Volume VII - Financial Reporting

Chapter 02 – Financial Statement Analytics

Questions concerning this policy chapter should be directed to:

0201 Overview

This chapter establishes the Department of Veterans Affairs’ (VA) financial policies regarding financial statement analytics.

Key points covered in this chapter:

- VA will comply with Office of Management and Budget (OMB) and Department of Treasury (Treasury) reporting requirements;

- To decrease risk of material misstatements on the financial statements, VA will perform different types of analytical reviews. Current analytics include:

- Abnormal balances;

- Budgetary to proprietary and other account relationships;

- Financial statement edit checks; and

- Fluctuation analysis.

- VA will analyze variances occurring in interim and year-end financial statements; and

- VA will present highlights of its financial statement analysis in the Management’s Discussion & Analysis (MD&A) section of the Agency Financial Report (AFR).

0202 Revisions

| Section | Revision | Requesting Office | Reason for Change | Effective Date |

|---|---|---|---|---|

| Various | Update primary responsibilities from Office of Financial Policy (OFP) to Office of Financial Reporting (OFR) function | OFP | Distinct groups subsequent to last update | September 2024 |

| Various | Reformatted according to current policy procedures. | OFP | Full Review | September 2024 |

| 0203 | Revised definitions | OFP | Consistency among financial policies | September 2024 |

| 0205 | Removed Required Supplementary Stewardship (RSSI) information as a required submission | OFP | OMB Circular A-136 no longer requires RSSI as part of reporting | September 2024 |

| 0205 | Updated interim and year-end financial package submission to include Budget Deficit Reconciliation | OFP | TFM-4700 requirement for year-end reporting | September 2024 |

| Appendix A | Updated Master Edit Check Review Signature Form | OFP | Current OFR signature form | September 2024 |

| Appendix B | Updated Financial Statement Analytics Signature Form | OFP | Current OFR signature form | September 2024 |

| All | New Chapter | OFP | Provide policy on Financial Statement Analytics | September 2024 |

0203 Definitions

Abnormal Balances – A general ledger account balance is abnormal when the reported balance does not comply with the normal debit or credit position assigned to the account by the United States Standard General Ledger (USSGL).

Adjusted Trial Balance (ATB) – A listing of all the account titles and balances contained in the general ledger after adjusting entries for an accounting period have been posted to the accounts.

Agency Financial Report – The Agency’s end of fiscal year financial report that contains various information about the Department as well as the financial statements, notes to the financial statements, the external financial auditor’s opinion, and other supplementary information.

Budgetary Accounts – An account that reflects budgetary operations and conditions, such as estimated revenues, appropriations, and obligations.

Budget Deficit Reconciliation (BDR) –Validates the budget deficit reported in the Financial Report (on the Statement of Changes in Cash Balance from Budget and Other Activities, and the Reconciliation of Net Operating Cost and Budget Deficit) against entity audited financial statements.

Budgetary to Proprietary Relationship – A comparison of certain budgetary and proprietary accounts, where the balances of the budgetary accounts should equal the balances of related proprietary accounts.

Financial Statement Analytics – Comprehensive data review and analysis of VA’s financial data to identify inaccuracies, abnormal balances, account relationship differences, and other financial reporting anomalies.

Financial Statements Edit Checks – A series of edits used to verify the accuracy of the financial statements by cross-referencing financial line items between statements to ensure they agree. The edit checks are established in accordance with Generally Accepted Accounting Principles promulgated by the Federal Accounting Standards Advisory Board and USSGL.

Fluctuation/Flux Analysis – A type of financial statement variance analysis performed to examine balances and/or comparative percentage differences over time.

Governmentwide Treasury Account Symbol Adjusted Trial Balance System (GTAS) – A Treasury operated Governmentwide accounting web-based system used by Federal agencies to submit both budgetary and proprietary financial data.

Management Information Exchange (MinX) System – A Hyperion-based reporting system that automates the preparation of VA’s financial statements. MinX receives data via interface from VA’s accounting systems.

MAX or OMB MAX – A portfolio of software applications sponsored by OMB including an agency portal used to submit data to OMB, a suite of analytical tools, and collaboration tools for agencies to share and work together with other community members towards common Federal goals.

Proprietary Accounts – Accounts used to recognize and track assets, liabilities, net position accounts, revenues, and expenses.

