Volume XVI - Charge Card Programs

Chapter 02A – Government Travel Card Individually Billed Accounts

Questions concerning this policy chapter should be directed to:

- Veterans Health Administration

- Veterans Benefits Administration

- Home | Salesforce

- For emergency only OPERATIONS.VBACO@va.gov

- National Cemetery Administration

- VACO IT Travel / Travel Card Support

- All Others

0201 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies regarding the issuance and use of a Government travel card individually billed account (IBA).

Key points covered in this chapter:

- VA will adhere to the requirements contained in:

- 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), Government Travel Charge Card Program; and

- Office of Management and Budget (OMB) Circular A-123 Appendix B, Revised 2019.

- Cardholders are required to use the IBA travel card to pay for all official travel expenses (41 C.F.R., Subtitle F, Federal Travel Regulations (FTR) § 301-51.7);

- An IBA travel card’s total outstanding balance of non-disputed charges must be paid by the statement due date, regardless of whether travel expenses have been reimbursed;

- Standard IBA travel card credit limits will be lowered to $1 when the account has had no activity for six months and restricted IBA travel card credit limits will be kept at $1 when the traveler is not in travel status;

- IBA cash credit limits are set at $0, unless an advance is authorized via a Travel Authorization (TA);

- Cardholders are required to notify their Level 4 Agency/Organization Program Coordinator (A/OPC) before commencing travel activities when transferring within, or when separating from VA; and

- IBA cardholders who are delinquent or misuse their travel card may be subject to disciplinary and/or administrative actions.

Under 5 U.S.C. § 406 (Inspector General Act of 1978 – PL 95-452), VA Office of Inspector General (VA OIG) employees will adhere to travel directives, policies, procedures, and guidance provided by VA OIG.

Union rights and privileges related to travel expenses, as defined in Union agreements, do not supersede the regulations contained in FTR Chapters 300 – 304.

0202 Revisions

| Section | Revision | Requesting Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| All | Rescinded previous Volume XVI, Chapter 2 – Government Travel Charge Card Program, creating three new chapters on IBAs (Ch. 2A), Centrally Billed Accounts (Ch. 2B), and A/OPC program management (Ch. 2C). | Office of Financial Policy | Full Review, Leadership organizational change | May 2024 |

| Various | Updated policy in accordance with5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries) and OMB Circular A-123, Appendix B, Revised 2019 | Office of Financial Policy | 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B, Revised 2019. | May 2024 |

| 020505 | Updated policy on the current application process, adding Appendix B, and eliminated the use of VA Form 0868, Credit Worthiness Evaluation. | Office of Financial Policy | Contracted bank change in the application process and Leadership directed for operational efficiency. | May 2024 |

| 020509 | Updated policy on weekly cash credit limits. | Office of Financial Policy | FSC NewsFlash FY 23, Issue 18. | May 2024 |

| 020513 | Added Section on Violations of Policy including 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), OMB guidance, and FSC administrative actions. | Office of Financial Policy | 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), and OMB Circular A-123, Appendix B, Revised 2019. | May 2024 |

| Appendix A | Added procedures for travel card reinstatement. | Office of Financial Policy | Provide new FSC guidance. | May 2024 |

| Appendix C | Added Split Disbursement procedures. | Office of Financial Policy | To reduce cardholder delinquency. | May 2024 |

0203 Definitions

Agency/Organization Program Coordinator (A/OPC) – An appointed employee serving as the point of contact and administrator for an organization’s travel cards. The A/OPC oversees the administration of the Government Travel Card Program in accordance with law, regulation, and policy.

Approving Official (AO) – A VA travel system role with the authority to approve travel documents.

Centrally Billed Account (CBA) – A travel card/account established by the contracted bank at the request of the agency/organization. These may be card or cardless accounts.

Charge – A debit value transaction posted to a Government travel card account resulting in an amount due and payable.

Declined Transaction – An action that the contracted bank may take when a Government travel card is used, usually due to insufficient funds, but may result from a condition where the merchant is blocked by VA, the contracted bank has flagged the account for fraud or potential fraud, or the account is closed.

Delinquency – A debt on which payment is overdue more than 45-days from the statement date on which the charges first appeared.

Disposable Pay – The part of pay remaining after the deduction of any amount required by law is withheld. Required deductions do not include discretionary deductions such as health insurance, savings bonds, charitable contributions, etc. Deductions may be made from basic, special, and incentive pay.

Disputed Charge – A charge that the cardholder believes is erroneous that has or will be disputed with the contracted bank.

Electronic Access System (EAS) – The charge card servicing bank’s internet-based system which provides a variety of reports and assists in the effective management of the travel card program.

Federal Travel Regulations (FTR) – The FTR provides travel and relocation regulations for all Title 5 Executive Agency employees.

Individually Billed Account (IBA) – A Government contractor-issued travel charge card issued to authorized individuals to pay for official travel and transportation-related expenses for which the contracted bank bills the employee, and for which the individual is fully liable.

Merchant Category Code (MCC) – A 4-digit code used to classify a business by the type of goods or services it provides.

Misuse – Use of a Government travel card in an unauthorized, illegal, or adverse manner (e.g., unauthorized cash advances, purchase of unofficial/personal expenses, or use not incident to official travel).

Official Travel – Travel under an official travel authorization (TA) to and from an employee’s official station or other authorized points of departure and a temporary duty location, travel between two temporary duty locations, or relocation at the direction of a Federal agency (FTR § 300-3.1, Official Travel).

Permanent Closure – Cancellation of an IBA by the contracted bank or VA.

Salary Offset – The process of deducting from a VA employee’s disposable pay the maximum allowable amount of the undisputed outstanding balance the employee owes to the contracted bank as a result of delinquency on their IBA.

Split Disbursement – A process in VA’s travel system allowing a travel reimbursement payment to be split between the Traveler and the contracted bank.

Suspension – Short-term prevention of a cardholder’s use of their IBA, by the contracted bank after the account is 60 calendar days delinquent on payment.

Temporary Closure – Short-term prevention of a cardholder’s use of their IBA, by an A/OPC.

Temporary Duty Travel (TDY) – Travel by an employee on official business to a designated location(s) away from their local area, as authorized by an employee’s AO through a TA.

