Volume VII - Financial Reporting

Chapter 01 – Financial Statement Reporting

0101 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies regarding the timely preparation and submission of reliable, accurate, and complete financial statement reporting.

Key points covered in this chapter:

- VA will abide by all financial reporting requirements mandated by regulation or statute;

- VA’s period-end closing process is an integral part of compliance with the financial reporting requirements;

- VA will publish the Agency Financial Report (AFR) to present its annual performance and financial activities;

- Office of Financial Reporting (OFR) will coordinate submission of the Agency’s financial statements to the Department of Treasury, OMB, and Congress; and

- Office of Financial Audit (OFA) will serve as the primary liaison between Agency stakeholders and the external financial auditors conducting the audit of VA’s department-wide financial statements.

0102 Revisions

| Section | Revision | Requesting Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Appendix E | Added FMS close schedule for FY24 | OFP | Updated 2024 FMS Annual Close Memorandum | December 2024 |

| Appendix F | Added IFAMS close schedule for FY24 | OFP | Updated 2024 iFAMS Annual Close Memorandum to include new Accounting Period 16 | December 2024 |

| Appendix G | Annual Certification of Accounting Records for VISN | OFP | Updated Annual Certification of Accounting Records for VISNs | December 2024 |

| Appendix H | Annual Certification of Accounting Records for Station | OFP | Updated Annual Certification of Accounting Records for Stations | December 2024 |

For a complete list of previous policy revisions, see Appendix A.

0103 Definitions

Accruals – Accounting adjustments for revenues that have been earned but are not yet recorded and expenses that have been incurred but are not yet recorded.

Actuarial Assumptions – Estimated values for variables made for the purposes of calculating future benefit liability costs. Possible variables include life expectancy, return on investments and interest rates.

Adjusted Trial Balance (ATB) – A listing of all the account titles and balances contained in the general ledger after adjusting entries for an accounting period have been posted to the accounts.

Agency Financial Report (AFR) – The Agency’s end of fiscal year financial report that contains various information about the Department as well as the financial statements, notes to the financial statements, the external financial auditor’s opinion, and other supplementary information.

Balance Sheet –Presents the Agency’s total assets, liabilities, and net position at a specific point in time.

Estimates – An approximation of a financial element, item, or transaction for which there is no precise means of measurement.

Governmentwide Treasury Account Symbol Adjusted Trial Balance System (GTAS) – A Treasury operated Government-wide accounting web-based system used by Federal agencies to submit both budgetary and proprietary financial data.

Legal Representation Letter (LRL) – A letter from Office of General Counsel (OGC) to the auditor, in response to a letter of audit inquiry from management to OGC. It is the auditor’s primary means of corroborating the information furnished by management concerning the accuracy and completeness of litigation, claims and assessments.

Management Information Exchange (MinX) System – A Hyperion-based reporting system that automates the preparation of VA’s financial statements. MinX receives data via interface from VA’s accounting system.

Management Representation Letters (MRLs) – Formal letters to the independent auditor, signed by the Agency’s senior management, that conform to OMB guidance.

MAX or OMB MAX – A portfolio of software applications sponsored by OMB including an agency portal used to submit data to OMB, a suite of analytical tools, and collaboration tools for agencies to share and work together with other community members towards common federal goals.

Statement of Budgetary Resources (SBR) – The statement and related disclosures provide information about budgetary resources and their use, as well as their status at the end of the period.

Statement of Changes in Net Position (SCNP) – The statement and related disclosures that report the changes in net position during the reporting period.

Statement of Net Cost (SNC) –This statement and related disclosures present the components of the net cost of the reporting entity’s operations for the period.

U.S. Standard General Ledger – Provides a uniform chart of accounts and technical guidance for standardizing federal agency accounting.

0104 Roles and Responsibilities

Secretary of Veterans Affairs is responsible for signing the management statement of assurance, management representation letter and Agency Head message.

Under Secretaries, Assistant Secretaries, Other Key Officials, Administration and Staff Office CFOs, and Fiscal Officers are responsible for ensuring compliance with the policies outlined in this chapter.

Assistant Secretary for Management/Chief Financial Officer (VA CFO) is responsible for overseeing all VA’s financial management activities, certifying VA’s annual accounting records, signing management representation letters, and coordinating with external financial auditors.

Administration and Staff Office CFOs are responsible for assisting and cooperating with the VA CFO to carry out VA’s financial reporting responsibilities and for signing the management representation letter.

Financial Services Center (FSC) is responsible for providing operational support of VA’s accounting system to prepare and produce financial statements.

Office of the Inspector General (OIG) is responsible for conducting an audit of the Department’s financial statements or contracting with external financial auditors to perform the audit.

Office of Financial Reporting (OFR) is responsible for preparing and submitting VA’s financial statements and related financial information in accordance with the laws and regulations of the United States Government. OFR ensures proper accounting, reporting, and consolidation of data.

Office of Financial Audit (OFA) is responsible for coordinating and supporting the financial statement audit process between the OIG, Administrations and Staff Offices, and the independent auditors. OFA is the principal audit liaison responsible for remediating financial statement audit findings and coordinating business process improvements and related internal controls.

Office of Enterprise Integration (OEI) is responsible for collecting, organizing, and reporting Department-wide performance results.

0105 Policies

010501 General Policies

- As an executive agency, VA is required to prepare and submit its audited financial statements, interim financial statements, and Agency Financial Report (AFR) in accordance with Office of Management and Budget (OMB) Circular A-136, Financial Reporting Requirements – Revised; Generally Accepted Accounting Principles (GAAP) promulgated by the Federal Accounting Standards Advisory Board (FASAB); U.S. Standard General Ledger (USSGL); and other applicable authoritative guidance.

- VA management is responsible for the fair presentation of the Department’s financial statements, which includes ensuring compliance with the GAAP hierarchy.

- VA will adhere to all financial reporting requirements including the financial management instructions and guidance within the Treasury Financial Manual (TFM) Volume I Federal Agencies.

- VA will present financial information using a core set of values and principles necessary to support responsible financial reporting. Those principles include accuracy, timeliness, relevance, reliability, auditability, consistency, comparability, and understandability.

- Each VA Administration and Staff Office will maintain documentation for all recorded transactions. The documentation must be readily available for review by VA, auditors, and other entities with oversight responsibility.

- Each VA Administration and Staff Office will adhere to the records retention policy as directed by the National Archives and Records Administration’s Records Schedule in support of the financial information presented in its financial reports.

010502 Financial Reporting Requirements

- VA will prepare its financial statements in accordance with OMB Circular A-136.

- VA will prepare the following financial statements and related disclosures:

- Balance Sheet;

- Statement of Net Cost (SNC);

- Statement of Changes in Net Position (SCNP); and

- Statement of Budgetary Resources (SBR).

- VA will comply with external reporting requirements from OMB, Treasury and GAO.

- VA will prepare and submit monthly adjusted trial balances via Treasury’s Governmentwide Treasury Account Symbol Adjusted Trial Balance System (GTAS)in accordance with the most recent TFM Volume I, Supplements – USSGL.

- To ensure accuracy of financial data, Administration Fiscal Staff and CFOs will perform thorough research of the key factors causing significant variances on individual line items on the principal financial statements and provide explanations for those variances.

- Facility Directors of VISNs and Stations will certify annual accounting records and submit a certification to VHA in accordance with OFR accounting certification letter due dates. See examples in Appendix G: Annual Certification of Accounting Records for VISN and Appendix H: Annual Certification of Accounting Records for Stations.

