA to understand the cost of implementation and evaluate patterns in the demand for services directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards.

- Activities authorized under P.L. 117-168, Title I, Subtitle B, Sec. 111 (“Expansion of period of eligibility for health care for certain Veterans of combat service”), which mandates the gathering and analyzing of data to assist in producing the required reports, dashboards, and visualizations that represent the number of Veterans enrolled in the patient enrollment system. This support is required to assist in outreach activities and report on the number of Veterans who enrolled in VA services during the special enrollment period. These activities are considered authorized administrative expenses allowable under 38 U.S.C. § 324 (c)(2) because they allow the VA to communicate eligibility and understand the ancillary effects of delivering health care and benefits associated with exposure to environmental hazards.

- Activities authorized under P.L. 117-168, Title I, Subtitle B, Sec 501 (“Interagency working group on toxic exposure research”), which mandates the gathering and analyzing of data to assist in producing the required reports, dashboards, and visualizations that represent the results of the Toxic Exposure Research Working Group. This support may also be required to support identification and use of clinical data scientifically necessary in determining the association, if any, between the medical condition of a Veteran and toxic exposure. These activities are considered authorized expenses allowable under 38 U.S.C. § 324 (c)(3) to assist medical and other research relating to exposure to environmental hazards.

- Activities authorized under P.L. 117-168, Title II, Sec 202 (“Toxic Exposure Presumption Process”), which creates new provisions in chapters 11 and 13 of title 38, U.S.C., regarding determinations relating to presumptions of service connection based on toxic exposure. This section may require data and data analytics support to crosswalk clinical findings to presumptive conditions. These activities are considered authorized expenses allowable under 38 U.S.C. § 324 (c)(3) to assist in determinations related to authorization of benefits and services.

- All activities associated with coordinating department-wide implementation of functions authorized under P.L. 117-168, Title I (“Expansion of Health Care Eligibility”), Title II (“Toxic Exposure Presumption Process”), Title III (“Improving the Establishment of Service Connection Process for Toxic-exposed Veterans”), Title IV (“Presumptions of Service Connection”), Title V (“Research Matters”), Title VI (“Improvement of Resources and Training Regarding Toxic-exposed Veterans”), and Title VIII (“Records and Other Matters”) are considered authorized expenses allowable under 38 U.S.C. § 324 (c)(3) to assist in determinations related to authorization of benefits and services to Veterans with environmental exposures.

- Activities associated with coordinating department-wide implementation of functions authorized under P.L. 117-168, Title VII (“Resourcing”) are allowable expenditures under 38 U.S.C. § 324 only if related to the modernization of resources such as information technology systems or the production of data and analytics that are directly connected to improving the delivery of care and benefits to toxic-exposed Veterans (Title VII).

- OEI will not use TEF to fund any activities authorized under P.L. 117-168, Title VII (“Resourcing”) related to leases for space, as these are specifically prohibited by statute. Additionally, OEI will not use TEF to fund activities authorized under P.L. 117-168, Title IX (“Improvement of Workforce of Department of Veterans Affairs”) for improvements to the VA workforce to reach Veterans in rural areas and the development of best practices to recruit and retain the personnel needed to directly deliver care and benefits to toxic-exposed Veterans.

Section 2: Methodology

- To effectively estimate, track, and reconcile the use of TEF funds for the above-mentioned allowable expenditures, OEI is committing to the following methodology, which is separated into three parts: staff, contracts, and other administrative expenses. More information on the details of the TEF-related expenditures for the VA’s PACT Act Enterprise Program Management Office is located in Appendix 1. More information on OEI’s FY24 TEF spend plan is located in Appendix 2.