Travel Advance – Pre-payment of authorized estimated travel expenses paid to an employee in the form of electronic funds transfer (EFT).

Travel Card (Government Travel Charge Card) – A method for Federal agencies and their employees to make payments for official Government travel-related expenses. There are three types of travel card accounts available under the GSA SmartPay Master Contract: Individually Billed Accounts (IBA) Centrally Billed Accounts (CBA), and Single-Use CBA (VA currently does not authorize the use of Single-Use CBAs).

Travel Management Center (TMC) – A common carrier travel firm, under contract with VA’s travel system contractor, providing reservations, tickets, and related travel management services for VA Travelers on authorized official travel.

0204 Roles and Responsibilities

Assistant Secretary for Management/Chief Financial Officer (ASM/CFO) has been delegated the authority from the Secretary, Department of Veterans’ Affairs (SECVA) to grant exemptions on the mandatory use of Government travel charge cards.

Financial Services Center (FSC) is responsible for performing operational, management, and oversight activities related to travel cards. FSC is responsible for increasing IBA credit limits for Continuity of Operations Plan (COOP) for emergency deployments. Executive Director, FSC, will determine when a violation of regulation or policy warrants referral to VA OIG or Federal prosecutors for criminal investigation.

Level 1 A/OPCs are responsible for the overall management of the IBA program, authorizing reinstatement of a cardholder’s closed account due to misuse or delinquency.

Level 2 A/OPCs are responsible for determining if reinstatement of an IBA, closed due to misuse or delinquency is appropriate.

Level 4 A/OPCs are responsible for the day-to-day management and oversight of IBAs assigned under their organization, initiating salary offsets and investigating potential policy violations, as well as reporting corrective actions to the next higher-level A/OPC.

Supervisors are responsible for:

- Ensuring their employees who travel obtain a Government IBA, unless exempt;

- Approving employee applications and appropriate IBA reinstatement requests; and

- Initiating appropriate administrative action with their local Human Resources office, and consulting with FSC on the closure of an employee IBA or removal of an employee as a Government Charge Card Program participant due to policy violations.

Employees are responsible for:

- Obtaining an IBA to pay for all authorized official travel expenses unless exempt;

- Managing their IBAs;

- Abiding by the rules and regulations of the cardmember agreement with the contracted bank;

- Appropriate use of their IBA;

- Ensuring the balance of undisputed charges owed on their IBA will be paid to their account in the travel claim by the statement due date;

- Reporting actual or possible violations of law when they have knowledge or information or suspect criminal activity (e.g., fraud); and

- Responding to oversight inquiries by the date requested.

0205 Policies

020501 Mandatory Use of Individually Billed Accounts

- In accordance with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), and Federal Travel Regulations (FTR) § 301-51.1, Government travel cards will be used to pay official Government travel expenses, unless an FTR § 301-51.3 or VA exemption applies (FTR § 301-51.4).

- Supervisors will ensure all eligible VA employees traveling more than two times per year (FTR § 301-51.4) obtain an IBA travel card and activate the account within 60 days of receipt (FTR § 301-51.1).

- IBAs not activated within 60-days of receipt will be closed by the cardholder’s Level 4 Agency/Organization Program Coordinator (A/OPC) (FTR § 301-70-708).

- VA employee participants in VHA’s Pathways Programs, Summer Jobs Programs, and Internship Programs may be issued a restricted IBA when authorized by their supervisor.

020502 Exemptions on Mandatory Use Requirements of Individually Billed Accounts

- FTR § 301-51.2, exempts employees from the mandatory use of the IBA to pay for official travel expenses where use is not practical (e.g., the vendor does not accept credit cards) or imposes unreasonable burdens or costs.

- FTR § 301-51.3, exempts employees (including Invitational Travelers per FTR § 301-1.2) from the mandatory requirement to obtain and use an IBA for all authorized official travel expenses, when:

- They have an application pending for an IBA travel card;

- Use would adversely affect the mission or put themselves at risk; or

- They are not eligible to receive a Government IBA travel card.

- VA will only issue an IBA to Federal employees. In accordance with FTR § 301-1.2 an “employee” is:

- An individual employed by an agency, regardless of status or rank; or

- An individual employed intermittently in Government service as an expert or consultant and paid on a daily when-actually-employed (WAE) basis; or

- An individual serving without pay or at $1 a year (also referred to as “invitational traveler”).

- In accordance with Office of Management and Budget (OMB) Circular A-123, Appendix B, Revised 2019, foreign nationals are not eligible to hold individually-billed travel charge cards issued by Federal agencies, as they are not Federal employees.

- Employees are not eligible to be issued an IBA if their IBA was canceled due to misuse or delinquency, unless reinstatement is determined to be appropriate by their Level 2 A/OPC and authorized by VA’s Level 1 A/OPC (refer to Appendix A).

- In accordance with FTR §§ 301-51.4 and 301-70.701, SECVA has designated the Assistant Secretary for Management/Chief Financial Officer (ASM/CFO) with the authority to exempt any person, type or class of personnel, payment, or type or class of payments, if the exemption is determined to be necessary for VA’s interest, or where use is not practical or in the best interest of the Government. In accordance with FTR § 301-70.702, upon exercising this authority the SECVA or designee is responsible for notifying the Administrator of General Services of exemptions granted.

- FTR § 301-51.4, VA exempts the following classes of employees from the mandatory use of an IBA:

- Employees who travel two times a year or less are exempt from the requirement to obtain an IBA but may be issued an IBA if requested (FTR § 301-51.5);

- Employees performing separation travel upon retirement since it is in the best interest of VA to require IBAs to be closed as part of VA’s separation procedures; and

- Employees traveling to or in an area where the political, financial, or communication infrastructure does not support the use of the IBA (e.g., certain foreign countries or emergency response areas).

- Invitational Travelers are exempt from being required to obtain and use an IBA unless the inviting organization determines the frequency of travel warrants issuance. Refer to Volume XIV, Chapter 1 – Travel Administration for policy on authorizing Invitational Travelers a travel advance (refer to FTR § 301-71.300).