- CFOs will submit quarterly and annual certifications to OFR for review (see Appendix B: Administration CFO Quarterly Financial Statements Certification and Appendix C: Administration CFO Year-End Financial Statements Certification)

- Administration CFO certifications address areas such as:

- MinX trial balance;

- Accuracy of Intra-governmental trading partner information recorded in the MinX;

- Adequate documentation and analysis of significant variances;

- Consistency and the effects of significant changes in accounting classifications or other concepts;

- Appropriately reviewed and approved journal vouchers ;

- The accuracy and completeness of the financial statements; and

- Compliance of the quarterly and annual financial statements with applicable accounting standards and OMB circular A-136.

- OFR will review the Administration CFO certifications to ensure compliance with the memorandum requirements. Review of exceptions to the certification will include steps such as:

- Identification of issues;

- Review of specific underlying causes; and

- Clarification and resolution of potential issues.

010503 Periodic Financial Reporting Closing Process

- OFR will develop and distribute comprehensive quarterly and fiscal year-end closing schedules. The closing schedules will identify tasks, responsible offices, and timelines. Financial reporting related stakeholders throughout the Department will adhere to the schedules to ensure that their financial reporting process is completed timely. See Appendix D: Example Tasks in FY 2022 Year-end Closing Schedule.

- Adjusting entries will be posted, as needed, to generate accurate Adjusted Trial Balances (ATBs) for financial statements preparation. Adjusting entries include but are not limited to intragovernmental eliminations, accruals, actuarial assumptions, and estimates. Examples of different types of adjusting entries are presented below:

- Accruals/Payroll – Entries specific to accrued expense and payroll, e.g., entries to record annual leave and accrual adjustments;

- Financial Presentation – Entries made to financial statement line items, e.g., entries to record offsetting receipts, to conform with Treasury’s reclassified crosswalks, and to eliminate intragovernmental activities;

- Timing Differences – Entries made to account for data not available at period-end, e.g., entries to record cash adjustments to reconcile with the Treasury system, prior year Federal Employees’ Compensation Act (FECA) actuarial expenses adjustment, and the Judgment Fund imputed costs and also the accrual related to legal contingencies;

- System Limitations – Entries necessary to account for VA system limitations, e.g., entries used to true-up Canteen Service ledgers for monthly close and properly record transactions with Trading Partners;

- Audit Adjustments – Auditor requested adjustments; and

- Other – One-time entries that do not belong to the above categories.

- VA will perform a year-end process for its accounting system in accordance with the annual closing schedule and instructions that closes all prior year nominal budgetary and proprietary account records reflected in the general ledger and to prepare the system for the up-coming year’s activities.

- FSC’s Financial Accounting Service (FAS) will coordinate with VA Administrations and Staff Offices on annual close activities. See examples in Appendix E: FSC-FAS FMS Annual Close Memorandum Example and Appendix F: FSC-FAS iFAMS Annual Close Memorandum.

- Stations within administrations will adhere to the given deadlines to record transactions in the accounting system prior to fiscal year-end.

- The annual close team will record significant adjustments requested by the stations after appropriate approval is received from Assistant Fiscal Officer or Administration CFO.

- Stations at the end of the fiscal year will close out accounts and certify accounting records to the Administration CFOs in accordance with Administration instructions. See Appendix G: Sample of Annual Certification of Accounting Records for Stations.

010504 Agency Financial Report

- The AFR will provide an overview of the financial and performance data to help Congress, the President, and the public assess VA’s stewardship over the resources entrusted to the agency.

- Pursuant to the Reports Consolidation Act of 2000, a transmittal letter from the Agency Head must be included in the AFR or PAR and include:

- An assessment by the agency head of the completeness and reliability of the performance and financial data used in the report;

- Any material inadequacies in the completeness and reliability of the data, and the actions the agency can take and is taking to resolve such inadequacies; and

- The letter should describe any material weaknesses in internal control and actions the agency is taking to resolve the weaknesses.

- VA will prepare and submit its AFR in accordance with OMB Circular A-136. The AFR contains the following sections:

- Management’s Discussions and Analysis (MD&A) should address VA’s:

- Context for the financial information in the MD&A;

- Analysis of financial statements;

- Analysis of systems, controls, and legal compliance; and

- Forward-looking information

- Financial Section – This section incorporates several components, such as:

- VA’s financial statements;

- Notes to financial statements;

- Required Supplementary Information (RSI);

- OIG Transmittal Letter; and

- Auditor’s Report.

- Other Information (OI) – This section contains different types of OI that are pertinent to VA’s mission and financial activities such as:

- Summary of financial statement Audit and management assurances;

- Management and Performance Challenges;

- Payment Integrity Information Act Reporting;

- Civil Monetary Penalty Adjustment for Inflation;

- Grants Program;

- Other Agency-specific Statutorily Required Reports and

- Climate-related financial risk.

- Management’s Discussions and Analysis (MD&A) should address VA’s:

- OFR will obtain from OEI performance information as required by OMB. OEI will prepare the performance information in a way that will meet OMB and external (Association of Government Accountants, Certificate of Excellence in Accountability Reporting) review requirements.

- OFR will create and maintain VA’s financial statement and footnote disclosure standard operating procedures internally to guide the statement production process.

- OFR will produce the AFR and will coordinate all information, staff support, and procedural documentation required to meet the AFR filing deadline.

- OFR will create a timeline of activities necessary to produce and distribute the ARF in a timely manner. See Appendix I: Example of AFR/MRL Critical Deadlines.

- OFR will coordinate approval of the final AFR by each Administration and Staff Office CFO.

- VA will comply with OMB Circular A-136 requirements and submit the AFR to the following groups and organizations:

- Congress;

- The Director of OMB and Treasury;

- GAO;

- Speaker of the House of Representatives;

- President and President pro tempore of the Senate;

- Chair and ranking minority members of the Senate Committee on Homeland Security and Government Affairs;

- House Committee on Oversight and Reform;

- Chair and ranking minority members of the Budget committees; and

- Relevant authorization and oversight committees and appropriations subcommittees.

- VA will in accordance with OMB Circular A-136 and TFM Volume I will prepare and submit consolidated interim and annual financial statements, disclosures, and required supplementary information (RSI) to OMB (through OMB MAX), Treasury’s Bureau of Fiscal Service, and the Government Accountability Office (GAO).

- OFR will coordinate with the Office of Information Technology (OIT) to make the AFR publicly available on VA’s website with a hyperlink included on the agency homepage.

010505 Audit of Financial Statements and Subsequent Activities

- OIG will perform an audit of VA’s consolidated financial statements or contract with external financial auditors to perform the audit as required by the Chief Financial Officers Act of 1990.

- VA CFO and Administration and Staff Office CFOs will fully cooperate with OIG and the external financial auditors during the audit of the VA’s consolidated financial statements.

- VA will comply with the requirements and guidance from GAO Financial Audit Manual (FAM) Section 500, TFM Chapter 4700, and the latest OMB Bulletin ‘Audit Requirements for Federal Financial Statements,’ to develop a Legal Representation Letter (LRL) for the external financial auditors, GAO, Treasury Fiscal Service, and the Department of Justice. OFR will coordinate the preparation and signature processes associated with the LRL. See Appendix J: FY 2022 Legal Representation Letter Schedule.