Tie-Points – Financial management equations that indicate whether certain account balances within a general ledger trial balance are consistent with other account balances. As an example, there are tie points that highlight relationships between budgetary and proprietary accounts.

U.S. Standard General Ledger (USSGL) – Provides a uniform chart of accounts and technical guidance for standardizing federal agency accounting.

0204 Roles and Responsibilities

Administration Fiscal Staff and Chief Financial Officers (CFOs) are responsible for implementing effective controls and safeguards to prevent, detect, and correct data errors; reviewing the abnormal balances and significant variances; researching and identifying underlying causes and key factors for variances; providing sufficient and comprehensive explanations; proposing corrective actions to fix accounting irregularities and errors within their jurisdictions; and assisting with tasks related to Department-wide reporting.

Office of Financial Reporting (OFR) is responsible for the completeness, reasonableness, and accuracy of financial statement analytics; preparing, maintaining, and providing quality consolidated and by Administration financial reports in MinX; as well as for preparing, submitting, and publishing the AFR.

0205 Policies

020501 General Policies

- VA will comply with guidance from OMB Circular A -136 and Treasury Financial Manual (TFM) Volume I Part 2 Chapter 4700 when submitting year-end significant variance analysis with explanations to OMB and Treasury.

- VA will perform an analysis of variations in the financial statements as part of VA’s internal controls over financial reporting. Financial statement analytics will consist of at a minimum the following five types of analyses:

- Abnormal Balances Analysis;

- Budgetary to Proprietary and Other Accounts Relationship Analyses;

- Financial Statements Edit Checks;

- Fluctuation/Flux Analysis; and

- Analysis of Entity’s Financial Statements included in MD&A.

- OFR will determine the scope and timeframe of general ledger and financial statement analyses, as well as criteria and metrics to be used.

- Administrations and Staff Offices will implement effective controls and safeguards to prevent, detect, and correct data errors. These include both manual and automated controls, such as compliance with USSGL posting models, reconciliation of systematic interfaces, proper review and approval of transactions and data validation to enhance the accuracy, quality, and reliability of financial data.

- The quarterly CFO certification submitted to OFR is an assertion that account balances are accurate, consistent, reviewed and supported by documentation. Prior to completing the quarterly certification CFOs must ensure a comprehensive financial data review and analysis process has been completed. This review must include processes/analytics to identify/explain inaccuracies, abnormal balances, significant variances, and other financial reporting anomalies. The CFO certification memo can be found in Volume I, Chapter 1- Financial Statement Reporting.

020502 Monthly Abnormal Balances Analysis

- VA will review abnormal balances on a monthly basis.

- Monthly OFR will generate a report that identifies USSGL level account balances that have an abnormal balance (e.g., a normal debit balance account with a credit balance or a normal credit balance account with a debit balance).

- OFR will distribute via email the abnormal balance report to the Administrations and Staff Offices for review and explanation of abnormal balances. Administrations and Staff Offices can also obtain the abnormal balance reports directly from MinX.

- OFR will assign funds for abnormal balance review and analysis in accordance with program functions established in Volume II, Chapter 2 – Budget Cycle and Fund Symbols. OFR will coordinate responses for explanations related to funds that cross several Administrations and Staff Offices (i.e., OI&T, CFM).

- Administrations and Staff Offices will provide explanations of all abnormal balances on USSGL accounts for assigned funds and submit the analysis along with explanations to OFR for review. Offices will provide sufficient evidence to demonstrate that an abnormal balance qualifies as a permitted deviation as determined by OFR.

- Administrations and Staff Offices will prepare and initiate corrective action plans (i.e., identifying the root cause, solutions, and implementations) for adjusting/correcting abnormal balances when appropriate.

- OFR will conduct a review of the analysis and explanations received from the Administrations and Staff Offices. OFR will follow up with Administrations and Staff Offices for additional information when needed to ensure the completeness, accuracy, and adequacy of the analysis and to prevent the misstatement of financial information.

- OFR will follow-up with Administrations, Staff Offices, and FSC to ensure appropriate corrective actions are taken.

020503 Quarterly Financial Statements Edit Checks

- VA will perform a Tie-Points analysis by Treasury Account Symbol (TAS) to mitigate potential out of balance conditions and enhance the integrity of reported data.