- Staff: To maintain transparency and accountability, OEI designates a single official – the OEI Director of Operations – to oversee all expenditure of TEF for staff salaries and benefits. For any OEI employees performing duties associated with allowable expenditures in Section 1 of this document, the OEI Director of Operations will apply a comprehensive understanding of the applicable regulations and guidelines and conduct monthly expenditure reviews with the Office of Management and lead training sessions with employees funded by or supervising staff funded by TEF funds to ensure:

- An accurate estimate is created to approximate the appropriate percentage of an employee’s time to be paid for using TEF funds. This estimate will be based on the percentage of activities listed in the position description that are covered under the allowable expenditures in Section 1 of this document.

- Employee performance of duties associated with allowable expenditures is tracked. This performance of duties will be tracked using several methods, including:

- the supervisor’s provision of the employee’s performance plan at the beginning of the performance year; and

- the supervisor’s provision of monthly summaries of any deviations from the performance plan, including the following:

- The tasks performed that deviate from the performance plan estimates;

- The number of hours performing those tasks; and

- The number of hours that do not deviate from the performance plan estimates and are considered allowable expenditures for TEF funds.

- Because cost accounting in the VA’s time and attendance system is not possible, OEI will determine which personnel will be funded by TEF funds or OEI’s base funds account (0142). OEI will track and review staffing expenditures monthly and will reconcile quarterly and annually. OEI will provide reconciliation amounts to the Office of Management (OM), which will conduct expenditure reclassification to either the TEF account or the OEI base funds account based on the reconciliation process.

- Continual communication with OM, OBO, and OGC to confirm compliance with 38 U.S.C. § 324 (c)(2), identify any necessary adjustments to estimation, tracking, or reconciliation methods, and confer on departmental approach on maintaining staffing records.

- Contracts: OEI designates a single official – the OEI Director of Operations – to oversee all expenditures of TEF for any OEI contracts subject to the Federal Acquisition Regulations (FAR) that may require products or services associated with allowable expenditures in Section 1 of this document. To maintain transparency and accountability in its use of TEF funds for contracts, OEI commits to the following procedures:

- OEI will create an Independent Government Cost Estimate (IGCE) when forecasting future contracting requirements for allowable expenditures in Section 1 of this document. This cost estimate will separate into discrete contract line item numbers (CLINs) those products and services to be contracted for paid for using OEI’s base funds and those products and services to be paid for using TEF funds. To the extent possible, OEI will avoid creating contracts that mix funds and will instead create contracts that are paid for using either 100% OEI base funds or 100% TEF funds, depending on the products or services to be purchased.

- Before entering into new contracts or task orders or modifying existing contracts or task orders, OEI will ensure all Contracting Officer Representatives (CORs) responsible for managing contracts or task orders for TEF-funded requirements are aware of any special payment procedures to ensure TEF funds are used for TEF-funded CLINS.

- During the contract’s performance, OEI will ensure all CORs responsible for managing contracts or task orders for TEF-funded requirements track allowable expenditures during their monthly invoice reviews. This will include reporting to the OEI Director of Operations on any deviations from the planned TEF-funded expenditures, including the following:

- Any work on any TEF-funded CLIN that deviates from the planned expenditure; and

- The deviation in the number of hours performed or products received.

- All OEI CORs for contracts with TEF-funded requirements will take action to ensure compliance under the law. This includes:

- Ensuring all Project Work Statements (PWS) accurately reflect which CLINs are for products or services associated with allowable expenditures in Section 1 of this document;

- Ensuring all PWSs compel the contractor to list in their monthly invoices the work performed in each CLIN and the associated costs;

- Ensuring in each contract kick-off meeting that contractors working on CLINs for products or services associated with allowable expenditures in Section 1 of this document are made aware of their responsibilities to work only on products and services that are incident to the delivery of Veterans’ health care and benefits associated with toxic exposures, as defined by 38 U.S.C. § 324;

- Reviewing monthly management reports to confirm that all tasks performed, and products received for CLINs that are for products or services associated with allowable expenditures in Section 1 are incident to the delivery of veterans’ health care and benefits associated with toxic exposures, as defined by 38 U.S.C § 324 (c)(2); and

- Reviewing invoices and invoice certification procedures to ensure vendors bill the correct CLIN.