- To comply with GAO FAM, 280.03 and the latest OMB Bulletin ‘Audit Requirements for Federal Financial Statements,’ VA will provide Management Representation Letters (MRLs) to OIG and the external financial auditors. The written representations from management should be submitted as soon as they are available but no later than when the audited financial statements are due. OFR will coordinate and prepare a schedule for the preparation and signature processes associated with the MRLs. See Appendix H: Example of AFR/MRL critical deadlines.

- Administration and Staff Office CFOs will inform OFA of their organization’s Audit Office Liaison and Alternate Audit Office Liaison contacts, and direct Alternate Audit Liaison to serve as Audit Liaison when needed.

- To ensure complete, accurate and timely communication with the auditors, OFA will serve as the chief Audit Liaison for VA. To this end OFA will:

- Lead and coordinate meetings with auditors and program offices to resolve any significant audit and accounting issues that may arise during the audit.

- Lead and conduct regular monthly audit status meetings with auditors, OIG, and VA stakeholders to assess the findings and their implications.

- Maintain a centralized repository to store and archive data related to ”Provided By Client” (PBC) requests from the external financial auditors. The repository should include the PBC requests, responsible party, due date, date submitted, date accepted, responses to the PBC requests, and approvals of the responses.

- Notify the appropriate Administration/Staff Office Audit Liaisons of each audit request and delivery timeline and manage production status against due dates to ensure responses are delivered in a timely fashion.

- Facilitate remediation of audit findings with VA stakeholders, to include the review, coordination, and provision of responses to auditors’ notice of findings and recommendations and auditors’ draft report.

- Develop and monitor corrective action plans that address the root cause of/and remediate deficiencies, improve business practices, and internal controls.

- Administration/Staff Office Audit Liaisons will provide, review, and approve responses to auditors’ inquiries in a timely, accurate and complete manner.

0106 Authorities and References

- United States Code (U.S.C.)

- Accountability of Tax Dollars Act of 2002

- Chief Financial Officers Act of 1990, Public Law 101-576

- Federal Financial Management Improvement Act of 1996, Public Law 104-208, Title VIII

- Federal Managers Financial Integrity Act of 1982, Public Law 97-255

- GAO Financial Audit Manual

- Government Management Reform Act of 1994, Public Law 103-356

- Government Performance and Results Modernization Act of 2010, Public Law 111-352

- National Archives General Records Schedules (GRS)

- OMB Circulars

- OMB Circular A-11, Preparation, Submission, and Execution of the Budget

- OMB Circular A-50, Audit Follow Up

- OMB Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control

- OMB Circular A-134, Financial Accounting Principles and Standards

- OMB Circular A-136, Financial Reporting Requirements – Revised

- OMB Bulletin, Audit Requirements for Federal Financial Statements

- TFM Volume I Federal Agencies

- TFM Volume I Supplements

- Treasury’s GTAS Information Portal

- Treasury’s USSGL Information Portal

- Statement of Federal Financial Accounting Concepts (SFFAC)

- SFFAC 1: Objectives of Federal Financial Reporting

- SFFAC 2: Entity and Display

- SFFAC 3: Management’s Discussion and Analysis

- SFFAC 4: Intended Audience and Qualitative Characteristics for the Consolidated Financial Report of the United States Government

- SFFAC 5: Definitions of Elements and Basic Recognition Criteria for Accrual-Basis Financial Statements

- SFFAC 6: Distinguishing Basic Information, Required Supplementary Information, and Other Accompanying Information

- SFFAC 7: Measurement of the Elements of Accrual-Basis Financial Statements in Periods After Initial Recording

- SFFAC 8: Federal Financial Reporting

- Statement of Federal Financial Accounting Standards (SFFAS)

- SFFAS 15: Management’s Discussions and Analysis

- SFFAS 24: Selected Standards for the Consolidated Financial Report of the United States Government

- SFFAS 34: The Hierarchy of Generally Accepted Accounting Principles, Including the Application of Standards Issued by the Financial Accounting Standards Board

0107 Rescissions

Volume VII, Chapter 1 – Financial Statement Reporting, July 2024.

Appendix A: Previous Policy Revisions

| Section | Revision | Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Appendices D and E | Update Obligations reference | OFP | Volume and chapter number changed | July 2024 |

| Overall | Full policy update | OFP | To align with current laws and regulations | September 2023 |

| 0103 | Update to definitions | OFP | Consistent with and aligned to OFP precedence | September 2023 |

| 010504 | Add transmittal letter as part of required content of the AFR submission | OFP | Required under 31 U.S.C § 3516(e) | September 2023 |

| Appendices | All appendices updated for most current reporting period | OFP | Relevancy to current period reporting | September 2023 |

| Appendix E | Added FSC Financial Accounting Service (FAS) iFAMS Annual Close Memo | OFP | VA Offices transitioned to new iFAMS accounting system | September 2023 |

| Appendix H | AFR and MRL critical deadlines and milestones combined | OFP | Deadlines presented in single format for FY23 tracking purposes | September 2023 |

| 010504 | Removed reference to Required Supplementary Stewardship Information (RSSI). | OFP | RSSI requirement was eliminated by SFFAS 57. | June 2021 |

| Rescissions | Added Volume II, Chapter 7 – Required Supplementary Stewardship Information, and Volume VII, Chapter 4 – Agency Closing Package. | OFP | RSSI requirement was eliminated by SFFAS 57 and Treasury reporting requirements have changed. | June 2021 |

| Appendix E | Removed reference to GFRS. | OFP | Treasury reporting requirements changed. | June 2021 |

| 0105 Policies | Added additional references to FASAB guidance on reporting | OFP) | Properly reflect VA’s current reporting and disclosure requirements | June 2019 |

| Appendix C and D | Added appendices providing guidance on disclosures for related parties and P3 | OFP | Publication of SFFAS 47 and 49 | June 2019 |

| All | New chapter | OFP | Created a comprehensive financial reporting policy that consolidates eight individual chapters | October 2018 |

Appendix B: Administration CFO Quarterly Financial Statements Certification

Department of Veterans Affairs Memorandum

Date: Month XX, 20XX

From: Administration Chief Financial Officer

Subj: FY 20XX QTR X Financial Statement Certification

To: Office of Financial Reporting (047GB)

- The following representations are made in connection with the preparation of the Department of Veterans Affairs consolidated financial statements and analytics for the period ended Month XX, 20XX.

- The MINX trial balances of the funds under my purview accurately recorded the underlying transactions and reflect accurate account balances. We continue to research and refine processes around obligations and accruals.

- The intra-governmental trading partner information recorded in the MINX trial balance is accurate and in conformance with Treasury Financial Manual Bulletin No 2011-4, and the Financial Services Center continues to research and reconcile material differences with trading partners.

- The quarterly financial statements produced from MINX are supported by adequate documentation and analysis of significant variances.

- The quarterly financial statements are prepared on a consistent basis from period to period. Where significant changes are made in accounting classifications or other concepts underlying them that significantly impair comparability, the effects of the changes will be disclosed.

- Exceptions to this certification are described on the attached Exceptions document.

- The accounting system’s journal vouchers equal to or greater than $100 million have been appropriately reviewed and approved.

- I confirm, to the best of my knowledge and belief, that I am satisfied that these statements are accurate, complete, and comply to the extent applicable with OMB Circular A-136, Financial Reporting Requirements, and the U.S. Department of the Treasury and the Department of Veterans Affairs financial policies and related procedures.

Name Date

Appendix C: Administration CFO Year-End Financial Statements Certification

Department of Veterans Affairs Memorandum

Date: Sept XX, 20XX

From: Administration Chief Financial Officer

Subj: FY 20XX QTR 4 Financial Statement Certification

To: Office of Financial Reporting (047GB)

- The following representations are made in connection with the preparation of the Department of Veterans Affairs consolidated financial statements and analytics for the period ended September 30, 20XX.