- In accordance with FTR § 301-51.6, VA employees who have an FTR or VA exemption on the mandatory requirement to obtain or use an IBA may pay for official travel expenses:

- Using personal funds;

- By obtaining a travel advance (refer to Volume XIV, Chapter 1 – Travel Administration); and/or

- Using their organization’s CBA to pay for authorized common carrier and lodging expenses.

020503 Training Requirements

- OMB Circular A-123, Appendix B, Revised 2019, requires initial and periodic refresher travel card training for all employees with an IBA.

- IBA applicants must complete VA 5508, “VA Online Travel Card Training” course, available in VA’s Talent Management System (TMS), and provide a copy of the training certificate to their Level 4 A/OPC before an IBA application will be processed. If the travel cardholder is an A/OPC, their training certificate must be provided to the next higher-level A/OPC in their organization.

- IBA cardholders are required to retake VA 5508, “VA Online Travel Card Training” every three years and to provide a certificate of completion to their Level 4 A/OPC.

- Failure to complete required refresher training will result in the temporary closure of an IBA.

020504 Statement of Understanding for Government Individually Billed Account Travel Card Cardholder

- Upon completion of the initial “VA Online Travel Card Training”, employees applying for an IBA are required to read and initial all statements on VA Form 0933A, Statement of Understanding for Government Travel Card Individually Billed Account Cardholder, then sign and date the form.

- OMB Circular A-123, Appendix B, Revised 2019, requires program participants to certify that they have received training, understand the regulations and procedures, and are aware of the consequences of inappropriate actions. This certification is accomplished using VA Form 0933A which is completed by the applicant and approved by their supervisor prior to the issuance of an IBA.

- The position authorizing an Invitational Traveler to be issued an IBA is required to sign and date VA Form 0933A.

020505 Individually Billed Account Application

- To initiate an application for an IBA the employee (including Invitational Travelers) must provide to their Level 4 A/OPC the information and documentation required in Appendix B and follow the procedures provided.

- The Level 4 A/OPC will determine the applicant’s eligibility. If eligible, the Level 4 A/OPC will sign and date VA Form 0933A and initiate the application process in the contracted bank’s Electronic Access System (EAS).

- IBA applications require the applicant to either allow or decline the contracted bank to complete a credit check.

- Credit information obtained by the contracted bank may contain the applicant’s credit score. The contracted bank’s credit check will not adversely impact the applicant’s credit score.

- A credit score rating of 660 or above will result in the issuance of a standard IBA.

- A restricted IBA will be issued if:

- A credit score rating is below 660;

- A valid credit score cannot be obtained; or

- The applicant refuses to have a credit check performed by the contracted bank.

020506 Management of Standard and Restricted Individually Billed Account Credit Limits

- Standard IBAs will be issued with a credit limit of $5,000 and a cash advance limit of $0. To reduce the potential for fraud or misuse, the credit limit will be reduced to $1 after six months of inactivity. This reduction will only occur when the cardholder is not actively on travel or pending imminent travel.

- Standard cardholders will be notified should an A/OPC reduce their IBA credit limit to $1.

- COOP employee’s standard IBA credit limit will not be reduced to $1 due to inactivity.

- A COOP employee’s restricted IBA credit limit will be set to $1 when not on travel. In the event of a COOP deployment, FSC will be responsible for ensuring COOP restricted IBAs affected have their credit limits raised.

- Restricted IBAs will be issued with a credit limit of $1 and a cash advance limit of $0. A restricted IBA’s credit limit will be kept at $1 whenever the cardholder is not on authorized travel.

- An IBA standard or restricted credit limit will be increased five business days in advance of the travel start date unless the cardholder notifies the Level 4 A/OPC of a need for advance charges.

- Cardholders will be notified of all changes to their credit limit. The notice from the A/OPC will include the date the credit limit was or will be increased and the amount of the credit limit.

- Cardholders who have requested credit limit increases are required to notify their Level 4 A/OPC of any change in the expected travel dates or if the scheduled travel was canceled so their Level 4 A/OPC can either disregard the request or reset the credit limits to the value before they were raised.

- For authorized Relocation (permanent change of station (PCS) or temporary change of station (TCS)), an IBA may only be used for authorized house hunting (HH) and/or en-route official travel expenses.

- Before using their IBA for PCS HH travel expenses, the Traveler must provide their current Level 4 A/OPC with a copy of their approved PCS HH TA.

020507 Cardholder Requirements

- Upon receipt of a new or re-issued IBA, cardholders must ensure their VA travel system user profile “Credit Card Information” reflects their current IBA information. The IBA information present in their profile when a TA is created, will be used to guarantee lodging and/or rental car reservations.

- The IBA information in the user profile at the time a travel claim. or local travel claim is created, will be used for remitting the split disbursement payment to the contracted bank.

- New cardholders may complete a user profile for their IBA with the contracted bank’s EAS. Registering will provide access to current account information and actions (e.g., current balance, recent transactions, credit limit, available credit balance, recent account statements, making an online payment, or setting up fraud alerts on the account). Contact your Level 4 A/OPC for current EAS set-up procedures.

- Upon receipt of a re-issued IBA, cardholders must ensure their existing user profile information in the contracted bank’s EAS is correct.

- Cardholders are required to notify their Level 4 A/OPC (or higher-level A/OPC) when a change to their account information occurs (i.e., official billing address, other contact information, or the cardholder’s reporting organization changes).

- Cardholders are required to secure their IBA in a safe location when not on authorized travel. It is recommended that cardholders only carry their travel card when on authorized travel.

- Cardholders are required to notify the Level 4 A/OPC and the contracted bank immediately when a card has been lost or stolen or upon identification of a potential fraudulent charge.

- Cardholders must determine their IBA is ready for use before commencing travel.

- Cardholders requiring a credit limit increase must notify their organization’s Level 4 A/OPC before commencing travel activities.

- Cardholders authorized for a cash advance must request their Level 4 A/OPC increase their cash credit limit.

- Standard and Restricted cardholders must notify their Level 4 A/OPC when they have multiple, long term TDY, or relocation travel, to ensure their credit limit needs will be met. Reference Volume XVI, Chapter 2C – Government Travel Card Program Management for guidance on A/OPC management of limit increases.