- Other Administrative Expenses:To ensure that all other non-FAR-based expenses funded by TEF are compliant with the statute as stated in 38 U.S.C. § 324, OEI designates a single official – the OEI Director of Operations – to oversee all TEF expenditures. These expenditures could include software licenses, travel expenses, data purchases, and equipment procurement. To maintain transparency and accountability in its use of TEF funds for non-FAR-based expenses, OEI commits to the following procedures:

- Creating and communicating to the VA Office of Management an annual spend plan that includes an estimate for TEF-related administrative expenses associated with allowable expenditures in Section 1 of this document. Estimates will also be created for any period of Continuing Resolution or as needed. (FY24 TEF administrative spend plan is in Appendix 2);

- A centralized approval process to approve and track expenses associated with allowable expenditures in Section 1 of this document. Each request will be thoroughly reviewed by the OEI Director of Operations to confirm cost management and 38 U.S.C. § 324 compliance requirements are met. The OEI Director of Operations will confirm approval of TEF funds for these other administrative expenses with the OEI Chief of Staff, a Senior Executive Service-equivalent position; and

- A centralized purchasing process for all such expenses. The purchase of each approved request will be input under the OEI Director of Operations’ authority and reviewed to confirm 38 U.S.C. § 324 compliance requirements are met. On a monthly basis, OEI will reconcile each month’s expenditures as compared to each month’s planned expenditures.

- Staff: To maintain transparency and accountability, OEI designates a single official – the OEI Director of Operations – to oversee all expenditure of TEF for staff salaries and benefits. For any OEI employees performing duties associated with allowable expenditures in Section 1 of this document, the OEI Director of Operations will apply a comprehensive understanding of the applicable regulations and guidelines and conduct monthly expenditure reviews with the Office of Management and lead training sessions with employees funded by or supervising staff funded by TEF funds to ensure:

- By following this comprehensive methodology, OEI will ensure that TEF execution is in full compliance with the language specified in 38 U.S.C. § 324. OEI’s commitment to transparency, accountability, and adherence to regulations will serve as a solid foundation for the successful management of these funds.

Appendix 1:

PACT Act Enterprise Program Management Office Details

- To oversee the delivery of expanded care and benefits to Veterans with environmental exposures under the PACT Act, VA established an Enterprise Program Management Office (EPMO) under OEI. The EPMO coordinates the implementation of all the activities delineated in the nine PACT Act titles and encourages integration across the Department.

- The EPMO has a need for 10 FTEs and minimal contract and travel expenditures. Although OEI oversees all EPMO staff, contract, and administrative expenses per the above methodology, more details on how EPMO has derived the percentages of staff and contract expenditures to be funded with TEF (as per 38 U.S.C. § 324) is below.

- Staff: The EPMO has determined the percentage of work and expenditures that constitute administrative expenses directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards. This includes:

- Activities such as the new provisions related to the toxic exposure presumption process (Title II) and improvements to the claims process which will be utilized to establish a service connection to toxic-exposed Veterans (Title III);

- The PACT Act also specifically created new eligibility criteria for toxin-exposed Veterans and new presumptive conditions due to toxic exposure, and the EPMO will coordinate the enterprise implementation of these titles (Titles I and IV);

- The PACT Act includes supporting actions directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards, such as epidemiological studies and research to monitor other potential toxic exposures of current to Veterans (Title V), publication of informative materials and resources for Veterans and their families on toxic exposure and training for VA personnel to identify, treat, and assess the impact on Veterans of illnesses related to toxic exposures (Title VI); and

- The PACT Act also includes the modernization of resources such as information technology systems to directly improve the delivery of care and benefits to toxic-exposed Veterans (Title VII), improvement of record systems to create accurate information to track toxic-exposed Veterans to allow proper assessment of any conditions (Title VIII).