- The MINX trial balances of the funds under my purview accurately recorded the underlying transactions and reflect accurate account balances. We continue to research and refine processes around obligations and accruals.

- The intra-governmental trading partner information recorded in the MINX trial balance is accurate and in conformance with Treasury Financial Manual Bulletin No 2011-4, and the Financial Services Center continues to research and reconcile material differences with trading partners.

- The quarterly financial statements produced from MINX are supported by adequate documentation and analysis of significant variances.

- The quarterly financial statements are prepared on a consistent basis from period to period. Where significant changes are made in accounting classifications or other concepts underlying them that significantly impair comparability, the effects of the changes will be disclosed.

- Exceptions to this certification are described on the attached Exceptions document.

- The accounting system’s journal vouchers equal to or greater than $100 million have been appropriately reviewed and approved.

- I confirm, to the best of my knowledge and belief, that I am satisfied that these statements are accurate, complete, and comply to the extent applicable with OMB Circular A-136, Financial Reporting Requirements, and the U.S. Department of the Treasury and the Department of Veterans Affairs financial policies and related procedures.

Name and Title Date

Appendix D: Example Tasks in FY 2022 Year-end Closing Schedule

The schedule is revised annually according to updated requirements and deadlines.

| Task # | Description of Item | Due from (POC – Name) | Due to (POC – Name) | Target Completion Date |

|---|---|---|---|---|

| 1 | Release draft closing schedule to the Administrations | FRS Deputy Director – Tony DeNicolis | VACO OFR CLOSE Schedule – Various | 8/29/2022 |

| 2 | Administrations submit suggested changes to draft closing schedule | VACO OFR CLOSE Schedule – Various | FRS Deputy Director – Tony DeNicolis | 9/6/2022 |

| 3 | Release FINAL closing schedule | FRS Deputy Director – Tony DeNicolis | VACO OFR CLOSE Schedule – Various | 9/9/2022 |

| 4 | Annual Treasury Account Symbol (TAS) Rollover Process to confirm FY22 TAS’s needed in FY23 (Admins provide data 9/2) | FRS – Victoria Pittman / Hien Dang | Treasury – baasgroup@fiscal .treasury.gov | 9/9/2022 |

| 5 | Completed research on SFFAS 47 Related Parties (for year-end disclosure) (initiated 8/1/22 per Q3 Closing Schedule) | FRS – Victoria Pittman | VHA / OAEM – Nate Pennington / Nick Kryiakidis / Bayla Gewirtz / Clinton Ricks | 9/9/2022 |

| 6 | Similar to Q3, request Q4 ESPC and UESC data + information (to include new agreements, updates, payments made, etc.) to record P3 JV (Due 9/23) | FRS – Victoria Pittman | VHA / OAEM – Nate Pennington / Nick Kyriakidis / Bayla Gewirtz / Clinton Ricks | 9/9/2022 |

| 7 | Request Lease payment schedules used to prepare the information contained in FS Note 16 Leases, for Direct and GSA Leases; plus EUL data. (due 10/3) | FRS – Victoria Pittman | OAEM – Sherrene Dugar / Nikki Zook | 9/9/2022 |

| 8 | Request Reports for the Capital Contribution, Private Sector Investment for EUL Projects, and EUL report showing number of ‘operational’ and ‘active but not yet operational’ EULs as of end of Sep 2022 (for the EUL P3 footnote+Note 16 Leases (Due 10/3) | FRS – Annie Park | OAEM – C.J. Cordova (Cynthia) / Aaron Pierce | 9/9/2022 |

| 9 | Unasserted Claims data call from FRS to CFOs (for period from 7/1/22 to 9/30/22) (due date 9/30) | FRS – Amy Chen | Administrations – Admin CFOs | 9/15/2022 |

| 10 | Submit Reappropriations for Recurring Expenses Transformational Fund (X.1124) reappropriation-CARS(Q4 only) | FRS – Hien Dang | Treasury – CARS | 9/15/2022 |

Appendix E: FSC-FAS FMS Annual Close Memorandum

FSC Chief Accounting Office (CAO)

FY 2024

FMS Annual Close Memo

Enclosed is FY 24 annual close information for FMS. Please review and take note of important dates and action items.

I. FY 24 FMS ANNUAL CLOSE ACTIVITY SCHEDULE

- 9/05/24 – FMS Call

- 9/12/24 – FMS Call

- 9/13/24 – Payroll input to FMS for PP17 (Accounting Period 12/24)

- 9/14/24 – FMS daily reports are available

- 9/15/24 – FMS daily reports are available

- 9/17/24 – September System Payroll Accruals input to FMS (view in FMS 9/18/24)

- 9/19/24 – FMS Call

- 9/21/24 – FMS daily reports are available

- 9/22/24 – FMS daily reports are available

- 9/23/24 – Last day for FASPAC related interface activity (see item II.B for IPAC/G-Invoicing details)

- 9/24/24 – Last day for payments using canceling funds expired as of BFY 19 (see item II.C)

- 9/25/24 – Charge Card System (CCS) transactions for US Bank invoice billings submitted 9/24 will be recorded in FMS (can be viewed in FMS on 9/26/24)

- 9/26/24 – FMS Call

- 9/26/24 – CCS interface to FMS is held throughout annual close

- 9/26/24 – Last day for station input of EB transactions in FMS (see item II.D)

- 9/26/24 – Last day for station input of Reimbursable Agreements in FMS (see item II.E)

- 9/26/24 – Last day for FSC staff other than Annual Close Team to process any type of transactions into FMS (see item II. F.1)

- 9/26/24 – VBA interfaces VALERI, CPTS (WEBLGY), CAATS and CWINRS will continue throughout annual close. A CAATS schedule with more specific information will be released separately and is based upon this annual close memo (see item II.F.2)

- 9/27/24 – FSC interfaces to FMS are held (see item II.F.2 for exceptions)

- 9/27/24 – Payroll input to FMS for PP18 (Accounting Period 12/24) but will be posted earlier if the DFAS files are available

- 9/28/24 – FMS daily reports are available

- 9/29/24 – FMS daily reports are available

- 9/30/24 – Last day for all other station input into FMS (see item II.H)

- FMS on-line processing will end at 8:30 PM ET

- The first DMI/IFCAP interface to FMS will process at 8:35 PM ET

- The final DMI/IFCAP interface to FMS will process at 10:00 PM ET

- AITC recommends a 9:00 PM ET deadline to process IFCAP transactions to ensure they are picked up on the final DMI interface to FMS

- All interfaces with the exception of FSC interfaces will take place as well as normal end of month processing

- 10/01/24 – FMS DOWN – no interfaces will process into FMS

- 10/01/24 – FY 24 Period 13 FMS Adjustments coordinated through VHA, VBA, NCA, etc. and processed by the Annual Close team (see item II.K)

- 10/02/24 – Period 13 Trial Balances and reports available

FRS – The FY tables in FRS will be available as follows:

FY24 Period 12 data available 10/1/24

FY24 Period 13 data available 10/2/24

FY25 Period 01 data available 10/3/24

- 10/02/24 – FMS DOWN – no interfaces will process in FMS

- 10/03/24 – FMS DOWN – no interfaces will process in FMS (if needed)

- 10/04/24 – FMS DOWN – no interfaces will process in FMS (if needed)