- Cardholders whose travel is related to a detail, en-route relocation, or is transferring to a new organization within VA must request their Level 4 A/OPC coordinate moving their IBA under the detail or new organization’s Level 4 A/OPC for management and oversight. When the detail has been completed (e.g., the last travel claim has been approved and payment has been posted to their IBA), the cardholder must notify their official station’s Level 4 A/OPC to take the appropriate actions to transfer the IBA back under their management and oversight.

- When a new or existing IBA cardholder volunteers as either a Disaster Emergency Medical Personnel System (DEMPS) or COOP member, or ceases to be a member, they are required to notify their Level 4 A/OPC.

- Cardholders are required to respond timely to any A/OPC oversight inquiry on an IBA charge by providing the information or available documentation requested. Failure to respond timely to requests for information will result in the applicable IBA credit limit being reduced to $1. This reduction will only occur when the cardholder is not actively on travel or pending imminent travel.

- Cardholders are required to notify their Level 4 A/OPC if a purchase or cash advance transaction has been declined when using their IBA.

- Cardholders are required to notify their organization’s CBA Level 4 A/OPC of any unused restricted tickets purchased.

- In accordance with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), cardholders shall ensure that, where appropriate, travel card payments are issued directly to the travel card-issuing bank for credit to the employee’s individual travel card account (refer to Appendix C).

- Cardholders must ensure amounts due are paid by the statement due date even if their claim has not yet been approved or was submitted and approved with an insufficient split disbursement amount to cover the balance owed.

- Cardholders are required to review each monthly billing statement upon receipt to:

- Determine the validity of posted charges;

- Identify invalid charges so they can be disputed with the contracted bank;

- Determine if there are any delayed charges (e.g., rental car toll charges);

- Ensure that payments made through split disbursement or directly with the contracted bank have been posted; and

- Verify that the balance owed on non-disputed charges has been paid in full and is not past due.

- In accordance with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), VA will ensure that the travel charge card of each employee who ceases to be employed by the agency is invalidated immediately upon termination of the employment of the employee. The cardholder must ensure their IBA has a $0 balance before requesting clearance from their Level 4 A/OPC.

- When a cardholder’s IBA has been suspended or closed their organization’s CBA may be used to pay for lodging and common carrier transportation (refer to Volume XVI, Chapter 2B – Government Travel Card Centrally Billed Accounts).

020508 Appropriate Use of an Individually Billed Account Travel Card

- Cardholders will only use their IBA in accordance with VA policy and the FTR.

- Appropriate charges to an IBA while on TDY include, but are not limited to, the following types of authorized expenses:

- An authorized cash advance, which may be taken no earlier than five calendar days in advance of the travel;

- Hotel/Lodging, and related non-exempt taxes;

- Meals and incidental expenses (M&IE);

- Ground transportation; and

- other miscellaneous expenses.

- When a lodging facility requires a deposit to secure a room reservation, and other lodging alternatives are unavailable or do not meet mission requirements, an IBA may be used. When the payment of an advance lodging deposit will be due to the contract bank before the Traveler will be reimbursed for travel expenses, the advance lodging deposit may be paid using their organization’s CBA. Reference Volume XVI, Chapter 2B – Government Travel Card Centrally Billed Accounts for guidance on payment of lodging using the CBA.

- Emergency-type expenses incident to official TDY travel (e.g., retail purchases such as clothing due to lost luggage or damaged clothing), may be charged to the IBA when authorized by their supervisor. Before using an IBA to make retail purchases, cardholders must coordinate with their A/OPC to temporarily add the merchant category for the store where the retail purchases will be made . Authorized retail purchases should be limited based on mission requirements. Personal expenses may not be reimbursed (General Services Board of Contract Appeals 16058-TRAV).

- Travelers may use their IBA to charge gasoline for their privately owned vehicle (POV) official travel expenses; however, the cost of gasoline is not a reimbursable expense, as the cost for gasoline is included in the “mileage allowance” amount claimed for the use of a POV. Gasoline charges should only occur within the authorized official travel dates and may not be charged on the IBA for any personal portion of travel when performed in conjunction with TDY.

- Appropriate charges to an IBA while on local travel include, but are not limited to, the following types of authorized expenses:

- Taxis;

- Tolls;

- Local transit;

- Parking;

- Rental car;

- Gasoline purchases for authorized rental car or POV use for official travel only; and

- Lodging and/or meals only when supported by a legal authority (refer to Volume XIV Travel, Chapter 7 – Local Travel for guidance on Government Employee Training Act (GETA) 5 U.S.C. § 4109, or occasional meals at non-VA meetings under 5 U.S.C. § 4110).

020509 Authorization of Cash Advances

- In accordance with FSC NewsFlash FY 23, Issue 18, all IBA cards will have a cash credit limit of $0.

- An Approving Official (AO) may authorize an IBA cash advance when one of the following exemptions are specified in the TA:

- Use is not practical (e.g., the vendor does not accept credit cards) or imposes unreasonable burdens or costs (FTR § 301-51.2); or

- The employee is traveling to or in an area where the political, financial, or communication infrastructure does not support the use of the IBA (e.g., certain foreign countries or emergency response areas).

- When on extended TDY a weekly IBA cash advance may be authorized.

- Should an unanticipated need arise for an IBA cash advance while in travel status contact travelcardops@va.gov. If the need for assistance is immediate call FSC VA-Wide TDY Travel Support at 866-533-0188 (select Option 1).

- IBA cash advances can be obtained either at an ATM or over the counter at a bank.

- FTR § 301-12.1, allows for the reimbursement of ATM or bank fees charged for authorized IBA cash withdrawal(s).

- When authorized, an IBA cash advance may be taken no sooner than five calendar days before the scheduled travel start date.

- Cardholders must not request or use an IBA cash advance, nor may an AO authorize a cash advance, to serve as a travel reimbursement instead of filing a claim.

- AOs will not authorize an IBA cash advance for local travel.

- Cardholders authorized to take an IBA cash advance to pay for specific expense(s) cannot then charge those expenses to the IBA instead of using the advance to pay for the expense.

- A cardholder’s IBA cash credit limit will be reduced back to $0 upon completion of the travel episode, without notice from their Level 4 A/OPC.

- An AO may only authorize an electronic funds transfer (EFT) travel advance instead of an IBA cash advance on a TA for a cardholder when:

- The amount of anticipated cash needed cannot reasonably be met by authorizing one IBA cash withdrawal per week (e.g., the amount needed exceeds the contracted bank’s weekly cash credit limit); or

- Use of the IBA will be unavailable upon reaching the TDY location.