- There is a small percentage of work and expenditures that EPMO has determined may not be administrative expenses directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards. This includes work and expenses related to leases for space (Title VII) and improvements to the VA workforce to reach Veterans in rural areas and the development of best practices to recruit and retain the personnel needed to directly deliver care and benefits to toxic-exposed Veterans (Title IX).

- The EPMO oversees six Lines of Effort (LOEs). The EPMO has determined that efforts under four of these LOEs can be funded 100% by TEF. The EPMO has determined that one LOE, Strengthening the VA Workforce will be 80% funded by OEI base funds and 20% funded by TEF. The sixth LOE is related to infrastructure capacity and is not allowed to be funded by TEF. Because employees are either assigned directly – and only – to an LOE or they provide support to all LOEs, the source of funding for employee salaries and benefits depend on the LOE they support. The list of LOEs and their funding source is below:

- Comms & Outreach LOE: 100% TEF-funded;

- SDM LOE: 100% TEF-funded;

- Workforce LOE: 80% OEI-funded; 20% TEF-funded;

- PP&R LOE: 100% TEF-funded;

- DMF LOE: 100% TEF-funded ; and

- Capacity LOE: 0% TEF-funded.

- One of the major lines of effort (LOEs) for the EPMO is Communications and Outreach. Because the Outreach LOE is determined to use TEF funds for allowable expenses, outreach costs such as travel that are incident to major outreach events (such as site visits to VAMC or VBA regional offices or to townhall-type events organized by VSOs, Members of Congress, or other stakeholders to encourage Veterans to seek care and benefits associated with exposure to environmental hazards) may be allocated to the TEF, pending review by the OEI Director of Operations to confirm 38 U.S.C. § 324 compliance requirements are met. All EPMO travel authorization requests will include information on which LOE the trip supports; if a trip is in support of multiple LOEs, the requester shall also include the percentage of time to be spent during the trip on each LOE.

Table G-1 demonstrates the % of TEF funding recommended for each FTE and describes the Titles that they support. - Contracts:The EPMO is assisted with its work by contractors.

- The contractors advise the PACT Act EPMO to ensure the appropriate tools and processes are readily available to maintain the VA’s strategic direction, flexibility, and efficiency levels required to support the provision of Veteran’s health care and benefits associated with exposure to environmental hazards. They provide strategic recommendations to mitigate risk and develop strategies for moving the Lines of Effort (LOEs), focused on toxic exposures, from reactionary to proactive and predictive. They identify evolving priorities or emerging issues that may impact the provision of Veteran’s health care associated with exposure to environmental hazards during military service. Additionally, the contractors provide project management support to the EPMO and LOEs, including tracking deliverables in the electronic integrated master schedule and supporting the weekly Battle Rhythm meetings. They are also focused on the continuation of the modernization, development, and expansion of capabilities and capacity of information technology systems and infrastructure of the Veterans Benefits Administration, to support expected increases in claims processing for new eligible Veterans.

- Staff: The EPMO has determined the percentage of work and expenditures that constitute administrative expenses directly related to the delivery of Veterans’ health care and benefits associated with exposure to environmental hazards. This includes:

Table G-1

| FTE | NON TEF % of Effort | TEF % of Effort | Discussion |

|---|---|---|---|

| Executive Director: | N/A | N/A | This salary is paid by the Office of the Secretary (non-OEI; non-TEF). |

| Deputy Executive Director: (vacant) | 20% | 80% | 80% of the Deputy Executive Director’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles PACT Act Titles I-VIII) and 20% on resourcing and workforce (PACT Act Titles VII & IX) |

| Executive Management Officer | 20% | 80% | 80% of the Executive Management Officer’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles PACT Act Titles I-VIII) and 20% on resourcing and workforce (PACT Act Titles VII & IX) |

| Program Manager | 20% | 80% | 80% of the Program Manager’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles PACT Act Titles I-VIII) and 20% on resourcing and workforce (PACT Act Titles VII & IX) |