- 10/05/24 – FMS available for FY 25 activity. All interfaces, including FSC interfaces, will resume on the first business day after the down time

- 10/05/24 – September Accruals Reversed (Accounting Period 01/25)

- 10/07/24 – CCS transactions for invoice billings submitted for 9/26/24-10/05/24 begin recording in FMS (Accounting Period 01/25)

- 10/07/24 – FMS reports and FMS tables with beginning balances (i.e., F852 and GLTS) will display a zero amount in the beginning balance column until after the final FMS annual close processing later in October (see II. M)

- 10/10/24 – FMS Call

- 10/11/24 – Payroll scheduled for input to FMS for PP19 but could possibly be delayed

- 10/19/24 – FMS down for Period 14, 15 and 00 annual close processing

- 10/20/24 – FMS down for Period 14, 15 and 00 annual close processing

- 10/21/24 – FMS down for Period 14, 15 and 00 annual close processing (if needed)

- 10/21/24 – Period 14, 15 and 00 Trial Balances available

- 10/22/24 – FMS up for FY 25 Activity (Accounting Period 01/25)

- 10/25/24 – Payroll input to FMS for PP20 but could possibly be delayed

Accounting Period Definitions

Period 12 – accounting period for the month of September. This period is closed during the nightly cycle on the night of September 30.

Period 13 – accounting period for adjustments on October 1st. This period is open only to the annual close team members. Material adjustments requested by field stations with approval from VACO program offices and selected annual close processing list adjustments are completed during this period. Trial balances from Period 13 are used for annual certification letters.

Period 14 – accounting period for financial reporting adjustments in mid to late October. This period is only open to select members of the annual close team.

Period 15 – accounting period for annual close. General ledger accounts like those used for revenue and expense are closed for the fiscal year based on the settings in the FMS YACT table.

Period 00 – accounting period for beginning of the new fiscal year. Trial balances for this period show the opening balances in FMS for the new fiscal year.

II. TO COMPLETE FMS PROCESSING FOR FY 24, THE FOLLOWING SCHEDULE IS PROVIDED AS A GUIDE FOR INPUT OF TRANSACTIONS:

- Annual Close Review

- Review outstanding obligations to determine if they meet the requirements of an obligation as defined in OFP Volume III, Chapter 2 Chapter 02 – Obligations – Financial Policy Documents (va.gov). Estimated obligations are to be adjusted (increased or decreased) accordingly.

- Review FMS suspense file (SUSF) for documents, which are in HELD or REJECTED status. Make corrections and resubmit or delete the documents. Do not delete documents generated by interfaces to FMS (e.g., CC, CB, TM, etc).

- Ensure transactions affecting unobligated balances, such as payroll accruals, adjustments, obligation of purchase orders, PCS obligations, adjustments of 1358, etc., are processed.

- In reviewing available unobligated balances, ensure sufficient funds are available to cover the balances in general ledger 1321 (Accounts Receivable Refunds – Non-Federal). An automated FMS process will post SV transactions to charge available funding for the amount in GL 1321 as of 9/30. Any abnormal credit balances in GL 1321 must be corrected prior to 9/30 for the SV transaction to post correctly.

- An automated process to move BFYs 20 – 24 Tricare and Shared Medical Resources bills to BFY 25 will take place as part of annual close processing. Only Revenue Source Codes for Shared Medical Resources and for Tricare are affected. These transactions should not be reversed because Public Law 104-262 allows funds to remain in the current budget fiscal year.

- Review and adjust the allowance for bad debts balance established in AMAF for public receivables in appropriated funds (0152, 0160, 0161, 0162, etc). These SV accrual transactions should be set to not reverse.

- September 23, 2024 is the last day for FASPAC (VA initiated IPACs) related interface activity and the last day to record performance and adjustments in G-Invoicing. September 26, 2024 is the last day for FASFED (Other Government Agency initiated IPACs)/G-Invoicing activity to post in FMS. To ensure timely processing it is recommended that IPAC/G-Invoicing activity be submitted at least 5 business days before the end of the year. Questions pertaining to FASPAC, IPAC and G-Invoicingcan be submitted to VAFSCIPACProcessing@va.gov.

- September 24, 2024 is the last day payments can be made for appropriations expired as of the end of BFY 19 (i.e. 368/90169, 3690160, 368/90160, 368/90161, 3690169, 3690162, 3690152, 3690140, etc.). The scheduled payment date must be the same date the payment voucher is processed and can be updated manually on UPVT. Payments with a scheduled date after September 24, 2024, will be cancelled.

- September 26, 2024 is the last day for Station input of any EB transactions in FMS.

- September 26, 2024 is the last day for Station input of reimbursable agreements in FMS. Ensure all reimbursable agreements with open balances on the CALT/CAHT are decreased, collected, or a bill of collection is established for the open balance. A bill of collection must reference the agreement.

-

- After September 26, 2024, FSC staff will be restricted from processing documents into FMS. The intent is to eliminate documents which would adversely affect FY 24 funds for the stations.

- The last FSC interfaces for the fiscal year will process in FMS during the night of September 26, 2024. Beginning September 27, 2024 the interfaces will be held for the rest of September. Examples of held FSC interfaces include: IPPS, Prime Vendor Subsistence EDI; CX files and Concur. Non-FSC interfaces including: IFCAP and CAATS will continue to process.

Special Note: Interfaces for Community Care payments will process through September 27 and will be held beginning September 28 until FMS is online for the new fiscal year.

-

- Stations can continue to process payment transactions via IFCAP, CAATS, or FMS directly through September 30, 2024. Only FSC generated payment transactions will be held. Stations should be mindful of other interfaces still generating transactions in FMS and budget accordingly for these transactions and any potential interest payments.

- Scheduled payments during the potential FMS down period will be accelerated. Payments for October 1st, October 2nd, October 3rd, and October 4th, will be accelerated to pay by September 30th. Payments for October 21st, October 22nd, and October 23rd will be accelerated to pay by October 18th.

- September 30, 2024 is the last day to process transactions affecting accounting period 12 for September 2024 business. Transactions should NOT be input in FMS with a reversal period of 13/24.

- Annual and multi-year appropriations expired as of the end of BFY 19 (includes 18/19) will close/cancel as part of the FY 24 Annual Close Process. Review ALL outstanding subsidiary records for validity.

- Travel Obligations MUST be reversed manually.

- Advances MUST be collected, written off, or reclassified as receivables if valid.

- Non-Travel Obligations/Payables will be automatically reversed as part of the annual close process. Payable balances will be recorded in the AMAF fund to general ledger 296A or 296B.

- Receivables should be reviewed for validity. The annual close process will automatically close the open receivables in BFY 19 and create the receivable using the same document number in Base BFY 99 Fund 36 3200 with a BD 09 transaction. Review GL 4221, clear balances in all funds with closing BFY 19.

- Work in Process (general ledger 1720 and GL 1832) must be reviewed and closed or moved as appropriate.

- General ledger 2130 obligations are to be cleared, and holdbacks released prior to 09/24/24.

- Payroll Accruals

- MANUAL PAYROLL ACCRUALS MUST HAVE A REVERSAL PERIOD OF 01/25.

- Payroll accrual adjustments for the September accrual period require special effort. To ensure accuracy, request Fiscal Officers to review payroll accruals.

- The number of business days in the system for the September 2024 payroll accrual is SIX workdays (September 23 – 27 and September 30).

- On October 1, 2024, material corrections to adjust the September 2024 Trial Balance should be coordinated with the respective office (VHA, VBA, NCA, etc.) for approval. VHA, VBA, NCA, etc. will contact the Annual Close staff to process the corrections.