- When authorizing an EFT travel advance the AO must ensure that once the TA has been approved sufficient time exists before commencing travel for the cardholder to receive the EFT.

- Cash advance fees using personal debit/credit cards are a personal expense and are not reimbursable.

- When conducting official international travel:

- Foreign currency may be obtained from an ATM or at a bank at the TDY location using the IBA if the cash advance was authorized in advance.

- Foreign currency transactions will be converted to US dollars using the conversion rate at the time the transaction was processed.

- A currency exchange fee (the charge for converting U.S. dollars into local currency) may be charged to your account or may appear on a separate statement. In accordance with FTR § 301-12.1, VA may authorize reimbursement of necessary currency exchange fees.

020510 Account Actions and Fees

- Contracted bank fees charged for cardholder non-payment will not be reimbursed by VA.

- The contracted bank may charge a fee when a payment has been returned due to non-sufficient funds (NSF). The NSF fee for a dishonored payment will not be reimbursed by VA. The cardholder must pay the NSF fee directly to the contracted bank using personal funds.

- The contract bank may close an account due to two episodes of NSF within a 12-month period.

- An account that has been suspended twice during 12 months for non-payment of undisputed principal and has become 120 days delinquent may be closed by the contracted bank or FSC.

- When an employee’s IBA has been closed due to NSF payment(s) or non-payment, the employee may request to be reinstated as an IBA cardholder only when the closed account has been paid in full. For guidance on reinstatement refer to Appendix A, Travel Card Reinstatement Procedures.

- When the amount paid to the contracted bank exceeds the balance on the account, a credit will exist on the account. The contracted bank will automatically issue an account credit refund once six months have occurred with no new charges posted. Cardholders should not leave credit balances remaining on IBAs for extended periods. A credit balance should be cleared as follows:

- Use the credit to offset anticipated upcoming travel charges within the next three months; or

- Contact the contracted bank and request a refund check be sent.

- The contracted bank will only send a requested refund to the official billing address on the account.

020511 Disputing Invalid Charges

- When a billing error from a vendor is found on the cardholder’s statement, the cardholder must first contact the vendor and attempt to resolve the matter.

- When the cardholder cannot resolve a billing error directly with a vendor, the cardholder must contact the contracted bank, and notify their Level 4 A/OPC of the need to dispute the charge.

- When fraud is suspected, the cardholder must immediately contact the contracted bank and notify their Level 4 A/OPC of the fraudulent charge.

- For disputed charges, the contracted bank may require the cardholder to enter the dispute using the contracted bank’s EAS or submit a signed, “Cardholder Statement of Questioned Item” form to the contracted bank within 90-days of the disputed charge’s transaction date as it appears on the cardholder’s statement. Once the dispute has been submitted, the contracted bank will issue a temporary credit to the cardholder’s account while the disputed charge(s) is being researched. While the contracted bank conducts this investigation, the cardholder will not be required to pay the amount of the disputed charge and it will not be treated as past due.

- The cardholder must notify their Level 4 A/OPC when a disputed charge is submitted to the contracted bank.

020512 Account Delinquency and Salary Offset

- Failure of a cardholder to comply with the payment terms of the Cardholder Agreement can result in the account becoming past due or delinquent. An unpaid account will become past due 30-days after the billing date of the statement on which the charge(s) first appeared. The following list identifies the subsequent changes to an IBA account status should it continue to remain unpaid beyond the 45-day delinquent period:

- 60-days – the account is suspended;

- 90-days – the account remains suspended, and the cardholder will receive a Salary Offset Letter from their Level 4 A/OPC indicating intent to collect from disposable pay the unpaid balance owed on the cardholder’s account if the account remains unpaid 120-days;

- 120-days – salary offset is initiated, and the contracted bank changes the account status to pre-cancellation or will cancel the account if within 12 months the account has been suspended twice for non-payment of undisputed principal;

- 126-days – the account is canceled;

- 150-days – the account remains canceled, but if the past due amount is paid in full between 150 and 179-days, the cardholder may request reinstatement of the account following the guidance in Appendix A; and

- 180-days – The account is charged off and the contracted bank will report the delinquency to credit bureaus and may refer the account for collection if salary offset has not been initiated.

- For more detailed information on the specific actions the contracted bank and/or the Level 4 A/OPC will take based on the aging of a past-due account, see Volume XVI, Chapter 2C – Government Travel Card Program Management.

- The contracted bank reserves the right to report adverse credit information to national credit bureaus on cardholder accounts exceeding 126-days past due. Adverse credit reporting on severely delinquent accounts can have a long-lasting negative effect on the cardholder’s ability to obtain personal credit and may adversely affect cardholders with security clearances.

- Should the contracted bank refer an account for collection, it may charge the cardholder collection costs, court costs, and allocated costs for attorneys, not to exceed 25 percent of the account balance.

- The cardholder’s supervisor will determine whether disciplinary action is appropriate.

020513 Misuse and Violations of Policy

- Misuse of an IBA travel card includes but is not limited to paying:

- Training, registration or conference fees as these fees must be paid using a Government issued Purchase Card;

- Official expenses for other employees (e.g., transportation, lodging, shared lodging, meal expenses or group meals);

- Unauthorized rental car refueling charges (e.g., prepaid gasoline), global positioning system expense, a toll transponder activation fee;

- Personal expenses (i.e., unauthorized expenses for the cardholder, family, or friends) such as:

- Upgrades to other-than-coach travel for personal reasons;

- Optional hotel fees (e.g., spa or exercise room fees, movie rentals);

- Lodging portion attributable to another other person when sharing a hotel room based on a double occupancy rate; or

- Meals for family or friends;

- Personal liability insurance for an authorized official rental vehicle (the U.S. Government is self-insured);

- Government-furnished automobile expenses (e.g., gasoline, repairs, and maintenance) require payment to be made using the vehicle’s assigned Fleet Charge Card (refer to Volume XVI, Chapter 3 – Fleet Charge Card);

- For retail purchases, except when authorized due to mission requirements (e.g., lost luggage);

- For gift or debit cards, or to reload existing cards (examples include, but are not limited to, store brand debit or loyalty cards, Starbucks card, Target “My REDcard”, and Amex/Wal-Mart “Bluebird” cards;

- Admission fees for entertainment (e.g., a performance, movie theatre, museum);

- Personal household expenses (e.g., rent, utilities, pet expenses, groceries en-route home from TDY); or

- Personal travel expenses, whether in conjunction with TDY or not.