| Comms and Outreach Lead | 0% | 100% | 100% of the Communications and Outreach Lead’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles I-VI & VIII) |

| Systems Development Lead | 0% | 100% | 100% of the Systems Development Lead’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles I & VII-VIII) |

| Workforce Lead: vacant | 80% | 20% | 20% of the Workforce Lead’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles I & VIII) and 80% on resourcing and workforce (PACT Act Title IX) |

| Data Management Lead: vacant | 0% | 100% | 100% of the Data Management Lead’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles II-VI) |

| Presumptive Process Lead: vacant | 0% | 100% | 100% of the Presumptive Process Lead’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Title II) |

| Administrative Officer (vacant) | 20% | 80% | 80% of the Administrative Officer’s effort is related to the provision of healthcare and benefits for Veterans exposed to toxins during their military service (PACT Act Titles I-VIII) and 20% on resourcing and workforce (PACT Act Titles VII & IX) |

Appendix 2:

FY24 TEF Spend Plan

Estimated FY24 personnel expenses

| Position (incumbent) | Annual base pay | Benefits estimate (36%) | *Estimated FY 2024 payroll cost | % TEF funded | $ TEF funded | % base funded | $ base funded | Funded by TEF or OEI Base |

|---|---|---|---|---|---|---|---|---|

| EPMO: Director | Will be paid through OSVA (non-OEI; non-TEF) | |||||||

| EPMO: Deputy Director (Vacant) | $175,910 | $63,328 | $239,238 | 80% | $191,390 | 20% | $47,848 | OEI base |

| EPMO: Executive Management Officer | $175,910 | $63,328 | $239,238 | 80% | $191,390 | 20% | $47,848 | TEF |

| EPMO: Program Manager | $132,368 | $47,652 | $180,020 | 80% | $144,016 | 20% | $36,004 | TEF |

| EPMO: Comms & Outreach LOE Lead | $128,182 | $46,146 | $174,328 | 100% | $174,328 | 0% | $0 | TEF |

| EPMO: SDM LOE Lead | $132,368 | $47,652 | $180,020 | 100% | $180,020 | 0% | $0 | TEF |

| EPMO: Workforce LOE Lead | $86,450 | $31,122 | $117,572 | 20% | $23,514 | 80% | $94,058 | OEI Base |

| EPMO: PP&R LOE Lead (vacant, projected Nov 2024) | $141,192 | $50,829 | $192,021 | 100% | $192,021 | 0% | $0 | TEF |

| EPMO: DMF LOE Lead (vacant, projected in Jan 2024) | $112,015 | $40,325 | $152,340 | 100% | $152,340 | 0% | $0 | TEF |

| EPMO: Admin Officer (vacant, projected in Jan 2024) | $94,199 | $33,912 | $128,111 | 80% | $102,489 | 20% | $25,622 | TEF |

| OEI/DGA: Data analyst | $157,817 | $56,814 | $214,631 | 100% | $214,631 | 0% | $0 | TEF |

| OEI/DGA: Data analyst | $157,817 | $56,814 | $214,631 | 100% | $214,631 | 0% | $0 | TEF |

| OEI/DGA: Data analyst | $157,817 | $56,814 | $214,631 | 100% | $214,631 | 0% | $0 | TEF |

| Totals | $1,652,045 | $594,736 | $2,246,781 | $1,995,402 | $251,379** | |||

**OEI will use this estimate in its FY24 base fund (0142) spend plan

These estimates may change with step increases, pay raises, gaps in filling positions, etc. The above expenditures should result in $1,995,402 being charged to TEF and $251,379 being charged to OEI base account. However, due to a lack of cost accounting, employees will be split, with some funded entirely from TEF and some funded entirely with OEI base account (see last column). As such, estimate d annual reimbursement of $105,430.74 from TEF to OEI base accounts is expected to replenish the OEI base account for allowable expenses funded from TEF.