IMPORTANT NOTES:

Stations are required to ensure all JV requests are signed and maintain sufficient documentation to defend the validity of any period 13 transaction. The JV approver must be the appropriate approving level and by signing understands they are certifying the JV is appropriate for period 13, documented for auditing purposes, and they are ultimately responsible for their submission. The JV must include all information that is required to process the document, e.g., BFY, Fund, Vendor code, Transaction code, Transaction type, Increase or Decrease, etc. as well as GL debits and credits. As well as a statement as to why it is appropriate for period 13 processing. - Posting fixed asset depreciation is not part of the annual close process and will post at the end of the calendar month for September 2024 as usual.

- FMS reports and FMS tables with beginning balances (i.e., F852 and GLTS) will display a zero amount in the beginning balance column until after the FY closes completely later in October.

- SO documents having the accrual flag set to N in FMS will not accrue at the end of the year. Review your SO documents to ensure the validity of the accrual flag. Note: SO documents with equipment BOCs should have the accrual flag set to N.

Standardized SO documents should have the accrual flag set to Y unless the BOC is equipment. Ensure enough funds are obligated for all Standardized Obligations.

Government Printing Office and Capital Lease Obligations SO/MO should have the accrual flag set to N.

Prime Vendor Pharmacy SO documents should have the accrual flag set to Y.

For VBA:

SOs in the FMS fund 0137 for State Approving Agencies (SAA) should have an N in the Auto Accrual indicator.

SOs established in fund 0137C for the FY 19 VetSuccess Contract Counseling obligations should have an N in the Auto Accrual indicator.

SOs established in fund 0137W for the FY 19 VetSuccess Contract Counseling obligations should have a Y in the Auto Accrual indicator. Therefore, an accrual will be processed automatically in FMS for the remaining unpaid balance.

VBA Interfaces VALERI, CPTS (WEBLGY), CAATS and CWINRS interfaces will continue throughout annual close. A CAATS schedule with more specific information will be released separately and is based upon this annual close memo.

ATTENTION IFCAP USERS:

To ensure synchronization regarding prior year processing, IFCAP has an option called “Enter/Edit Date When SOs become ARs”. This option is found on the “FMS Documents Inquiry/Error Process” sub-menu of the “Funds Distribution Program Menu”. Field station personnel must manually input

September 30, 2024 in this date field. This field must be populated earlier than September 30 as IFCAP prohibits the entry of a prior date in this field. - Direct questions concerning annual close to FAS staff as follows:

| VISN/Organization | Nationwide Accountants | |

| Primary Stations: | Primary Accountant: | Alternative Accountant |

| VISNs: 05, 06, 07, 08, 12, 16, 17, 21 | Beatriz Herrera (512) 386-2144 | Wesley Hall (512) 386-0636 |

| VISNs: 01, 02, 04, 15, 19, 20, 23 | Wesley Hall (512) 386-0636 | Beatriz Herrera (512) 386-2144 |

| VISNs: 99, 09, 10, 22 | Rachel Maynez (512) 386-2412 & Kay Lana Tate (512) 460-5041 | Beatriz Herrera (512) 386-2144 |

| Payroll Reject Issues | Accountants | |

| Kimberly Hall (512) 386-2349 Lucia Hamill (512) 460-5183 William Somach (512) 541-9571 | ||

| Nationwide Accounting Team Email Account | VA Nationwide Accounting | |

| (We prefer all email communication be sent to our email group account.) | VAFSCNWAccounting@va.gov | |

| Chief, Accounting Systems Operations Division | Scott Jones | |

| James.Jones11@va.gov | ||

- The annual station certification letter is based on Accounting Period 13

- Certification letters for VHA must be uploaded to the appropriate FY 24 Annual CFO Certification folder.

- Certification letters for VBA should be sent to the Administrative and Loan Accounting Center (ALAC) per the Year-End VBA Letter.

- The NCA Finance Service will submit the certification letter to the cemetery station Director for signature and subsequent return to the NCA Finance Service. Certification memos are emailed to NCAFinance@va.gov.

Detailed instructions for these certifications are sent separately from the responsible offices.

III. CHIEF ACCOUNTING OFFICE (CAO) YEAR-END PAYMENT PROCESSING PLANS FOR CHARGE CARD SYSTEM (CCS), PRIME VENDOR PAYMENT SYSTEM, TRAVEL MANAGEMENT AND REJECTED PAYMENTS ARE AS FOLLOWS:

- CCS (PURCHASE) TRANSACTIONS

- CAO will follow these procedures in processing purchase card transactions for FY 24. On the night of Wednesday, September 25, 2024, Charge Card System (CCS) will record the obligation/expenditure transactions for the billings in FMS. These transactions will include invoice billings submitted to US Bank as of close of business September 24. FMS reports reflecting those postings will be available on September 26. This report, along with input from cardholders should be used to determine the unbilled purchases for September 25-30 to record the undelivered order. Obligation/expenditure transactions for the daily billings received beginning with charges for activity on September 25 will not be recorded in FMS until the system opens for FY 25. When the recording of these transactions’ resumes, the CCS will determine the proper appropriation year to be charged based on the purchase date provided by the merchant.

- The purchase card is to be used through the end of FY 24 and into FY 25 on a business-as-usual basis. There is no suspension on the use of the purchase card provided an appropriation or continuing resolution has been enacted for FY 24.

- Stations should compute their unbilled purchase and fleet card transactions for FY 24 and, depending on the appropriation or fund, process an SV CC document with a transaction date of 9/30 and an accounting period of 12/24. The SV CC document must have a reversal period of 01/25. To minimize the effort required for this step, the transaction may be established at summary cost center and BOC levels.

- Use the IFCAP “Accrual (Monthly)” menu option to record the year-end undelivered orders.

- Ensure there are funds obligated and accrued for outstanding convenience check amounts.

- Cost transfers made by VBA between fiscal year appropriations may be done using CAATS.

- Some VHA stations ask their IS/IRM to take action to keep Purchase Card ET transactions from hitting FMS at year end to aid in their unobligated balance reconciliation. For example, in some VISNs after the last file of charges are received and reconciled, the IS makes the VISTA option, Reconciliation and Edit/Remove Reconciliation, unavailable so no ET can be generated.

Cardholders are reminded they MUST determine if funds are available in the control point before using the purchase card. All purchase card payments with a post date of September 25, 2024, should be reconciled by September 30, 2024.

- PRIME VENDOR PROCESSING

Prime Vendor Pharmacy Charge Card (CD) transactions are held beginning September 26, 2024, like other charge card transactions. Prime Vendor EDI transactions will be held in conjunction with other FSC interfaces beginning on September 27, 2024. - TRAVEL MANAGEMENT

Travel Management Center (TM) Reject documents should be resolved prior to the end of the fiscal year for the field stations to maintain an accurate record of funds. TM Rejects cause differences between Treasury and VA accounting records and can result in findings on VA’s financial statement audit.

Field stations can research the SUSF table to determine if there are any TM transactions in held or reject status for their station. The instructions for scanning the SUSF table in FMS are in the FMS Field Station User’s Guide, page B-60. Do not delete TM rejects from SUSF. - REJECTED IPPS PAYMENTS

- During the period September 26 through September 30, 2024, FSC will contact Station Fiscal Offices concerning any critical FY 24 appropriation transactions increasing and decreasing Station’s unobligated balances by $100 or more.

- The last day for FSC to process rejects is September 26, 2024.

IV. FY24 Annual Close Checklist

Annual Close Item Accomplished

Memo Ref #

II. A. 1. Review outstanding obligations

II. A. 2. Review FMS table (SUSF) for held or rejected documents

II. A. 3. All documents affecting unobligated balances processed

II. A. 4. Available unobligated balances have sufficient funds to cover general ledger 1321

II. A. 5. BFYs 20 – 24 Tricare and Shared Medical Resources bills moved to BFY 25 are not reversed

II. A. 6. Review and adjust the allowance for bad debt

II. B. September 23, 2024, last day for FASPAC

II. C. September 24, 2024 – last day for payments from BFY 19 and BFY 18/19 appropriations

II. D. September 26, 2024, last day for EB transactions

II. E. September 26, 2024, last day for station input of reimbursable agreements in FMS.

II. F. 1. After September 26, 2024, FSC Staff restricted by system modifications from processing documents

II. F. 2. After September 27, 2024, FSC interfaces are held

II. G. 1. IFCAP and CAATS interfaces will continue through September 30, 2024.

II. G. 2. Scheduled payments will be accelerated.

II. H. September 30, 2024 – last day for station input, which affects September 2024 business

II. I. 1. BFY 19 and BFY 18/19 travel obligations are reversed

II. I. 2. BFY 19 and BFY 18/19 advances – collected, written off or reclassified

II. I. 3. BFY 19 and BFY 18/19 non-travel obligations and payables are reviewed

II. I. 4. BFY 19 and BFY 18/19 receivables are reviewed

II. I. 5. BFY 19 and BFY 18/19 work in process – review and take action

II. I. 6. BFY 19 and BFY 18/19 GL 2130 obligations cleared/holdbacks released prior to 09/24/24

II. J. 1. Manual payroll accruals have a reversal period of 01/25.

II. J. 2. Payroll accrual adjustments reviewed for accuracy

II. J. 3. September 2024 payroll accrual is six days

II. K. October 1, 2024 – coordinate September 2024 Trial Balance corrections with respective office (VBA, VHA, NCA, etc)

II. L. Fixed Asset depreciation will post at the end of calendar month

II. M. FMS reports and FMS tables with beginning balances will display zeros

II. N. Review accuracy of accrual flags for SO documents

II. O. Annual Close questions to FAS staff

II. P. Annual Station Certification letter is based on Accounting Period 13

III. A. 1. September 25, 2024, CCS will record the obligation/expenditure for the billings in FMS.

III. A. 2. Purchase cards are to be used through FY 24.

III. A.3. Process SVCC to record undelivered orders for unbilled purchase and fleet card transactions

III. C. Process TM rejects

Appendix F: FSC-FAS iFAMS Annual Close Memorandum

FSC Financial Accounting Service (FAS) FY 2024

iFAMS Annual Close Memo

I. FY24 ANNUAL CLOSE ACTIVITY SCHEDULE

- 9/13/24 – Payroll input to iFAMS for PP17 (Accounting Period 12/24)

- 9/24/24 – September system payroll accruals input to iFAMS.

- 9/24/24 – Last day for payments using canceling funds expired as of BFY 19 (see item II.B)

- 9/26/24 – Last day for organization (station) input of SEB transactions in iFAMS (see item II.C)

- 9/26/24 – Last day for FSC staff other than Annual Close Team to process any type of transactions into iFAMS (see item II.D1)

- 9/27/24 – FSC interfaces to iFAMS are held i.e. Concur, IPPS, US Bank, etc. (see item II.D2)

- 9/27/24 – Payroll scheduled for input to iFAMS for PP18 (Earlier if DFAS provides sooner)

- 9/30/24 – Last day for organization (station) input into iFAMS (see item II.F)

- iFAMS on-line processing will end at 11:59 PM CDT – Note: Administrations may impose earlier transaction submission deadlines.

- All interfaces except for FSC interfaces will take place as normal end of month processing.

- iFAMS/ eCMS integration is almost real-time but recommend a 11:00PM CDT deadline to process transactions in eCMS to ensure they are integrated into iFAMS for FY 24 business.

- 10/01/24 – iFAMS DOWN – no interfaces will process into iFAMS except for eCMS

- 10/01/24 – FY 24 Period 12 limited adjustment period from 7:00AM to 10:00AM CDT (time subject to change based on system availability). Input must be coordinated through VBA, NCA, OIT, etc.; specific instructions for requesting adjustments will be provided by the applicable administration.

- 10/02/24 – Period 12 Trial Balances and reports available.

- 10/02/24 – iFAMS DOWN – no interfaces will process in iFAMS except for eCMS

- 10/03/24 – iFAMS DOWN – no interfaces will process in iFAMS except for eCMS

- 10/04/24 – iFAMS DOWN – no interfaces will process in iFAMS except for eCMS

- 10/05/24 – iFAMS up for FY 25 activity (Accounting Period 01/25)

- 10/05/24 – All interfaces including FSC interfaces resume.

- 10/05/24 – September accruals reversed (Accounting Period 01/25)

- 10/05/24 – iFAMS reports and iFAMS tables with beginning balances will display a zero amount in the beginning balance column until after the FY closes completely in mid-November (see II. K)

- 10/05/24 – Concur catch up (travel authorizations, advances, and payments).

- 10/06/24 – Concur catch up (travel authorizations, advances, and payments).

- 10/11/24 – Travel authorizations, advances, and payment reject corrections resume.

- 11/8/24 – iFAMS down starting at 9PM CST for annual close processing

- 11/9/24 – iFAMS down for annual close processing

- 11/10/24 – iFAMS down for annual close processing

- 11/11/24 – iFAMS down for annual close processing

- 11/12/24 – iFAMS down for annual close processing

- 11/13/24 – Period 16 and 00 Trial Balances available

- 11/13/24 – iFAMS reopens for FY 25 activity (Accounting Period 02/25)

Accounting Period Definitions

Period 12 – accounting period for the month of September. This period closes on October 1st. Access to Period 12 on October 1st is limited to members of the annual close team and select Administration staff. Adjustments will only be input for valid FY 24 obligations that didn’t process in iFAMS on September 30th. Adjustment hours are 7:00AM to 10:00PM CDT (subject to change due to system availability). Field organizations (stations) must coordinate the input of obligations on October 1 through the applicable Administration. Period 12 trial balances are used for annual certification letters.

Period 13 – preclosing adjusting entries to support GTAS reporting. This period is open only to select FSC/OFR staff.

Period 14 – accounting period for audit adjustments and other reporting entries needed to finalize the financial statements. This period is only open to select FSC/OFR staff.

Period 15 – accounting period for annual close. Carryover will be recorded in this period.

Period 16– accounting period for annual close. Nominal general ledger accounts like revenue, expense, and other fiscal year based budgetary and proprietary accounts are closed for the fiscal year based on the settings in the iFAMS Year End Definitions Table.

Period 00 – accounting period for beginning of the new fiscal year. Trial balances for this period show the opening balances in iFAMS for the new fiscal year.

II. INSTRUCTIONS TO COMPLETE FY 24 PROCESSING

- Annual Close Review

- Review outstanding obligations to determine if they meet the requirements of an obligation as defined in OFP Volume III, Chapter 2 (Chapter 02 – Obligations – Financial Policy Documents (va.gov) ) Estimated obligations are to be adjusted (increased or decreased) accordingly.

- Review the iFAMS Unprocessed Document Report (E-GS01 in Power BI) to make corrections and submit or delete the documents. Do not delete documents generated by interfaces to iFAMS (e.g. PAI, PFI, PGI, PWI, etc.).