- OFR will use VA’s financial reporting system to generate the monthly tie-point reports after MinX is closed for adjustments. In addition, there are 3 tie-point reports sourced from GTAS that will be run for businesses remaining in FMS after GTAS certification:

- Expended Authority = Expended Appropriations;

- Anticipated Resources = Anticipated Status; and

- Net Position Analysis Unexpended Appropriations.

- OFR will distribute via email tie-point workbook to the Administrations and Staff Offices with instructions to research the out of balance conditions and provide the research results in explanations that describe the causes and corrective action identified to resolve them.

- Administrations and Staff Offices will research out of balance conditions for assigned accounts to identify the underlying causes of imbalances. Documentation explaining the causes and intended corrective actions will be provided to OFR 5 days from the first budgetary to proprietary (B2P) data call. An additional 5 days is given for the second B2P data call, which is updated with Tie-Points 7, 14, and 19 after GTAS is certified.

- OFR will conduct a review of the Administration and Staff Office explanations for the underlying causes of imbalances and corrective actions for sufficiency. OFR will follow up with Administrations and Staff Offices for additional information when needed to ensure the completeness, accuracy, and adequacy of the analysis.

- OFR will follow-up with Administrations, Staff Offices, and FSC to ensure appropriate corrective actions are taken.

020504 Quarterly Financial Statements Edit Checks

- VA will perform financial statement edit checks on a quarterly basis to uncover accounting anomalies and identify if corrective actions are needed.

- VA will perform three levels of financial statements edit checks: Fund level, Administration level, and Department-wide consolidated level.

- VBA will run validation reports from the MinX System to perform fund level edit checks.

- VBA will review, reconcile, and analyze the financial statements for variances at the VBA TAS level. Variance explanations and necessary corrections will be provided to OFR.

- OFR will conduct a review of the final analysis and explanations of the unresolved VBA variances at the fund level to ensure the explanations are satisfactory.

- OFR will conduct a multi-level review by Administration for VHA, NCA, and Departmental Administrations at the individual fund, individual Administration and VA consolidated levels. OFR will research the root causes of variances and make necessary corrections.