| Expense | Contract | % TEF funded | $ TEF funded | % base funded | $ base funded | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EPMO Contract | $1,360,000 | 100% | $1,360,000 | 0% | $0 | ||||||||||||||

| EPMO Contract | $995,000 | 100% | $995,000 | 0% | $0 | ||||||||||||||

| EPMO Contract | $1,600,000 | 100% | $1,600,000 | 0% | $0 | ||||||||||||||

| EPMO Contract | $1,225,000 | 100% | $1,225,000 | 0% | $0 | ||||||||||||||

| EPMO Detailee | $45,000 | 100% | $45,000 | 0% | $0 | ||||||||||||||

| EPMO TEF-related travel | $82,000 | 100% | $82,000 | 0% | $0 | ||||||||||||||

| EPMO TEF-related training, supplies | $10,000 | 100% | $10,000 | 0% | $0 | ||||||||||||||

| OEI contract: TBD (Dashboard) | $1,592,000 | 100% | $1,592,000 | 0% | $0 | ||||||||||||||

| Totals | $6,909,000 | $6,909,000 | $0 | ||||||||||||||||

| Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Training | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||

| Travel | $0 | $3 | $3 | $8 | $8 | $9 | $9 | $10 | $10 | $9 | $7 | $6 | $82 | |||||

| Supplies | $2 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2 | |||||

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||

| $2 | $3 | $3 | $8 | $8 | $9 | $9 | $10 | $10 | $9 | $7 | $6 | $84 | ||||||

Appendix I: OEI Budget Execution

TBD

Appendix J: GenAd TEF Estimation Methodology

General Administration (GenAd) Funded Staff Offices

Methodology for Administrative Costs for Use of the Toxic Exposures Fund

- “The Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics Act of 2022” or the “Honoring our PACT Act of 2022” (PACT Act, PL 117–168) represents the most significant expansion of VA healthcare and disability compensation benefits for Veterans exposed to burn pits and other environmental exposures in 30 years. As part of the PACT Act, Congress authorized the Cost of War Toxic Exposures Fund (TEF) to pay for increased costs above 2021 funding levels for health care and benefits delivery for Veterans exposed to a number of environmental hazards to ensure there is sufficient funding available to cover these costs, without shortchanging other elements of Veteran medical care and benefit delivery. Specifically, TEF is available for:

- the provision of Veterans’ health care associated with exposure to environmental hazards in service (section 805 of the PACT Act, codified at 38 U.S.C. § 324(c)(1));

- expenses incident to delivering health care and benefits to Veterans associated with exposure to environmental hazards in service, including administrative expenses, such as information technology and claims processing and appeals (38 U.S.C. § 324(c)(2));

- medical and other research relating to exposure to environmental hazards (38 U.S.C. § 324(c)(3)), and

- continuation of the modernization, development, and expansion of capabilities and capacity of information technology systems and infrastructure of the Veterans Benefits Administration, including for claims automation, to support expected increased claims processing for newly-eligible Veterans pursuant to the PACT Act (section 701 of the PACT Act, 38 U.S.C. § 324 note).

- This document provides the VA GenAd Staff Offices’ methodology to identify indirect costs and reconcile the expenses considered incident to delivering health care benefits to Veterans associated with exposure to environmental hazards in service, including administrative expenses for GenAd Staff Offices.

Indirect Cost Methodology for GenAd Staff Offices

- GenAd consists of:

- Headquarters Staff Offices;

- Office of the Secretary;

- Office of General Counsel;

- Office of Management;

- Human Resources Administration/Operations Security and Preparedness;

- Office of Enterprise Integration;

- Office of Public and Intergovernmental Affairs;

- Office of Congressional and Legislative Affairs;

- Office of Acquisition, Logistics and Construction;

- Veterans Experience Office; and

- Office of Accountability and Whistleblower Protection.

