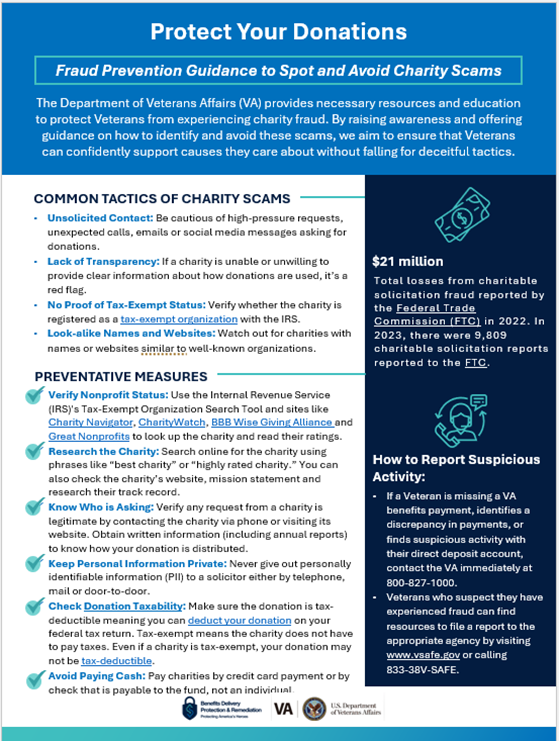

Fraud Prevention Guidance to Spot and Avoid Charity Scams

The Department of Veterans Affairs (VA) provides necessary resources and education to protect Veterans from experiencing charity fraud. By raising awareness and offering guidance on how to identify and avoid these scams, we aim to ensure that Veterans can confidently support causes they care about without falling for deceitful tactics.

COMMON TACTICS OF CHARITY SCAMS

- Unsolicited Contact: Be cautious of high-pressure requests, unexpected calls, emails or social media messages asking for donations.

- Lack of Transparency: If a charity is unable or unwilling to provide clear information about how donations are used, it’s a red flag.

- No Proof of Tax-Exempt Status: Verify whether the charity is registered as a tax-exempt organization with the IRS.

- Look-alike Names and Websites: Watch out for charities with names or websites similar to well-known organizations.

PREVENTATIVE MEASURES

- Verify Nonprofit Status: Use the Internal Revenue Service (IRS)’s Tax-Exempt Organization Search Tool and sites like Charity Navigator, CharityWatch, and BBB Wise Giving Alliance to look up the charity and read their ratings.

- Research the Charity: Search online for the charity using phrases like “best charity” or “highly rated charity.” You can also check the charity’s website, mission statement and research their track record.

- Know Who is Asking: Verify any request from a charity is legitimate by contacting the charity via phone or visiting its website. Obtain written information (including annual reports) to know how your donation is distributed.

- Keep Personal Information Private: Never give out personally identifiable information (PII) to a solicitor either by telephone, mail or door-to-door.

- Check Donation Taxability: Make sure the donation is tax-deductible meaning you can deduct your donation on your federal tax return. Tax-exempt means the charity does not have to pay taxes. Even if a charity is tax-exempt, your donation may not be tax-deductible.

- Avoid Paying Cash: Pay charities by credit card payment or by check that is payable to the fund, not an individual.

$21 million

Total losses from charitable solicitation fraud reported by the Federal Trade Commission (FTC) in 2022. In 2023, there were 9,809 charitable solicitation reports reported to the FTC.

How to Report Suspicious Activity:

- If a Veteran is missing a VA benefits payment, identifies a discrepancy in payments, or finds suspicious activity with their direct deposit account, contact the VA immediately at

800-827-1000. - Veterans who suspect they have experienced fraud can find resources to file a report to the appropriate agency by visiting www.vsafe.gov or calling 833-38V-SAFE.