- Any VA employees with knowledge or information about actual or possible violations of law concerning the use of an IBA must report the violation (refer to 38 Code of Federal Regulations, Chapter 1, PART 1 – General Provisions, §1.201). Employees may choose to report a violation to their supervisor, FSC via email to VAFSCChrgCardReview@va.gov, or directly to VA OIG via the “VA OIG Hotline website”.

- In accordance with 5 U.S.C. § 5701, (Statutory Notes and Related Subsidiaries), VA shall provide for appropriate adverse personnel actions to be imposed in cases in which employees of the executive agency fail to comply with applicable travel charge card terms and conditions or applicable agency regulations or commit fraud with respect to a travel charge card, including removal in appropriate cases.

- In accordance with 5 U.S.C. § 5701 (Statutory Notes and Related Subsidiaries), VA shall establish guidelines and procedures for disciplinary actions to be taken against agency personnel for improper, fraudulent, or abusive use of Government charge cards, which shall include appropriate disciplinary actions for use of charge cards for purposes, and at establishments, that are inconsistent with the official business of the Department or agency or with applicable standards of conduct.

- In accordance with OMB Circular, A-123, Appendix B, Revised 2019, VA will ensure effective controls are in place to mitigate the risk of internal fraud, misuse and delinquency. Circumstances surrounding each case of card misuse, abuse and/or fraud must be considered when determining the proper type of corrective or disciplinary action, if any, which may be imposed.

- Supervisors, consulting with local Human Resource Office personnel, will consider a range of appropriate adverse personnel actions, including removal. Refer to VA Handbook 5021, Employee-Management Relations, for policy guidance on disciplinary personnel actions.

- Administrative penalties may also be taken, see table of administrative actions in Volume XVI, Chapter 2C – Government Travel Card Program Management.

- IBA cardholders who violate FTR or VA policy may be referred by Executive Director, FSC, to VA OIG for criminal investigation.

0206 Authorities and References

- United States Code (U.S.C.)

- Code of Federal Regulations (C.F.R.)

- General Services Board of Contract Appeals 16058-TRAV

- Office of Management and Budget, Circular A-123, Appendix B, Revised 2019

- Cardholder Statement of Questioned Item Form

- Electronic Access System (EAS)

- FSC NewsFlash FY23, Issue 18 – Automated Teller Machine (ATM) Cash Withdrawals on Individually Billed Account (IBA) Travel Cards

- Talent Management System

- US Bank Access Online website

- VA Financial Policy Publications

- VA Handbook 5021, Employee/Management Relations

- VA Form 0933A, Statement of Understanding for Government Travel Card Individually Billed Account Cardholder

- VA OIG Hotline website

0207 Rescissions

- Volume XVI, Chapter 2 – Government Travel Charge Card Program, October 2021.

- Travel Notice 10-03A New Credit Worthiness Requirement for Travel Charge Card Applicants, December 2009, and revised March 2010.

Appendix A: Travel Card Reinstatement Procedures

- An IBA will be canceled by the contracted bank when the account is:

- 126 days past due;

- Had two (2) or more NSF returned payments within 12 months; or

- Within 12 months the account has been suspended twice for non-payment of undisputed principal.

- A cardholder may request their IBA to be reinstated upon completion of the following requirements:

- The balance owed on the past-due canceled account must have been paid in full.

- Prepare a memo or letter, signed by the account holder and their supervisor, with a detailed explanation as to why the account went past due or why the payments were returned (as applicable), demonstrating that the account holder understands how to properly manage his/her card to prevent this situation in the future.

- Retake the TMS VA Online Travel Card Training (course # 5508), regardless of when it was last completed, and provide a copy of the current training certificate.

- Prepare a new VA Form 0933A, Statement of Understanding for a Government Travel Card Individually Billed Account Cardholder, with all required signatures.

- The Level 4 A/OPC will verify and document that the balance owed on the past due canceled account has been paid in full before forwarding the paid-in-full documentation, prepared memo/letter, TMS VA Online Travel Card training certificate, and VA Form 0933A.

- The cardholder’s Level 2 A/OPC will determine if the reinstatement request is appropriate, after reviewing the provided required documents. If appropriate, the Level 2 A/OPC will forward the documents via email to TravelCardOps@va.gov to the Level 1 A/OPC for review and consideration of reinstatement.

- If approved, the Level 1 A/OPC will submit a written request to the contracted bank to allow the reinstatement of the closed account as a “Restricted” account for the cardholder.

- If approved by the contracted bank, the Level 1 A/OPC will notify the Level 4 A/OPC the account has been reinstated, or for any account which the contracted bank has charged-off, to initiate a new “Restricted” online IBA application for the cardholder.

- If a reinstated account is subsequently canceled due to any of the three causes listed in paragraph A above, any future reinstatement request will be denied without explanation.

Appendix B: Travel Card Individually Billed Account Application Procedures

- This appendix contains procedures on how to initiate a request for an IBA online application, online application procedures, and instructions for the applicant once the IBA has been received.

- The applicant will initiate the application process by providing the following information and documents to their organization’s Level 4 A/OPC:

- Scheduled start date of travel;

- Notify A/OPC if the travel card needs to be rushed or expedited overnight;

- Notify A/OPC if travel card delivery should be made to other than the official billing address, providing the alternate delivery address;

- Notify A/OPC if on the application you intend to Accept or Decline authorization to obtain credit information;

- Identify if you are either a DEMPS or a COOP current volunteer for your organization;

- A copy of the applicant’s current TMS training certificates for the ”VA Online Travel Card Training”; and

- VA Form 0933A, Statement of Understanding for a Government Travel Card Individually Billed Account Cardholder, signed and dated by the applicant and their supervisor (or position authorizing issuance to an Invitational Traveler).