- GenAd Staff Offices have overall responsibility for centralized policymaking and oversight and engage in activities that benefit the entity, not just TEF activities, which generally precludes a direct allocation approach. For example, GenAd (Headquarters) executives and staff meet regularly to discuss major VA initiatives, including implementation of PACT Act, and to track each meeting, each participant, and total minutes spent on PACT Act implementation, specific to TEF, would pose undue burden with minimal benefits. Furthermore, except in limited instances,[1] there is no precedent for GenAd Staff Offices to track costs by project and to employ these procedures is impractical.

[1] OGC requires certain staff to track time spent on each activity within a case using their GCLaws application.

GenAd Office Indirect Cost TEF Methodology and Quarterly Bona Fide Attempt to Determine Actual Costs

- GenAd Staff Offices have been advised to develop a methodology that maximizes direct costallocation to TEF activities. For example, the Enterprise Program Management Office was established to oversee execution of PACT Act and most of its costs can be traced directly to TEF, therefore, their cost methodology will be direct allocation of costs to TEF. In cases where GenAd Staff Offices support general and administrative activities that are part of overall function of the office, including execution of TEF, GenAd Offices may use an indirect cost methodology. As general rule, GenAd Offices should carefully consider which costs are direct or indirect and should consistently adhere to those determinations. Exceptions to the general rule may be allowable if exceptions are reasonably justified and properly documented.

- At the beginning of each fiscal year, the Office of Budget will calculate the total allowable indirect cost amount for GenAd Staff Offices based on prior year GenAd expenditures. This amount is a not-to-exceed amount used for developing spend plans and for management control purposes (see Management Control section for additional information). The Office of Budget will use the spend plan process to sub-allocate TEF funds to GenAd Staff Offices based on their direct and indirect costs to execute TEF, which will ensure VA remains under the total allowable indirect cost amount established for the year. Indirect cost sub-allocations are estimates, will vary by office, and will be determined by Office of Budget.

- Quarterly Bona Fide Attempt to Determine Actual Indirect Costs. Each GenAd Staff Office will use their annual base appropriation for incurring costs that are ordinary and necessary to its operation. In cases where general and administrative expenses are incurred to execute TEF supporting activities, each GenAd Staff Office may develop a reasonable approximation of actual administrative cost incident to delivering health care and benefits related to toxic exposure. At the end of each quarter, each GenAd Staff Office can request a cost transfer of its incurred general and administrative costs, such as executive and administrative support salaries, supplies, and travel, based on a reasonable approximation of actual costs incurred supporting TEF activities. For general and administrative costs to be considered allowable and reasonable under the indirect cost sub-allocation, the GenAd Staff Office must pass three tests:

- Is the cost generally recognized as ordinary and necessary for the operation?

- Would a prudent official under the circumstances prevailing at the time of decision believe the general and administrative costs are incidental to delivering health care and benefits to Veterans associated with exposure to environmental hazards in service?

- Would a prudent official determine the methodology used to derive the costs incurred are reasonable and supportable with documentation considering all other circumstances?

- Indirect costs may notinclude costs identified as direct costs. At the end of each quarter, GenAd Staff Offices must provide its indirect cost amount and supporting documentation to Office of Budget, along with a certification memo signed by the Assistant Secretary or Other Key Official. Signature authority may be delegated to a member of the Senior Executive Service (see Appendix 1 for certification memo Template). The indirect cost amount requested must be based on actual costs incurred. GenAd Staff Offices are required to maintain adequate supporting documentation for indirect costs incurred.

- Quarterly Reconciliation Process. Office of Budget will establish procedures for executing cost transfers to TEF and will coordinate with the Financial Services Center to record the cost transfers. Office of Budget will ensure the total costs transferred to TEF are reconciled to the certification memos and ensure total transferred costs do not exceed the annual indirect cost ceiling for both the sub-office allocation and GenAd in aggregate. Not later than October 10th of each year, GenAd Staff Offices must provide Office of Budget the year-end results of the direct cost methodology to enable Office of Budget to make direct cost transfers to the appropriate accounts.