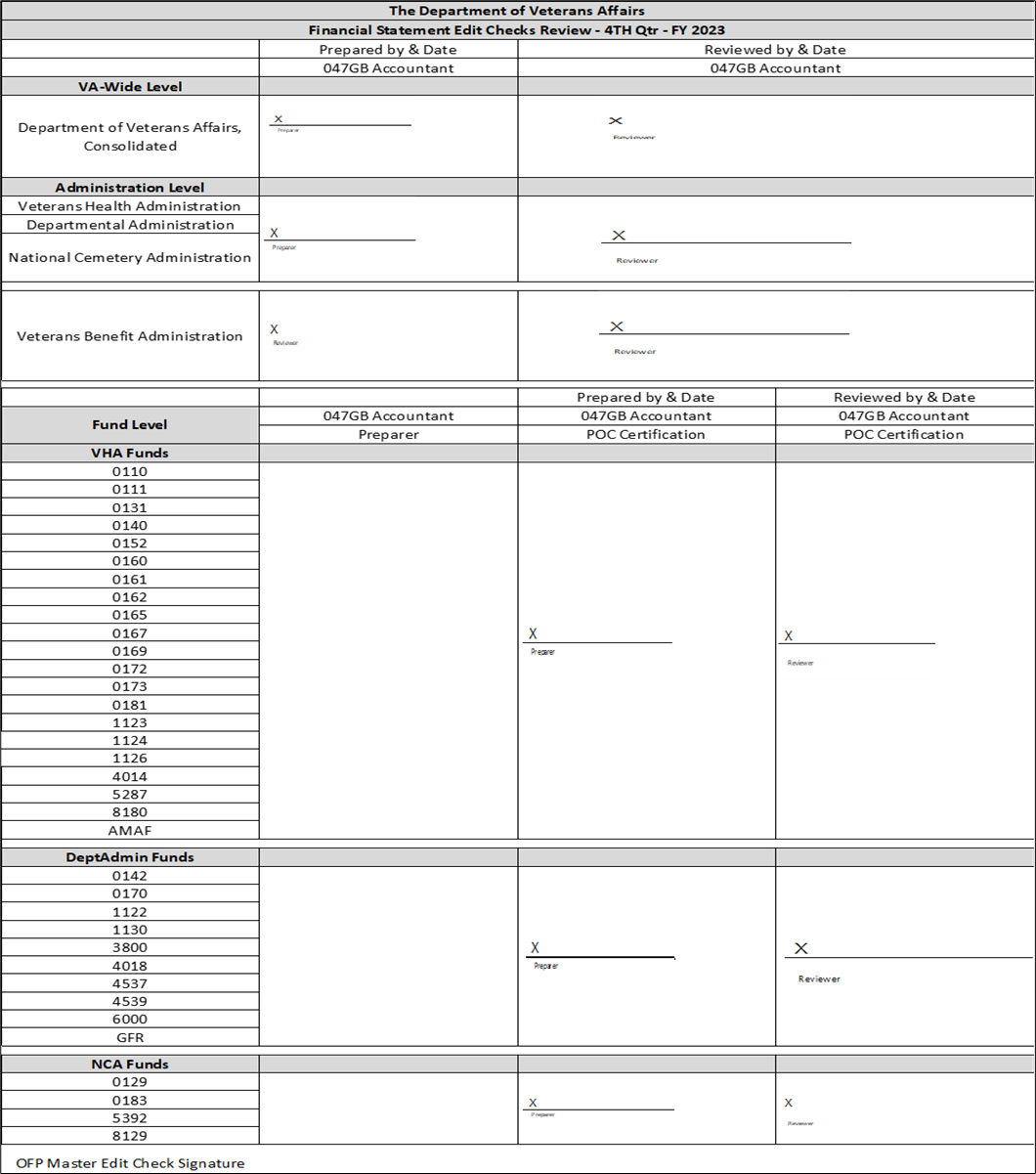

- OFR will review and validate the explanations of the unresolved variances after all reviews are complete by electronically signing the OFR’s Financial Statement Edit Checks Review. See Appendix A for an example.

020505 Quarterly Fluctuation/Flux Analysis

- OFR will notify preparers when all known JV’s are complete that quarterly fluctuation reports are available to the Administrations and Staff Offices in MinX for analysis. The analysis will focus on line-item fluctuations of the principal financial statement balances from current to prior period. While consolidated reports are generated, each Administration’s reports will only include dollar amounts by GTAS which are identified as the responsibility of the Administration as stated in Volume II Chapter 02 – VA’s Budget Cycle and Fund Symbols, Appendix C or by the Appropriation Act, the President’s Budget, or other regulatory legislature. Fluctuation analysis must include all four financial statements:

- Balance Sheet;

- Statement of Net Cost;

- Statement of Changes in Net Position; and

- Statement of Budgetary Resources.

- Administrations and Staff Offices will run updated reports for GTAS for their analyses if they believe changes have occurred after the initial reports were created.

- Administrations and Staff Offices will perform thorough research of the key factors causing significant variances on individual line items for assigned accounts on the principal financial statements and provide explanations for those variances within the timeframe specified in the “Financial Reporting Closing Schedule”.

- Administrations and Staff Offices will sign the OFR Financial Statement Analytics Sign-Off Sheet indicating that their analysis is complete and submit the sheet along with the explanation of variances to OFR.

- OFR will conduct a review of the variance explanations to ensure the completeness, accuracy, and adequacy of the flux analysis and explanations.