- Upon receipt of the above information and documents, the Level 4 A/OPC will initiate the online application in the contracted bank’s EAS for eligible applicants and instruct the applicant to follow the procedures below. The A/OPC will take the necessary actions when a rush or expedited overnight travel card is required and arrange for alternate delivery of the travel card as requested.

- Online application processing first requires your Level 4 A/OPC to initiate the process in the contracted bank’s EAS. Once the process has been initiated, the applicant will receive two emails that will provide the employee access to the EAS to enter their personal information:

- The first email will provide a link, valid only for 14-days.

- The second email will provide an access code.

- Select the link in the first email and enter the access code provided in the second email, then select the submit button. If the access code was entered and submitted correctly you will receive a screen titled, “Create Account”, where you will need to enter your personal information. All fields are required unless noted as optional. If the access code was entered incorrectly three times the link will be deactivated. Should deactivation of the link occur, contact your Level 4 A/OPC for assistance.

- Enter your account information as follows:

- You must enter your first and last name exactly as the employee’s official name is recorded in the GAL. No nicknames or abbreviations will be allowed unless space restrictions necessitate an abbreviation. The account name field can hold a maximum of 21 characters.

- Enter your 9-digit SSN without spaces or dashes.

- Enter your mailing address: This address is the official billing address where your account statements will be mailed and is typically the employee’s home address unless a P.O. Box is utilized. The home address information must be completed regardless of which card delivery option was selected above.

- Enter your VA.gov email address only. VA employees must use their va.gov email address on their account. You can register a personal email address in the contracted bank’s EAS for receiving fraud alerts after the card has been issued.

- Enter your work phone number. Your personal and additional phone fields, as well as your fax number, are optional.

- The Optional 1, Optional 2, Identification Number, and Tax-Exempt fields are optional and should remain blank.

- Select the appropriate response, “Allow” or “Decline”, to Authorization to obtain/decline credit information. If you respond “Decline”, the contracted bank will issue a restricted IBA.

- Legal Information must be accurately entered as this information can affect the contracted bank’s ability to obtain credit information. Inaccurate information can result in a restricted IBA being issued even if the applicant’s FICO score is 660 or above. Enter your information as follows:

- Enter your full legal name. If you don’t have a middle name leave the field blank (e.g., do not type NA or None).

- Enter your date of birth as indicated mm/dd/yyyy.

- For Legal Residential Address, select the appropriate option, Not Provided, Use Mailing Address, or Enter a Different Address.

- The optional Legal Information Comments should be left blank.

- Review the Account Information and Legal Information entered and if correct, select Submit.

- The EAS will respond confirming the Account Owner’s information has been submitted or will identify any required fields not provided or errors will be identified in “red” requiring correction before selecting Submit again.

- Contact your Level 4 A/OPC if you need assistance.

- Your Level 4 A/OPC will complete your account information, (e.g., enter the applicable designation DISASTER/EMERGENCY for DEMPS, or COOP for COOP under the respective account’s Organization Name field) and submit the application. The Level 4 A/OPC will contact the contract bank to arrange for cards requested to be rushed, expedited, and/or for delivery requests to an alternate mailing address, as applicable. Your Level 4 A/OPC will notify you when the contracted bank has completed the application process.

- The contracted bank will process the application within one to three business days from receipt of the application. Once the account has been opened the contracted bank will determine the appropriate delivery method, i.e., regular mail, or other required methods such as shipping contractor based on the expedited requests received from the submitting A/OPC. Delivery of travel cards not expedited should normally occur within seven to ten business days from the date the application was received. Employees are advised to open all of their mail until the card has been received as it will not identify the contracted bank’s name on the envelope. Typically, the envelope containing the travel card will have a return address of Fargo, ND.

- Upon receiving the new travel card employees must do the following:

- Call the number on the card to activate the account or activate the account online at US Bank Access Online website by clicking on the “Activate Your Card” link. IBAs must be activated within 60-days of receipt, or the account will be closed (refer to FTR § 301-70.708). Activation requirements apply to new and re-issued IBAs. When activating an IBA, the contracted bank will state the credit limit the card was issued with towards the end of the automated message. The account limit will indicate which type of IBA, standard ($5000) or restricted ($1), was issued to the cardholder based on the credit information obtained or the alternate credit assessment. Understanding which type of IBA has been issued determines how a cardholder and A/OPC are required to manage the account credit limit.

- Update your VA travel system User Profile “Credit Card Information” with the new account information. This information will be needed for making lodging or rental car reservations. The IBA information must be updated in the User Profile before creating a travel claim to ensure the split disbursement payment will be sent to the contracted bank with your current IBA account number.

- For any previous lodging reservations made using a personal credit card, either before or upon check-in, the Traveler must request the lodging facility change the reservation guarantee by providing the IBA information directly to the lodging facility. If an advance deposit was placed on a personal card the Traveler must request the deposit, be reversed and charged to the IBA.

Appendix C: Split Disbursement Procedures

- The guidance provided below will enable a cardholder to identify the balance owed on their IBA, and how to allocate reimbursable funds in the travel claim or local travel claim for payment to their IBA account.

- Use the contracted bank’s EAS to determine your total outstanding balance. You should wait at least three business days after returning from travel to allow all charges to be posted to your account before using these instructions.

- Once logged in:

- On the Menu options in the upper left-hand corner, select “Home”. The Home page will display your current balance owed and it includes a list of all posted transactions since your last statement up through the contracted bank’s previous business day. Generally, the contracted bank’s statements are produced inclusive of transactions posted through the 23rd of each month. A travel episode occurring just before or crossing over the 23rd of a month may also require a review of your last bank statement charges and payments to accurately determine what the Home page’s current balance owed includes in addition to the listed transactions.

- First, determine if the current balance owed includes all charges you paid with your IBA for your most recently completed travel and confirm all charges posted are valid and for the correct amount authorized. On the return day of travel, transactions incurred for hotels, rental cars, or restaurants may not post to your IBA for up to two to three business days.

- Review the recent transactions to verify all approved travel and/or local travel claim split payments have been posted since the last billing statement was issued. If you had a claim for a previous travel episode approved within the last two or three business days, you need to determine if the current balance on your account includes the payment from the previous claim. If the previous claim payment has not been received and posted to your account, you will need to reduce the “current” balance owed by the pending claim’s split payment amount.