- Ensure transactions affecting unobligated balances, such as payroll accruals, adjustments, obligation of purchase orders, PCS obligations, etc., are processed.

- September 24, 2024 is the last day payments can be made for appropriations expired as of the end of BFY 19 (i.e. 3690151, 3690129, etc.). Payments must be scheduled to pay on or before September 24, 2024. Payments scheduled after September 24, 2024 will be cancelled.

- September 26, 2024 is the last day for Organization (station) input of any SEB transactions in iFAMS.

- FSC Processing and Interfaces

- After September 26, 2024, FSC staff will be restricted from processing documents into iFAMS with exception for processing payroll rejects, if needed. The intent is to eliminate documents which would adversely affect FY 24 funds for the organizations (stations).

- All interface transactions generated by the FSC will also be held after September 26, 2024. Examples of held FSC interfaces include: IPPS, US Bank, and Concur. Non-FSC interfaces will continue to process. The last day for G-Invoicing inbound and outbound integrations for Performance transactions (BRG, BMG, CIG, PIG) is Sept 27. G-Invoicing inbound integrations for GT&C and Orders (OAI) will continue through 9/30 to allow users to complete downstream OEG and EDG documents.

- Payments

- Organizations (stations) can continue to process payment transactions through September 30, 2024. Only FSC generated payment transactions will be held. Organizations (stations) should be mindful of other interfaces still generating transactions in iFAMS and budget accordingly for these transactions and any potential interest payments.

- Scheduled payments during the potential iFAMS down period will be accelerated. Payments for October 1st through October 4th will be accelerated to pay by September 30th. Payments for November 12th will be accelerated to pay by November 8th.

- September 30, 2024 is the last day to process transactions affecting accounting period 12 for September 2024 business, except for limited obligation adjustments on October 1st. Accrual transactions should be input in iFAMS with a reversal period of 01/25.

- Annual and multi-year appropriations expired as of the end of BFY 19 (includes BFY 19, BFY 18/19, and BFY 15/19) will close/cancel as part of the FY 24 Annual Close Process. Review ALL outstanding subsidiary records for validity.

- Travel Obligations MUST be reversed manually.

- Advances MUST be collected, written off, or reclassified as receivables if valid.

- Non-Travel Obligations/Payables should be reviewed for validity. Non-Valid payable must be manually reversed prior to annual close. Valid payables will be recorded in the appropriate C fund (3690120 to 0129CA, 3690151 to 0151CA, etc.) as part of the annual close process.

- Receivables should be reviewed for validity. The annual close process will automatically close the open receivables in BFY 19 and create the receivable using the same document number in Fund 36 3200.

- Work in Process (GL 17200001 and GL 18320001) must be reviewed and closed or moved as appropriate by 09/23/24.

- General ledger 21300001 obligations must be cleared, and holdbacks released prior to 09/23/24.

- Allowance for Loss on Accounts Receivable (GL 13190001) must be reviewed and cleared as appropriate.

- Payroll Accruals

- MANUAL PAYROLL ACCRUALS MUST HAVE A REVERSAL PERIOD OF 01/25.

- Payroll accrual adjustments for the September accrual period require special effort. Fiscal Officers should review payroll accruals to ensure accuracy.

- The number of business days in the system for the September 2024 payroll accrual is SIX workdays (September 23-27 and September 30).

- On October 1, 2024, any valid FY 24 obligations adjustments should be coordinated with the respective office (VBA, NCA, etc.) for approval. Refer to the instructions provided by the applicable administration for instructions on how to submit adjustments.

- Posting fixed asset depreciation is not part of the annual close process and will post at the end of the calendar month for September 2024 as usual.

- iFAMS reports and iFAMS tables with beginning balances will display a zero amount in the beginning balance column until after the FY closes completely in mid-November.

- Review the Unprocessed Documents Report (E-GS01 in Power BI) and correct and submit or delete unprocessed documents prior to September 30. Any remaining unprocessed documents for FY 24 may be deleted prior to annual close processing.

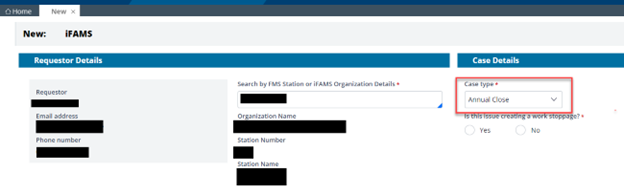

- Direct questions concerning annual close to iFAMS Service staff using the following options:

- Send an email to VAFSCiFAMSTier1NAS@va.gov.

- Submit a CRM ticket at Self Service Portal (va.gov) with a Case type of Annual Close.

- The annual organization (station) certification letter is based on Accounting Period 12.

- Certification letters for VBA should be sent to the Administrative and Loan Accounting Center (ALAC) per the Year-End VBA Letter.

- The NCA Finance Service will submit the certification letter to the cemetery organization (station) Director for signature and subsequent return to the NCA Finance Service. Certification memos are emailed to NCAFinance@va.gov.

- Detailed instructions for these certifications are sent separately from the responsible offices.

- During the period September 27 through September 30, 2024, FSC will contact Organization (station) Fiscal Offices concerning any critical FY 24 appropriation transactions increasing or decreasing organization’s (station’s) unobligated balances by $100 or more.

- Reimbursable Agreements

- For any agreements with end date of 9/30/24 or sooner, Target 100% spending by September 10th, 2024. If this date is not met, there is a risk for the agreement to be reduced. If the full funding is not anticipated to be executed, then users must modify the agreement to reduce the anticipated execution.

- Validate agreement END DATE, BILL CYCLE, and SCHEDULE.

III. FINANCIAL ACCOUNTING SERVICE (FAS) YEAR-END PAYMENT PROCESSING PLANS FOR US BANK, TRAVEL MANAGEMENT AND REJECTED PAYMENTS ARE AS FOLLOWS:

- US BANK (PURCHASE) TRANSACTIONS

- The US Bank interface will run through 9/26/24. It will be held along with other FSC interfaces on 9/27/24 and 9/30/24.

- The purchase card is to be used through the end of FY 24 and into FY 25 on a business-as-usual basis. There is no suspension on the use of the purchase card provided an appropriation or continuing resolution has been enacted for FY 25.

Cardholders are reminded they MUST determine if funds are available before using the purchase card.

- TRAVEL MANAGEMENT

Travel Management Center (PFI) Reject documents should be resolved prior to the end of the fiscal year for the field organizations (stations) to maintain an accurate record of funds. PFI Rejects cause differences between Treasury and VA accounting records and can result in findings on VA’s financial statement audit.

Field organizations (stations) can review the Unprocessed Documents Report to determine if there are any unprocessed PFI transactions for their organization (station) and work with the FSC travel team to resolve them. Do not delete PFI rejects. - IPPS PAYMENTS

- The last day for FSC to process through IPPS is September 26, 2024.

Appendix G: Annual Certification of Accounting Records for VISN

Appendix H: Annual Certification of Accounting Records for Stations

Appendix I: Example of AFR/MRL Critical Deadlines

Enclosed is an example from FY 2023. The AFR Critical Deadline is revised annually according to updated requirements’ deadlines.

Link to Example of AFR/MRL Critical Deadlines

Appendix J: FY 2022 Legal Representation Letter Schedule

Enclosed is an example from FY 2022. The schedule is revised annually according to updated requirements and deadlines.

Link to Example FY 2022 Legal Representation Letter Schedule.