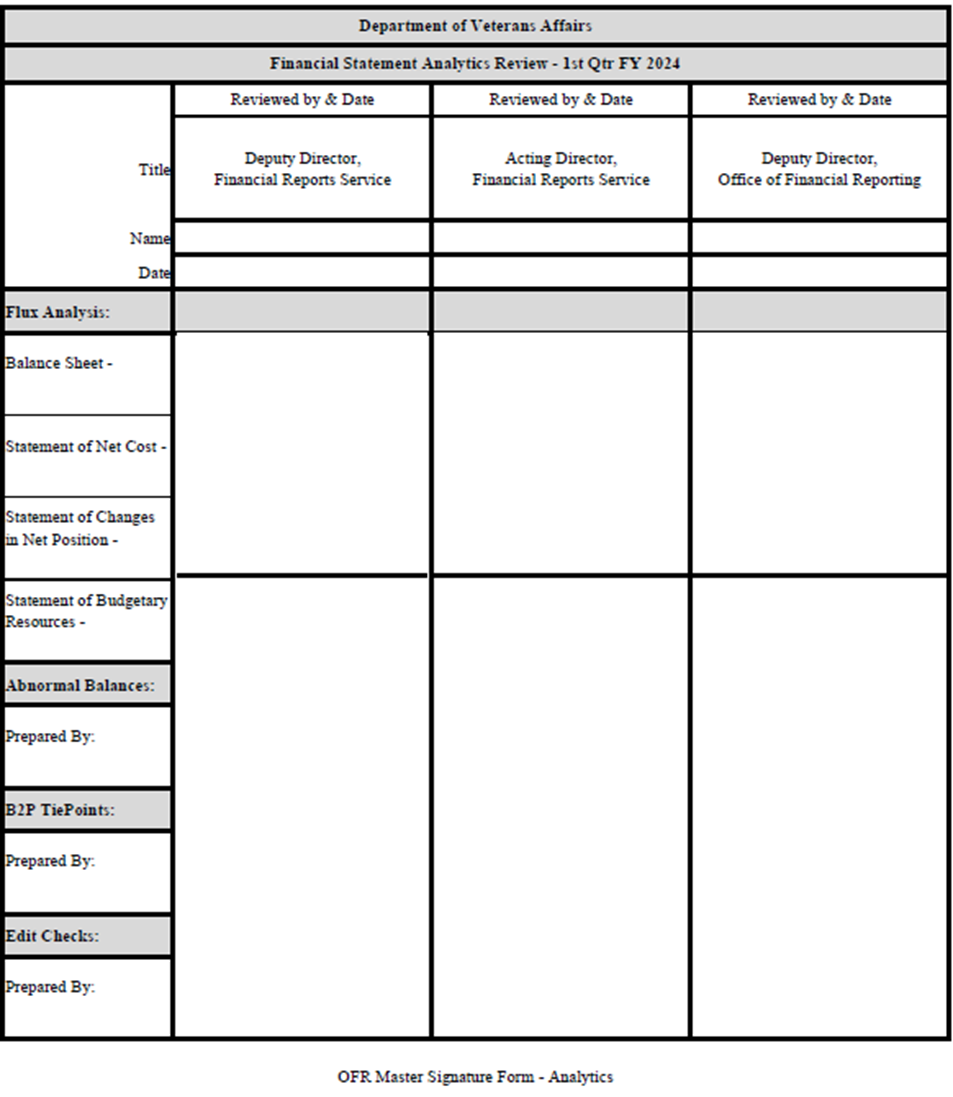

- OFR will conduct a quarterly analytics panel review during which significant changes to applicable balances will be discussed in detail. This review may include identifying the need for better explanations or follow up research. Once all questions are resolved at a sufficient level the “Financial Statement Review Signature Form” will be signed to evidence the review. For an example of the form, see Appendix B, Example of OFR Financial Statement Analytics Signature Form.

- At fiscal year-end, OFR will compile and edit analyses provided by Administrations; and create a further five-year analysis of line-item details contained in the financial statements.

- OFR will use the five-year financial statement analytics as the basis for the analysis component of the MD&A.

- In accordance with OMB Circular A-136, VA will submit the required interim and year-end financial statements with notes, and at year-end a completed Budget Deficit Reconciliation (BDR) template, and analysis of significant variances with explanations to OMB through the OMB MAX portal.

020506 Analysis of Entity’s Financial Statements in MD&A

- VA will analyze its year-end financial statements to provide an integrated summary of annual financial position, results, significant changes, and any financial management issues that arose during the reporting period.

- VA will provide explanations for significant variances of key items within the MD&A portion of the AFR. The analysis may be presented as narratives, illustrative tables, and/or data visualizations for key measures.

- VA will develop data visualizations for the key measures that depict important financial factors and changes in the current year, and significant changes in the principle financial statements over the five-year period.

0206 Authorities and References

- Chief Financial Officers Act of 1990, Public Law 101-576

- Government Performance and Results Modernization Act of 2010, Public Law 111-352

- Financial Accounting Standards Advisory Board (FASAB)

- OMB Circulars

- TFM Volume I Part 2 Chapter 4700 Agency Reporting Requirements for the Financial Report of the United States Government

- TFM Volume I Supplement – USSGL

- GTAS Edits and Validations

- VA Financial Policy

0207 Rescissions

Vol VII, Chapter 2 – Financial Statement Analytics, October 2018

Appendix A: Example of the OFP Master Edit Check Signature Form

Link to example of OFP Master Edit Check Signature Form

Appendix B: Example of OFP Financial Statement Review Signature Form

Link to example of OFP Financial Statement Review Signature Review Form