- Once you have determined the balance owed amount reflects all payments made since your last statement, you should adjust the balance owed by:

- Adding valid charges that you paid using your IBA which are not yet posted;

- Reducing the balance owed by any known credits that are not yet posted (e.g., hotel credits provided after check-out for occupancy tax exemption); and

- Subtracting any invalid charges (with immediate follow-up with the contracted bank to dispute the charge(s) and notify your Level 4 A/OPC).

- The remaining balance will be the amount you must ensure is split in your current travel or local travel claim, to the extent of available funds reimbursable to the traveler, for disbursement to your IBA.

- When you create a travel claim, if the lodging indicates a “Payment Method” of “IBA”, then skip the instructions in this paragraph. When lodging expenses do not indicate a Payment Method of IBA, then either the payment method was intentionally changed to “Other” when the TA was created, or your User Profile does not have your IBA information entered. Cardholders performing travel should ensure their user profile contains their current IBA information before creating a travel claim or a local travel claim. If your user profile does not contain your IBA information you will need to perform the following steps before you can continue:

- Close a travel claim or local travel claim created before the IBA information was entered into your User Profile.

- Under View Vouchers, select the travel claim or local travel claim created, and under the “Action” options menu, choose Delete.

- Enter your IBA information in your User Profile and save the information entered.

- Create a new travel claim or local travel claim as applicable, and “IBA” will now be reflected as the Payment Method for any lodging or lodging taxes, and an authorized rental car if applicable in your travel claim.

- Under the Expenses and Receipts Tab, once you have adjusted all of your expenses to the amounts incurred, review the Payment Method for each expense to ensure “IBA” has been selected for each expense (except for M&IE on a travel claim) that you paid using your IBA (e.g., baggage fee, taxi, tip, parking, ATM Fee, etc.). VA’s travel system will automatically assign “IBA” as the payment method in travel claims for authorized lodging, lodging taxes, and rental car expenses since VA policy requires you to use your IBA for these expenses. If for any reason you did not use your IBA for an expense with “IBA” as the Payment Method, you must change the Payment Method to “Other”. Generally, you will never change the Payment Method for M&IE to “IBA” from “Other”, as the M&IE amount is an allowance and not equal to the actual meal expenses incurred and charged to your IBA. For a local travel claim you only need to verify the amount of each expense is correctly stated.

- The final step to ensure the total balance owed has been split for payment requires you to determine the total of all meal expenses posted to your account and any other expenses remaining unpaid (e.g., previous travel unpaid balance).

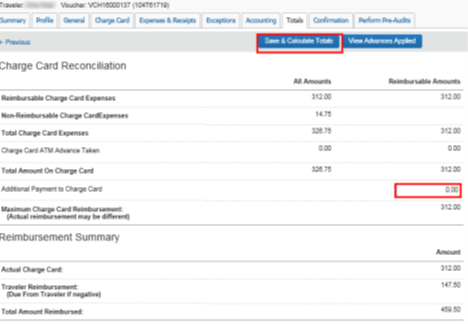

- In a travel claim, select the “Totals Tab” (refer to the screen print provided below) then look in your travel claim under the “Charge Card Reconciliation” section:

- Find the “Total Amount On Charge Card” line. VA’s travel system will display the total sum of all expenses you identified with an “IBA” Payment Method under the Expenses and Receipts Tab in the “Total Amount on Charge Card” line.

- Take your previously determined total outstanding balance owed (refer to Paragraph B, above) and subtract the amount provided in the “Total Amount On Charge Card” line, then enter the remaining balance in the next line “Additional Payment to Charge Card”, then select the “Save & Calculate Totals” tab.

- In a local travel claim, select the “Totals Tab”. Refer to the screen print provided below for a travel claim then look in your local travel claim under the “Charge Card Reconciliation” section:

- In your local travel claim the “Total Amount On Charge Card” will read $0.00 since VA travel system local travel claims do not provide payment methods to be assigned when expense items are entered.

- Find the “Additional Payment to Charge Card” line, then enter the total outstanding balance you determined was owed when following the guidance in Paragraph C above, then select the “Save & Calculate Totals” tab.

- VA’s travel system will add the amounts in the two lines (“Total Amount On Charge Card” (only applicable in a travel claim) and “Additional Payment to Charge Card”) and will post the sum of these two amounts in the “Maximum Charge Card Reimbursement” line. This amount should equal the outstanding balance you determined was owed when following the guidance in Paragraph B, above. As long as there are sufficient Traveler reimbursable funds to cover the total entered in the “Maximum Charge Card Reimbursement” line this is the correct amount and will be sent to the contracted bank to your IBA on your behalf once the travel claim has been submitted and approved.

- Review the “Reimbursement Summary” to confirm the amount shown for the “Traveler Reimbursement” is equal to or greater than $0.00. Any negative amount indicated means there are insufficient funds to pay the total balance owed. You should never submit a travel claim with a negative “Traveler Reimbursement” amount. If you have a negative “Traveler Reimbursement” amount you will need to subtract the negative “Traveler Reimbursement” shown amount from the amount you previously entered in the “Charge Card Reconciliation” section, “Additional Payment to Charge Card” line, then select the “Save & Calculate Totals” tab. This should result in the maximum available payment on the outstanding balance owed to be paid on your behalf, with $0.00 reflected under the “Reimbursement Summary”, “Traveler Reimbursement” line amount.

- When there are insufficient travel reimbursement funds available in a claim to split the total outstanding balance owed, you are required to pay the difference between the total outstanding balance owed on the IBA and the total amount split shown under “Reimbursement Summary”, “Actual Charge Card” line, to the contracted bank by the statement due date. This should be done by paying the contracted bank directly, in time to post before the statement’s due date.

- Once you have entered the maximum allowable split amount of your total outstanding balance owed in your travel claim or local travel claim you are finished under the “Totals Tab”.

- In a travel claim, select the “Totals Tab” (refer to the screen print provided below) then look in your travel claim under the “Charge Card Reconciliation” section:

- After splitting payment in a claim, a cardholder must open the next contracted bank’s statement to ensure the balance has been paid in full, confirming the split payment was received and there were no additional charges posted.

Concur Screen Print of Charge Card Reconciliation: